Alternus Clean Energy, Inc.

Alternus Clean Energy is a forward-thinking utility-scale clean energy independent power producer that effectively leverages transatlantic markets to amplify its impact and create value for shareholders. With a strategic focus on solar, battery storage and microgrids, Alternus has a robust portfolio and pipeline featuring operational and projects in development across America and Europe, backed by long-term power purchase agreements that ensure stable revenue streams.

OTCQB: ALCE

IR Website: https://ir.alternusce.com/

Headquarters: Fort Mills, S.C.

.

.

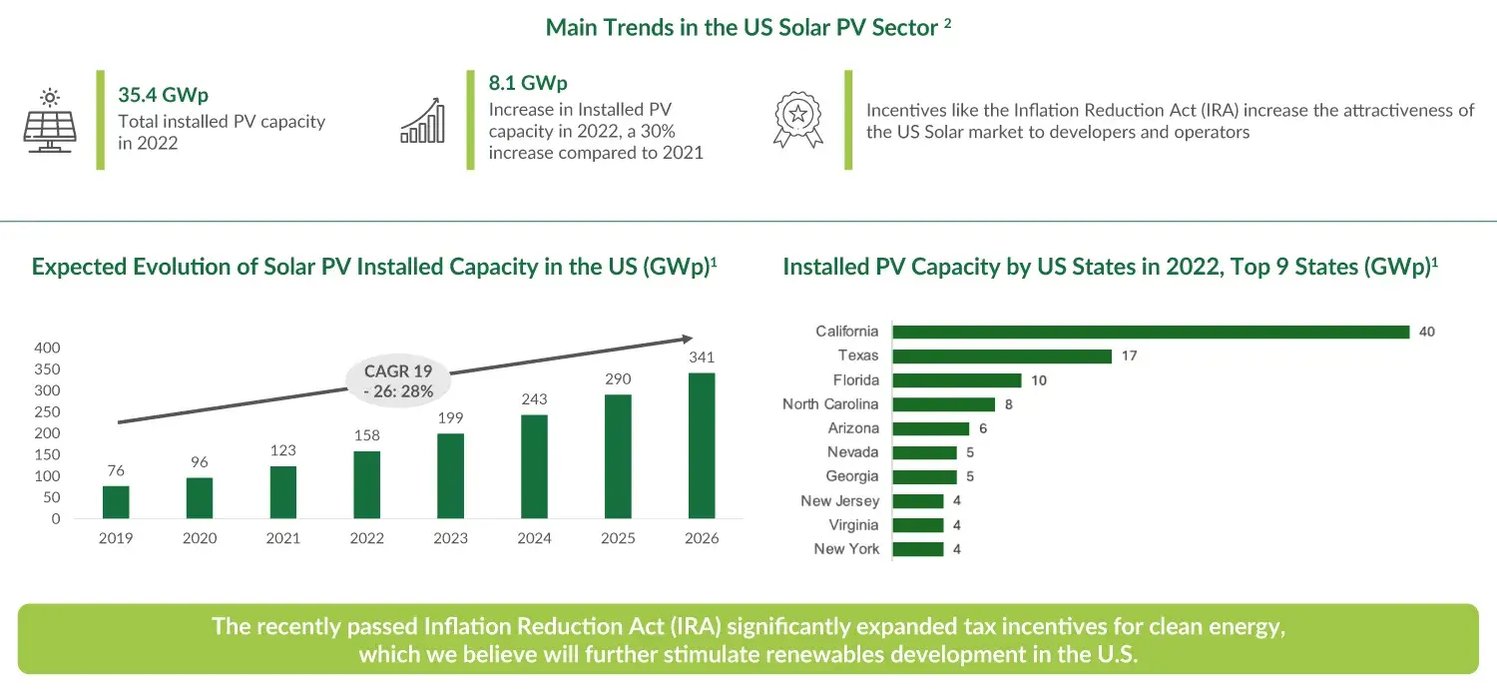

The company is expanding its physical footprint in the United States, supported by the Inflation Reduction Act, and deepening its market penetration through judicious acquisitions and the cultivation of strategic development partnerships. This approach of organic growth, partnerships, and acquisitions positions Alternus to capitalize on the increasing global shift towards renewable energy, supporting its mission to deliver sustainable power solutions while fostering economic growth.

TALK TO MANAGEMENT

Alternus Clean Energy is always available to talk to current and potential investors. They're happy to answer any questions you may have and tell you what makes their story unique. Please fill out this form, and we will connect you shortly.

Alternus Clean Energy At A Glance

Founded in 2015, Alternus Clean Energy is a prominent transatlantic clean energy independent power producer (IPP) focusing on developing, owning, and operating utility-scale solar parks. The company, headquartered in the United States, has strategically positioned itself across markets in America and Europe, leveraging a model that spans the entire lifecycle of solar energy projects from development to long-term operation. Alternus aims to capitalize on the growing demand for renewable energy, underpinned by long-term power purchase agreements ensuring consistent revenue stream and financial stability.

Alternus has been aggressively expanding its operational capacity and geographic footprint in recent years. The company's growth strategy combines organic development with strategic acquisitions, targeting a reach of 1.46 GW of operational projects by 2026. This approach is bolstered by the company's listing on Nasdaq, which provides access to capital markets necessary to fuel its expansion. With its dynamic and experienced management team, Alternus is well-positioned to play a significant role in the global shift towards sustainable energy, aiming to deliver economic returns and environmental and societal benefits.

Key Considerations:

Scalable Growth Strategy Through Strategic Acquisitions and Organic Development

With a targeted goal of reaching 1.46GW of operational projects by 2026, Alternus strategically combines organic growth initiatives with selective acquisitions to expand its operational footprint across key markets in the US and Europe.

Leveraging Policy Driven Opportunities like the Inflation Reduction Act

The company strategically positions itself to capitalize on significant policy-driven opportunities such as the US Inflation Reduction Act, which promotes renewable energy through incentives and tax benefits, aligning with Alternus's growth initiatives.

Press Releases & Media Coverage

Social Media Updates

Recent LinkedIn Posts

Recent Facebook, Instagram, Pinterest, YouTube, TikTok and X Posts

Investor Presentation

To download the Alternus Clean Energy investor presentation, please fill out the form below.

Stock Chart (Historical)

Stock Detail

Transatlantic Operations and Market Expansion

Strategic Capital Utilization in Europe and the U.S.

Alternus Clean Energy's strategic presence in both Europe and the U.S. is central to its business model. This presence enables the company to optimize its capital structure and leverage different financing opportunities available in each market. This transatlantic approach not only broadens the company's operational footprint but also stabilizes its financial performance by diversifying market risk.

European Market Dynamics and Financing

In Europe, Alternus benefits from the ability to fully leverage its development assets using available debt facilities. This financial strategy is particularly advantageous as it minimizes the equity required for project development, thereby enhancing returns on invested capital. The significant value gained during the development process in Europe is due to the mature solar market and favorable regulatory frameworks, which facilitate efficient project scaling and robust government incentives.

Capital Structure in the U.S. Market

In the United States, the company uses tax equity financing, which typically covers between 30% and 50% of the cost of renewable projects. This form of financing is crucial in the U.S. renewable energy sector and is supported by federal tax incentives, including those expanded under the Inflation Reduction Act. Tax equity investments are a central component of Alternus's funding strategy, enabling the company to mitigate upfront capital expenditure and improve project IRR (Internal Rate of Return).

Source: Company Website

Balancing Capital and Risk through Transatlantic Operations

Navigating and optimizing different financing mechanisms in the U.S. and Europe allows Alternus to balance its capital deployment effectively. By strategically managing its financial resources across these markets, Alternus enhances its overall investment appeal and operational sustainability. This approach not only secures the company's long-term profitability but also aligns with its growth and expansion strategies in key renewable energy markets.

Future Prospects in Transatlantic Expansion

Looking forward, Alternus is poised to continue expanding in the European and U.S. markets, leveraging legislative support and economic incentives to foster growth. The company's adeptness at managing complex financial structures and capitalizing on market-specific advantages underscores its resilience and forward-looking strategy in the renewable energy industry.

Source: Company Reports

Capital Structure Differences between European Development Assets and US Tax Equity

Alternus Clean Energy's transatlantic presence allows the company to optimize its capital structure by leveraging the unique financing opportunities available in each market. In Europe, Alternus benefits from the ability to fully leverage its development assets using available debt facilities, such as the €500 million Deutsche Bank facility. This financing strategy minimizes the equity required for project development, enhancing returns on invested capital. The significant value gained during the development process in Europe is due to the mature solar market and favorable regulatory frameworks, which facilitate efficient project scaling and robust government incentives.

In contrast, the United States market utilizes tax equity financing, which typically covers between 30% to 50% of the cost of renewable projects. This form of financing is crucial in the U.S. renewable energy sector and is supported by federal tax incentives, including those expanded under the Inflation Reduction Act. Tax equity investments are a central component of Alternus's funding strategy in the U.S., enabling the company to mitigate upfront capital expenditure and improve project IRR (Internal Rate of Return).

Growth Strategy

Strategic Expansion and Capacity Enhancement

Alternus Clean Energy is on a strategic trajectory to significantly expand its operational capacity by 2026. This ambitious growth is anchored in the company's proven ability to scale its portfolio across key transatlantic markets. By leveraging deep industry expertise and a robust development pipeline, Alternus aims to enhance its utility-scale solar projects significantly. The company plans to increase its current energy production capabilities by deploying advanced technologies and capitalizing on strategic market opportunities. This strategy includes both organic growth through new projects and expanding existing operations, as well as through tactical acquisitions that complement their long-term growth objectives.

Leveraging Market Dynamics and Policy Support

The growth strategy of Alternus is intricately linked to the evolving dynamics of the global renewable energy market, which is supported by favorable government policies and increasing demand for sustainable energy solutions. Particularly in the United States and Europe, policies like the Inflation Reduction Act in the U.S. and Europe's aggressive carbon reduction targets provide a conducive environment for the growth of renewable energy projects. These policy frameworks not only offer financial incentives but also stabilize long-term operational planning for companies like Alternus. By aligning its growth strategy with these policies, Alternus ensures it remains competitive and well-positioned to capitalize on the increasing shift toward renewable energy.

Potential 80MWp US Solar Acquisition

In May 2024, Alternus announced the signing of definitive agreements to acquire over 80 MWp of operating solar projects across eight states in the U.S. The portfolio, consisting of 33 projects, is expected to generate an average of $6.7 million in revenue and $5.1 million in operating income annually. This acquisition aligns with Alternus' strategy to expand its footprint in the U.S. market and pursue near-term acquisitions of both operating and ready-to-build projects.

$2.16M Private Placement

In April 2024, Alternus closed a $2.16 million private placement of convertible notes and warrants. The proceeds from this offering will be used to continue executing the company's business plan, including funding planned capital expenditures and working capital. This financing demonstrates Alternus' ability to access capital markets to support its growth initiatives.

200MW Microgrid JV in New York State

In April 2024, Alternus entered into a joint venture with Acadia Energy to co-develop 200 MW of microgrid projects in New York State. The joint venture will focus on developing and operating a portfolio of microgrid projects over the next 2-3 years, providing clean, reliable, and affordable energy to local communities and businesses. Alternus will hold a 51% majority ownership stake in the projects, showcasing its commitment to expanding its renewable energy initiatives in the U.S.

Strategic Alliance with Hover Energy

In January 2024, Alternus entered into a strategic alliance with Hover Energy, an established leader in the development and deployment of Wind Powered Microgrid™ systems. This alliance aims to offer differentiated 24x7 zero-carbon power to customers by creating microgrids that integrate Alternus' utility-scale solar projects with Hover's 24x7 wind-powered generators. The combined systems will significantly reduce intermittency and minimize the need for expensive storage capacity to achieve full grid independence. This innovative approach positions Alternus to provide reliable and cost-competitive clean energy solutions to commercial and industrial customers.

Future Outlook and Commitment to Sustainability

Looking ahead, Alternus is committed to expanding its market presence and enhancing its contributions to global sustainability efforts. The planned expansion into new regions and scaling of operations are expected to substantially increase the company's clean energy output, thereby supporting the broader transition to a low-carbon economy. In 2023, Alternus produced a total of 165 GWh of clean energy, further offsetting global CO2 emissions. As the company continues to grow its portfolio of renewable energy assets, it aims to make an even greater impact on reducing greenhouse gas emissions and combating climate change.

Alternus's strategic initiatives are designed to create substantial value for stakeholders while adhering to the highest standards of environmental responsibility and sustainability. The company's commitment to sustainability extends beyond its core business operations, as demonstrated by its ongoing efforts to rehabilitate land, support local biodiversity, and engage with communities to ensure long-term mutual benefits.

Furthermore, Alternus's sustainability goals align with international frameworks such as the United Nations Sustainable Development Goals (SDGs), particularly SDG 7 (Affordable and Clean Energy), SDG 9 (Industry, Innovation, and Infrastructure), and SDG 13 (Climate Action). By contributing to these global objectives, Alternus positions itself as a key player in the transition to a more sustainable future.

Strong Growth Visibility In Portfolio Growth By 20261

Future Growth Plan Focused On Organic And Targeted Strategic Opportunities

.png?width=1500&height=842&name=ALCE-Company-Presentation---January-2024-page12(1).png)

Source: Company Documents

- Currently Owned assets expected to be funded from existing or committed funding facilities to achieve operations.

- Growth reflects execution of full business plan – from currently identified projects in both US and Europe – does not include additional project identification over the planning period.

- Operating plan assumes that projects are 100% funded at project level reducing need for corporate share issuances – may involve Alternus selling minority ownership equity positions in projects.

Project Lifecycle Management

Comprehensive Approach from Development to Operation

Alternus Clean Energy excels in managing the complete lifecycle of its solar energy projects, ensuring efficiency and value maximization at every stage. The process begins with meticulous site selection and feasibility studies to evaluate environmental, economic, and community impacts. This initial phase sets the foundation for sustainable project development, incorporating stakeholder feedback and regulatory requirements to ensure seamless progression.

Construction and Installation Excellence

Once a project receives the green light, Alternus transitions into the construction phase, where precision and adherence to technological best practices are paramount. The company employs advanced construction methodologies that not only expedite the build-out but also emphasize safety and environmental sustainability. During this phase, Alternus leverages its engineering expertise to install high-efficiency solar panels and supporting infrastructure, which are critical to maximizing the energy output and operational reliability of the solar parks.

Operational Efficiency and Maintenance

After the installation, Alternus shifts its focus to the operational management of the solar parks, which involves continuous monitoring and routine maintenance to ensure optimal performance. The company utilizes sophisticated data analytics and IoT technology to predict and preempt potential issues, thereby minimizing downtime and extending the lifespan of the solar installations. Regular performance assessments help refine operational practices, ensuring that the solar parks deliver on their projected energy production and environmental benefits.

Long-Term Asset Management and Optimization

Beyond daily operations, Alternus is committed to the long-term success of its projects. This commitment is reflected in their proactive asset management strategies, which involve regular upgrades to solar technology, renegotiation of power purchase agreements, and engagement with local communities to ensure that the projects continue to deliver mutual benefits over their entire operational lifespan. By effectively managing the end-to-end lifecycle of its projects, Alternus not only enhances its project ROI but also strengthens its market position as a leader in the renewable energy sector.

(1).png?width=1500&height=833&name=ALCE-Company-Presentation---January-2024-page9(1)(1).png)

Source: Company Reports

Alternus manages all aspects of Development, Installation, O&M and Asset Management activities providing full project value control & greater profit capture at each stage.

Leveraging Policy for Growth

Strategic Alignment with Government Incentives

Alternus Clean Energy proactively aligns its growth strategies with governmental policies and incentives that support the expansion and profitability of renewable energy projects. By staying abreast of legislative developments in key markets such as the United States and Europe, Alternus leverages these policies to secure financial incentives, enhance project feasibility, and drive competitive advantage. This strategic alignment is crucial in an industry heavily influenced by national and international energy policies.

Capitalizing on the Inflation Reduction Act in the U.S.

In the United States, the Inflation Reduction Act has marked a generational shift in the renewable energy landscape, offering expanded tax credits and financial incentives for solar power projects. Alternus Clean Energy capitalizes on these opportunities by structuring projects to maximize tax benefits, which significantly lowers the capital cost and enhances the investment appeal of their U.S. operations. These incentives not only help reduce the initial financial outlay but also improve the long-term economics of the projects, making them more attractive to investors and partners.

Source: Company Reports

Navigating European Energy Policies

In Europe, Alternus leverages the increasingly supportive regulatory environment, which is geared towards accelerating the transition to renewable energy in light of climate change targets and energy security concerns. European countries offer a range of incentives such as feed-in tariffs, grants, and favorable regulatory conditions that facilitate the development and operation of solar projects. Alternus’s strategy involves engaging with policymakers and industry associations to influence and anticipate changes in the regulatory landscape, ensuring they can quickly adapt and capitalize on new opportunities as they arise.

Future Outlook and Strategic Policy Engagement

Looking forward, Alternus plans to continue leveraging policy frameworks to support its growth initiatives. The company remains committed to engaging with legislative processes, advocating for policies that support the renewable energy sector, and participating in public-private partnerships that align with its strategic goals. This proactive approach not only helps mitigate regulatory risks but also positions Alternus as a key player in shaping the future of the energy sector.

Source: Company Reports

Technological Advancements in Solar Energy

Innovation Driving Efficiency and Sustainability

Alternus Clean Energy is committed to leveraging cutting-edge technology to enhance the operational efficiency and sustainability of its solar energy projects. The company invests in high-efficiency photovoltaic (PV) technologies that improve energy conversion rates, thereby maximizing output and reducing the land use for solar installations. This approach not only supports higher energy yield but also contributes to more environmentally friendly project footprints.

Smart Solar Solutions

A pivotal aspect of Alternus’s technological strategy is the integration of smart grid technologies and advanced energy storage solutions. These systems facilitate the effective integration of intermittent solar power into the grid, enhancing energy reliability and grid stability. By using advanced battery storage technologies, Alternus can store excess energy during peak production and release it during peak demand, optimizing energy use and increasing the financial viability of renewable energy solutions.

Source: Wikipedia

Data-Driven Operational Excellence To ensure peak performance of its solar parks, Alternus utilizes data analytics and Internet of Things (IoT) technologies for real-time monitoring and management. These tools allow for predictive maintenance and operational adjustments based on comprehensive data analysis, which helps prevent downtime and extends the life of solar installations. This proactive management approach ensures continuous improvement in performance and reduction in maintenance costs.

Commitment to Technological Leadership

Alternus continues to push the boundaries of solar technology by exploring innovative materials and techniques that minimize environmental impacts and enhance the efficiency of solar power generation. The company’s commitment to technological advancement is integral to its mission of leading the transition to a sustainable energy future marked by reliable, efficient, and clean energy solutions.

Diverse and Resilient Asset Portfolio

Dancing Horse Project in Tennessee, USA

Alternus recently acquired a 32MWp solar PV project in Tennessee, USA, known as 'Dancing Horse.' This project is expected to start operating in Q1 2025 and should produce annual revenue of approximately $2.3 million when fully operational. Notably, 100% of the offtake from this facility is secured by 30-year power purchase agreements with two regional utilities, ensuring long-term revenue stability.

NF Projects in Valencia, Spain

Alternus has also announced a planned expansion in Spain with the acquisition of 32 MWp of Solar PV projects in Valencia, known as the NF Projects. The portfolio consists of six projects, with five projects totaling 24.4 MWp expected to reach operation in Q2 2024 and the remaining project expected to achieve operation in Q1 2025. Once operating, the initial portfolio of five projects will generate approximately $2.3 million in average annual revenues over 10 years, increasing to $2.8 million once all projects are connected.

Focused Development in Italy

Alternus Clean Energy has strategically positioned itself with a robust portfolio of 11 solar projects in Italy, showcasing a total capacity of 210 MWp. These projects are near-term construction-ready, with all development milestones expected to be achieved within the next 12 months. This concentrated effort in Italy represents Alternus's commitment to enhancing its renewable energy footprint in regions with high solar potential and favorable regulatory environments.

Strategic Significance of Italian Assets

The Italian projects are situated to take advantage of Italy’s supportive policies for solar energy, including incentives for renewable power generation and goals for reducing carbon emissions. Each project is designed to integrate seamlessly into the local energy infrastructure, contributing significantly to Italy's renewable energy targets. The choice of Italy as a focal point for these developments highlights Alternus’s strategic approach to selecting markets that offer both stability and growth potential due to their policy-driven support for renewables.

Building a Resilient Portfolio

Alternus Clean Energy maintains a broader vision for diversity in its global asset portfolio. The strategic selection of Italy for these near-term projects does not preclude the presence or future development of assets in other regions, reflecting the company's ongoing strategy to balance its portfolio across different geographies to mitigate risks and maximize returns. This approach ensures long-term stability and resilience, aligning with Alternus’s commitment to sustainable growth and energy diversity.

Future Expansion and Asset Optimization

Looking forward, Alternus continues to evaluate additional opportunities to expand its asset base. This expansion is supported by continuous investment in technology and operational efficiencies, which enhance the overall resilience and performance of its assets.

Source: Company Reports

Sustainability and Environmental Impact

Commitment to Environmental Sustainability

Alternus Clean Energy is deeply committed to promoting environmental sustainability through its core business operations. As a leader in the renewable energy sector, Alternus leverages the power of solar energy to provide clean, green, and sustainable energy solutions. Solar energy, by its nature, plays a crucial role in reducing carbon emissions by displacing conventional fossil fuels and mitigating climate change.

Impact Through Solar Project Development

Each of Alternus’s solar projects is designed with a focus on environmental impact and sustainability. This involves careful site selection to minimize ecological disruption, the use of environmentally friendly materials, and adherence to best practices in construction and operations to ensure that projects are not only energy-efficient but also beneficial to local ecosystems. The company’s approach often involves rehabilitating land and implementing measures that support local biodiversity, such as planting pollinator-friendly plants and using land management techniques that enhance soil health.

Advancing Global Sustainability Goals

By increasing the share of renewable energy in the global energy mix, Alternus Clean Energy directly supports international sustainability goals, including the United Nations Sustainable Development Goals (SDGs), particularly those related to affordable and clean energy (SDG 7), industry, innovation, and infrastructure (SDG 9), and climate action (SDG 13). Alternus’s commitment to sustainability is also reflected in its efforts to ensure that its projects generate long-term social and economic benefits for the communities in which they operate, including creating jobs, providing stable energy supplies, and contributing to local development.

Ongoing Commitment to Environmental Excellence

Looking forward, Alternus is dedicated to continuing its leadership in environmental stewardship by exploring new technologies and practices that further reduce its operations' environmental footprint. This includes ongoing improvements in solar panel efficiency, investments in energy storage to enhance the usability of solar power, and initiatives to recycle and reuse solar panel components at the end of their lifecycle.

Source: Company Reports

Financial Strategies and Capital Efficiency

Strategic Balance Sheet Management

Alternus Clean Energy's financial strategy is deeply intertwined with the management of its balance sheet, particularly in how the company structures its assets and liabilities to support sustained growth and increase market capitalization. An important aspect of the strategy involves the careful management of debt levels and the amortization of these debts over time. As Alternus's operational projects mature and generate stable cash flows, the company uses these revenues to systematically reduce its debt burden. This amortization strategy not only decreases financial risk but also strengthens the company's balance sheet, leading to an intrinsic increase in market capitalization over time.

Leveraging Capital Resources for Expansion

Strategic financial resources, such as the significant €500 million Deutsche Bank facility, further enhance balance sheet efficiency. This facility is earmarked specifically for funding planned construction activities in Europe, demonstrating Alternus's proactive approach to leveraging external capital for growth without overextending its immediate financial commitments. By securing such substantial funding, Alternus can accelerate its expansion in key markets while maintaining capital efficiency and financial health.

FY 2023 Financial Results

In the fiscal year 2023, Alternus reported revenue of $20.1 million, a 17.5% increase year-over-year. Gross profit also increased by 25% to $15.6 million, with a gross margin of 78%. Despite the challenges faced due to one-time events, including project divestments and bond waiver fees, Alternus maintained a positive adjusted EBITDA of $4.4 million. These results demonstrate the company's resilience and ability to generate stable revenues even during strategic realignments.

Capital Efficiency in a Favorable Interest Rate Environment

Another cornerstone of Alternus's financial strategy is capitalizing on the current decreasing interest rate environment. The predictable cash flows from their operational projects provide a solid foundation for the company to further deleverage over time. This deleveraging is strategically planned to align with lower interest rates, thereby reducing the cost of debt and improving net income margins. As interest expenses decrease, Alternus can redirect savings towards further investment in project development or debt reduction, enhancing both capital efficiency and shareholder value.

Long-Term Financial Stability

The combination of strategic debt management, efficient use of capital facilities, and opportunistic financial planning underpins Alternus Clean Energy's approach to achieving long-term financial stability. By aligning its balance sheet management with operational cash flow generation and market opportunities, Alternus not only ensures it can meet its current financial obligations but also positions itself for sustainable growth and increased profitability in the future.

Retirement of $10 Million Convertible Debt

In January 2024, Alternus retired approximately $10 million of debt, consisting of a senior note, accrued interest, and expenses. This deleveraging initiative frees up borrowing capacity that the company intends to use to fund accelerated growth. The retirement of this note was funded by issuing Alternus common stock to the noteholder, Greenlight Asset Management GP S.a.r.l. ("Greenlight"), a leading Nordic asset manager focused on sustainable investing. By bringing Greenlight on as a strategic investor, Alternus gains access to its deep expertise and strong reputation in renewable energy investing, supporting the company's long-term financial strategies.

Source: Company Reports

€500 Million Deutsche Bank Facility for European Construction

In December 2022, Alternus secured a significant €500 million facility from Deutsche Bank specifically earmarked for funding planned construction activities in Europe. This financing vehicle demonstrates Alternus's proactive approach to leveraging external capital for growth without overextending its immediate financial commitments. By having this dedicated facility in place, Alternus can efficiently fund its European development pipeline, accelerating the construction of solar projects in key markets. The Deutsche Bank facility provides Alternus with the financial flexibility to execute its growth strategy while maintaining a strong balance sheet and optimizing its capital structure. Access to this substantial funding source positions Alternus to capitalize on the expanding renewable energy market in Europe and reinforces its ability to deliver on its operational targets.

Revenue Streams

Predictable Revenue from Operating Projects

Alternus Clean Energy's business model ensures stable and predictable long-term cash flows, primarily derived from its operating solar projects. The company has successfully minimized operational input costs post-Capital Expenditure (CapEx), which, combined with stable and predictable energy production, results in consistent margins over the long term. These projects are largely backed by long-term Power Purchase Agreements (PPAs); in the U.S., these agreements typically extend for over 20 years, while in Europe, PPAs are expected at 10 years with possibilities for extension or renewal. This structure provides a reliable income stream and financial stability.

Source: Company Reports

Enhanced by Feed-In Tariffs and Market Sales

In addition to PPAs, Alternus leverages Feed-In Tariffs (FiT) at fixed prices for 15 years for all energy produced in certain markets. This is supplemented by the sale of approximately 30% of energy produced at prevailing market rates, which helps to maximize revenue from each project. The combination of FiTs, long-term PPAs, and market sales ensures diversified and robust revenue streams across different regulatory environments and market conditions.

Strategic Growth and Future Revenue Projections

Looking forward, Alternus is focused on organic growth and targeted strategic opportunities to expand its portfolio. The company plans to increase its operational capacity significantly, from 613 MW in 2024 to 1,460 MW by 2026. Each additional 100 MWp of capacity in European projects is expected to deliver approximately $10M of annual recurring revenues over their useful life of about 35 years. Similarly, every 100 MWp of U.S. projects added is projected to generate roughly $8M of annual recurring revenues over an expected useful life of about 40 years. These projections underscore the scalability of Alternus's business model and its ability to generate increasing revenue streams as the portfolio grows.

Financial Efficiency and High Gross Margins

Alternus's strategic financial management ensures high gross margins, with projects expected to maintain an average of over 80% across both U.S. and European markets. This high margin is indicative of the efficiency and effectiveness of Alternus’s project management and operational execution, reflecting the company’s ability to optimize costs and maximize revenue generation.

SEC Filings

Financials

Risks & Disclosures

This communication is neither an offer to sell nor a solicitation of an offer to buy, nor a recommendation of any securities of the company mentioned herein.

Alternus Clean Energy, Inc. (the “Company”) has reviewed the content of this page as well as the accompanying presentation (“Company Presentation”) displayed on this page. To the best of its knowledge, the Company does not believe this content to be misleading or inaccurate in any material respect, nor does it believe there are any material omissions with respect to such content. The Company does not believe the contents of the page or the Company Presentation to contain any non-public material information.

Information and opinions presented in the Company Presentation are provided by the Company, and b2iDigital makes no representation as to their accuracy or completeness. The information contained on this page is not intended to constitute any form of advice, and the information provided is not intended to provide a sufficient basis on which to make an investment decision. It is not investment research, nor does it constitute a research recommendation, as it does not constitute substantive research or analysis. This information is not to be relied upon in substitution for the exercise of independent judgment.

Information, opinions and estimates contained on this page or in the Company Presentation reflect judgments by the Company as of the original date of publication by the Company and are subject to change without notice. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied is made regarding future performance.

A complete description of the risks and uncertainties relating to the Company and its securities can be found in the company's filings with the U.S. Securities and Exchange Commission available for free at www.sec.gov.

Information on this page may relate to penny stocks, which may also be referred to as low-priced stocks. Penny stocks are low-priced shares typically issued by small companies. Penny stocks involve greater than normal risk, they may be less liquid than other stocks (i.e., more difficult to sell), and there may be less reliable information available regarding such stocks. Investors in penny stocks should be prepared for the possibility that they may lose their entire investment.

b2i digital or its related entities may own securities of the Company.

The Company is a client of b2i Digital. The Company agreed to pay b2i Digital no greater than $100,000 in cash for 12 months of digital marketing consulting and investor awareness services.

This communication includes forward-looking statements that involve risks, uncertainties and assumptions that are difficult to predict. Words and expressions reflecting optimism, satisfaction or disappointment with current prospects, as well as words such as “believes,” “hopes,” “intends,” “estimates,” “expects,” “projects,” “plans,” “anticipates” and variations thereof, or the use of future tense, identify forward-looking statements, but their absence does not mean that a statement is not forward-looking. The Company’s forward-looking statements are not guarantees of performance, and actual results could vary materially from those contained in or expressed by such statements due to risks, uncertainties and other factors. The Company urges readers to consider specifically the various risk factors identified in its most recent Form 10-K, and any risk factors or cautionary statements included in any subsequent Form 10-Q or Form 8-K, filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this communion. Except as required by law, the Company does not undertake any responsibility to update any forward-looking statements to take into account events or circumstances that occur after the date of this communication.

Management Team

Vincent Browne

Vincent Browne

Chief Executive Officer

Vincent leads Alternus’ expansion across America and Europe, drawing on over two decades of senior and c-suite management expertise in finance and operations as CEO and Interim CFO.

His track record includes orchestrating M&A deals, navigating project finance intricacies, and executing capital market transactions across both public and private sectors. With a history of leadership roles as CEO or CFO in OTC listed companies and as a strategic advisor on M&A, spinouts, and corporate restructuring, Vincent brings invaluable insights to the organisation.

Beyond his corporate endeavours, Vincent’s entrepreneurial spirit shines through his founding of technology start-ups that rose to prominence in their industries. His tenure as Head of Procurement at Esat Telecom Group, a NASDAQ-listed telecom powerhouse, further fortified his strategic acumen.

Vincent’s educational background includes a Bachelor of Commerce (Accounting) from University College Dublin. He also actively contributes to the commercialization of research and technology projects at Trinity College Dublin’s Technology and Enterprise Campus. His innovative mindset and wealth of experience are instrumental in charting Alternus’ path to continued success.

David Farrell

David Farrell

Chief Commercial Officer

David joined the executive management team at Alternus in 2022. He oversees all commercial and M&A activity for the Company in addition to leading the funding and investment activities in conjunction with the CFO and CEO. He has over 20 years’ experience across capital markets, incorporating project finance, infrastructure and renewables, and finance industry.

Prior to joining Alternus, he was a Director of Corporate Finance at advisory firm Grant Thornton. Additional previous roles include Director of Mergers & Acquisitions at the investment bank, Duff & Phelps, Regional Head of Debt Structuring at the accountancy firm, FGS and various management roles in corporate, institutional, and commercial banking, together with several advisory board roles. In these roles, Mr. Farrell acquired extensive experience on both sides of corporate, real estate, and infrastructure and renewable financings along with numerous M&A transactions.

Taliesin Durant

Taliesin Durant

Chief Legal Officer

Taliesin was appointed as General Counsel in Alternus in 2018. Given her wealth of experience and solutions orientated and methodical style, Taliesin ensures the company takes the best legal approach across all levels of the business. Taliesin has served in senior operating roles in a variety of corporate and public enterprises for over twenty years, providing general corporate legal advice. Taliesin’s most recent role was as the President of Dart Business Services LLC, a company which she founded in 2010. Dart Business Services provided consultancy services to a few small public and private companies, similar to those provided by a general counsel or in-house counsel and corporate secretary.

Prior to founding Dart, Taliesin was the Chief Legal Officer and Corporate Secretary of Flint Telecom Group and previously spent 8 years at Semotus Solutions as General Counsel and Corporate Secretary where she was part of the team that took the company from its listing on the OTC Markets to Amex and then to Nasdaq.

Taliesin holds a BA in Economics from Connecticut College and is a member of the California State Bar Association, having earned a Juris Doctor degree at North-western School of Law at Lewis and Clark College and completed her final year at Santa Clara University School of Law.

Gary Swan

Gary Swan

Chief Technical Officer

Gary joined Alternus in 2021 as Chief Technical Officer bringing with him 30 years’ construction experience where he has worked on the design, construction, operation and sale of approximately 1 GWp of renewable energy assets while demonstrating a significant track record of delivering projects safely, on time, on budget and managing successful client and partner relationships.

For the 3 years prior to joining Alternus, Gary was responsible for the construction of several large-scale wind and solar projects owned by Actis Energy portfolio companies AELA Energia (Chile) and BioTherm Energy (Africa), where he held the role of acting Technical Director. Prior to Actis, he spent almost 6 years at Mainstream Renewable Power, where as Head of Construction he held the responsibility for delivering wind and solar projects through the construction phase into operation across Europe, North America, Latin America and Africa. During this time, Gary managed relationships with Mainstream’s JV partners Actis and JV platforms Lekela Power (Africa) and AELA Energia. He was Mainstream’s representative on the project Steering Committees and alternate director on project company boards. He also held interim responsibility over a two-year period for all aspects of safety, security and quality within the Mainstream group.

Gary has a BAI in Civil, Structural and Environmental Engineering from Trinity College Dublin and an MSc in Project Management from the University College Dublin Michael Smurfit Graduate Business School.

Larry Farrell

Larry Farrell

Chief Information Officer

Larry joined Alternus in 2019 excited by the company’s plans for growth and at the prospect of getting involved in one of the fastest growing industries across Europe. With over 20 years of experience in senior leadership roles across production, operations and service delivery management, in both startups and fortune 500 companies, Larry brings with him the necessary expertise to facilitate the company’s operational expansion across Europe.

In his previous role as senior director of global operations for Xerox, consolidating and developing support systems and infrastructure globally, Larry successfully managed a team of 300+ people across multiple lines of the business. Larry brings a core skillset of building and managing cross functional global teams in an international environment simultaneously enabling growth whilst maintaining control at all operational levels.

Larry is ITIL and Lean Six Sigma certified and studied Mechanical Engineering at Dundalk Institute of Technology and holds Diplomas in Management from Dublin Business School and Printing and Graphic Communication from Technological University Dublin.

Alternus Clean Energy, Inc. is guided by an experienced leadership team.

Alternus Clean Energy is propelled by a highly experienced leadership team, each member bringing deep industry expertise and a proven track record in renewable energy and corporate management. Under the strategic direction of this diverse team, Alternus is committed to achieving sustained growth and maintaining a leading position in the renewable energy sector.

Note: The company can only disclose information that is shared in the public domain through press releases, SEC filings, and other public forums. As securities law and industry regulations require, such information will always be shared with all investors simultaneously.

Transatlantic Renewable Energy Innovator Specializing in Solar Power

Alternus Clean Energy operates as a transatlantic clean energy independent power producer, focusing on utility-scale solar parks that harness innovative renewable technologies and sustainable practices.