Beneficient

Beneficient is on a mission to democratize the global alternative asset investment market by providing traditionally underserved investors − mid-to-high net worth individuals and small-to-midsized institutions − with early exit solutions that could help them unlock the value in their alternative assets. Ben’s AltQuote™ tool provides customers with a range of potential exit options within minutes. Customers can log on to the AltAccess® portal, explore opportunities, and receive proposals in a secure online environment.

Its subsidiary, Beneficient Fiduciary Financial, L.L.C., received its charter under the State of Kansas’ Technology-Enabled Fiduciary Financial Institution (TEFFI) Act and is subject to regulatory oversight by the Office of the State Bank Commissioner.

Nasdaq: BENF

IR Website: https://shareholders.trustben.com/

Headquarters: Dallas, TX

TALK TO MANAGEMENT

Beneficient is always ready to engage with current and potential investors, eager to answer your questions and share what makes their story unique. Please fill out this form, and we will connect you shortly.

Beneficient At A Glance

Beneficient (NASDAQ: BENF) headquartered in Dallas, Texas, is a technology-enabled financial services company that provides innovative early exit solutions and related trust and custody services to holders of alternative assets. The company's mission is to democratize the global alternative asset investment market by offering solutions to traditionally underserved investors, including mid-to-high net worth individuals, small-to-midsized institutions, and General Partners seeking early exit options, financing of anchor commitments, and value-added services for their funds.

Through its subsidiary, Beneficient Fiduciary Financial, L.L.C., which operates under a charter pursuant to the State of Kansas' Technology-Enabled Fiduciary Financial Institution (TEFFI) Act.

Beneficient offers a suite of products and services designed to provide options for alternative asset holders. These offerings are delivered through the company's proprietary Ben AltAccess® platform, which enables secure, end-to-end transactions. Beneficient's business model focuses on building a diversified portfolio of alternative assets through its early exit solutions while generating recurring revenue from trust and custody services.

Key Considerations:

Diverse Alternative Asset Portfolio

The company's loan portfolio is supported by a highly diversified alternative asset collateral portfolio spanning various asset classes, industry sectors, and geographies. This diversification includes exposure to over 250 private market funds and approximately 850 investments, providing a broad range of market exposure.

Market Opportunity

Beneficient targets an underserved segment of the alternative asset market, focusing on mid-to-high net worth individuals and small-to-midsized institutions. The company estimates its target market to include approximately $2.1 trillion in alternative assets held by these investors in the U.S. alone.

Liquidity The Ben® Way

Source: Company Documents

Press Releases & Media Coverage

Social Media Updates

Recent LinkedIn Posts

Recent Facebook, Instagram, Pinterest, TikTok, YouTube and X Posts

Investor Presentation

To download the Beneficient investor presentation, please fill out the form below.

Stock Chart (Historical)

Stock Detail

Company Overview

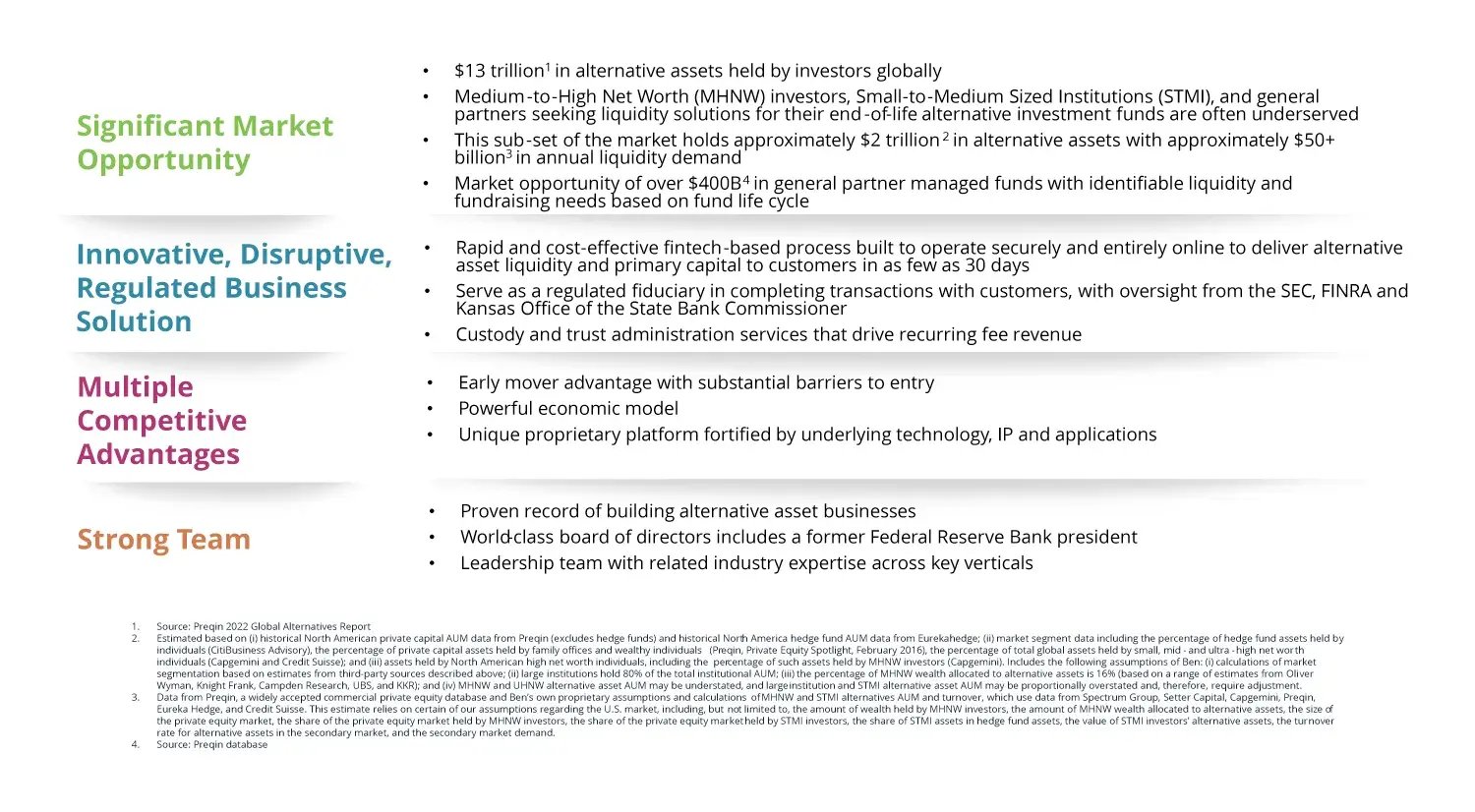

Beneficient operates in a vast market of alternative assets, which globally amounts to approximately $13 trillion. The company specifically targets medium-to-high net worth (MHNW) investors and Small-to-midsized institutions (STMI), who often need help finding liquidity solutions for their alternative investments. This underserved segment holds about $2 trillion in alternative assets, with an estimated $50+ billion in annual liquidity demand. Additionally, there is a $400+ billion opportunity in General Partner managed funds. Ben’s strategic initiative GP Solutions can address the needs of GPs in the alternative asset space through fund monetizations and primary capital solutions.

The company has developed a fintech-based process that operates entirely online, providing a rapid and cost-effective way to deliver liquidity options to customers. Beneficient's process can be completed significantly faster than traditional methods, depending upon the securities a customer offers for liquidation and the documentation they provide Beneficient’s early exit solutions are effected through its subsidiary, Beneficient Fiduciary Financial, L.L.C., which is chartered under the Kansas TEFFI Act and is subject to regulatory oversight from the Kansas Office of the State Bank Commissioner. Beneficient also offers custody and trust administration services, which generate recurring fee revenue, adding stability to its business model.

Source: Company Reports

As an early mover, Beneficient has established substantial barriers to entry for potential competitors. The company has developed a unique proprietary platform strengthened by its underlying technology and intellectual property. This technology, combined with the company's expertise in alternative assets, creates a robust economic model. These factors make it challenging for new entrants to replicate Beneficient's offerings quickly or easily.

Beneficient's leadership team brings a proven track record of building successful businesses in the alternative asset space. The company boasts a world-class board of directors, with significant financial and regulatory expertise. The leadership team has extensive industry experience across key verticals relevant to Beneficient's business, ensuring the company is well-guided in its strategic decisions and day-to-day operations.

Source: Company Reports

To view a two-minute video overview of Beneficient, please click below:

Source: Company Documents

Addressing Market Needs

Beneficient has developed an innovative approach to address the growing liquidity challenges in the alternative asset market, particularly for medium-to-high net worth investors and small-to-midsized institutions. The company's business model is designed to provide liquidity options for these traditionally underserved investors who often find themselves with limited exit opportunities from their alternative asset investments.

The alternative asset market is experiencing significant growth, with global alternative assets under management increasing rapidly. This growth is coupled with several key trends:

-

Mid-to-high net worth and smaller institutional investors are increasing their allocations into alternative assets.

-

There's a growing demand for early exit options, as typical private fund lockups last 10-12 years.

-

The number of GPs fundraising continues to grow, alongside an increase in GP-led restructuring and liquidity events.

-

There's an increased demand for capital commitments as fundraising headwinds persist across most asset classes.

However, current in-market liquidity options are often inefficient, slow, difficult to scale, and largely unregulated. Beneficient's technology-driven platform, AltAccess, aims to disrupt this market by providing a more efficient, secure and accessible solution.

Source: Company Reports

Importantly, Beneficient's comprehensive approach addresses multiple aspects of the market:

-

For LPs (Limited Partners): Providing early exit options for individual and institutional investors.

-

For GPs (General Partners): Offering primary capital solutions and supporting fund monetizations and restructurings.

-

Value-Added Services: Delivering trustee and custody services, data analytics, and other services for all owners of professionally managed alternative assets.

Source: Company Reports

While Beneficient's current offerings don't provide immediate cash liquidity, they are designed to offer a structured solution where clients exchange their illiquid assets for other securities issued by Beneficient. While still not immediately liquid, these offered securities may provide advantages such as potential tax benefits or improved portfolio management options.

By addressing the needs of both LPs seeking exit options and GPs looking for primary capital or fund restructuring solutions, Beneficient positions itself as a comprehensive service provider in the alternative asset ecosystem. The company’s offerings may differ from time to time and such offerings may include cash-out options.

Innovative Early Exit Solutions

Beneficient offers proprietary exit solutions for alternative asset holders through its AltAccess® platform. These solutions are designed to provide options for mid-to-high net worth individuals and small-to-midsized institutions who may have limited access to traditional liquidity providers. (Link: Liquidity The Ben® Way)

At the core of Beneficient's product lineup are three main offerings, which may differ from time to time and may not be available for all customers: ExchangeTrust®, InterchangeTrust®, and LiquidTrust®. ExchangeTrust® provides exit options through equity or debt securities issued directly from Beneficient's balance sheet via their FINRA-member broker-dealer. InterchangeTrust® offers a hybrid solution, combining cash with equity or debt securities. LiquidTrust® is designed to provide cash liquidity options. These products are intended to offer flexibility and potentially tax-efficient solutions for investors seeking to receive a high percentage of net asset value (NAV) for the exchanged assets.

Source: Company Reports

In addition to these primary offerings, Beneficient provides complementary services through its AltAccess® platform. These include online platform subscriptions (expected to launch in the future), trustee services for digitizing alternative assets (expected to launch in the future), custody, sub-custody services, data management and quick quote valuations, and transfer agency and broker-dealer services. These services are designed to enhance the overall value proposition for clients, providing comprehensive support throughout the lifecycle of their alternative investments.

Beneficient's innovative approach extends to its GP Solutions program, which includes the GP Primary Commitment Program. This initiative facilitates anchor capital commitments for GPs and offers optional participation in the Preferred Liquidity Provider Program. By addressing the needs of both individual investors and fund managers, Beneficient positions itself as a versatile player in the alternative asset ecosystem, capable of providing solutions across various stages of the investment lifecycle.

Source: Company Reports

AltAccess® Technology Platform

AltAccess® is Beneficient's proprietary, early-to-market technology platform designed to revolutionize how alternative asset holders access liquidity and related services. This innovative platform is the central hub for Beneficient's operations, designed to provide a secure, interactive, and user-friendly interface for customers to engage in end-to-end transactions for liquidity and associated services.

The platform is built with two distinct user interfaces: one for individual investors and another for advisors. This dual-dashboard approach allows for a tailored experience catering to the specific needs of each user type. Investors can directly submit applications for liquidity, while advisors can manage applications on behalf of their clients, streamlining the process for all parties involved.

Source: Company Documents

One of the key features of AltAccess® is its ability to facilitate rapid transactions. The platform guides users through a step-by-step process, from initial application submission to final transaction closure. Users can easily upload necessary documents using a simple drag-and-drop feature, track the status of their applications in real time, and receive notifications for any outstanding tasks or updates. This level of transparency and ease of use is intended to significantly reduce the time and complexity typically associated with alternative asset transactions.

Source: Company Reports

Engineered and Designed for Systematic Accuracy and Transparency

The AltAccess® platform guides users through a comprehensive, streamlined workflow to facilitate efficient transactions. The process begins with creating a user account, followed by submitting a liquidity application. Users can easily search for and select the specific alternative assets they wish to transact, providing relevant fund and investment details. The platform's integration with Beneficient's extensive database of over 82,000 funds simplifies this step, often pre-populating much of the required information.

Once the initial application is submitted, users are prompted to complete a custody account setup, ensuring compliance with regulatory requirements. The platform then facilitates the secure upload of all necessary asset-related documents. As the application progresses, Beneficient's team reviews the submission, conducts diligence, and generates a proposal for the user's consideration.

Upon acceptance of the proposal, the platform guides users through the completion of required forms and the execution of definitive documents. Throughout this process, AltAccess® provides real-time status updates and a clear overview of any pending tasks, ensuring transparency and enabling users to track their application's progress at every stage. The workflow culminates in the final closing steps, including the execution of closing documents and, where applicable, the disbursement of funds or securities.

Source: Company Documents

Security and compliance are paramount in the design of AltAccess®. The platform operates under stringent security protocols, protecting sensitive financial information. It's also designed to comply with Ben’s regulatory requirements. This combination of security and regulatory compliance is why users have high trust and confidence in their transactions and are willing to transact high-value assets online.

Ben's Statutory Early-Mover Advantage

Beneficient has established a unique position in the alternative asset market through its statutory early-mover advantage. As one of the industry's first regulated, tech-enabled online platform for delivering liquidity options for alternative investments, Beneficient offers an end-to-end customer experience with regulatory oversight. This unique positioning allows the company to deliver a suite of products in an environment of safety, soundness, and security.

The ongoing reviews and exams by both state and federal regulators further reinforce the company's commitment to compliance and best practices. This regulated status sets Beneficient apart in several important ways. First, it allows the company to operate as a principal without third-party intermediaries, providing financing directly from its balance sheet. This capability streamlines transactions and potentially reduces costs for clients. Second, Beneficient's operations are compliant with Know Your Customer (KYC), Anti-Money Laundering (AML), Bank Secrecy Act (BSA), and Office of Foreign Assets Control (OFAC) requirements for financial transactions, ensuring a high level of integrity and security in all dealings.

Source: Company Documents

Diverse Alternative Asset Portfolio

Beneficient has developed a loan portfolio supported by collateral comprised of a diverse alternative asset portfolio that mirrors the endowment model, providing exposure to a wide range of asset classes, industries, and geographies. This diversification strategy is implemented through the company's proprietary OptimumAlt model and other intellectual property, which enables Beneficient to build a robust and balanced loan portfolio backed by alternative assets.

As of March 31, 2024, Beneficient's loan portfolio was supported by a highly diversified alternative asset collateral portfolio, providing diversification across more than 250 private market funds and approximately 850 investments. This extensive diversification potentially helps to mitigate risk and enhance returns, similar to the approach taken by many successful endowment funds. The collateral portfolio includes exposure to some of the most sought-after private companies worldwide, spanning various sectors such as space exploration, innovative software and payment systems, consumer goods, e-commerce, and fintech.

The collateral portfolio's industry sector allocation demonstrates a balanced approach, with significant exposure to software and services (18%), real estate (16%), and food and staples retailing (9%), among others. This diversification across sectors helps to reduce the impact of industry-specific risks on the overall collateral portfolio. Geographically, the portfolio maintains a strong focus on North America (68%) while also providing exposure to Asia & Pacific (15%), South America (10%), and Europe (6%), offering a global perspective on alternative investments.

In terms of investment strategies, Beneficient's collateral portfolio is well-distributed across various approaches. Venture capital (late stage) and private equity (growth) each account for 28% of the collateral portfolio, followed by private real estate at 17%. This mix allows the company to capture opportunities across different stages of the investment lifecycle and various asset types. Including other strategies, such as natural resources, hedge funds, and private debt, further enhances the collateral portfolio's diversification.

Source: Company Documents

Beneficient's OptimumAlt model plays a crucial role in maintaining this diversified collateral portfolio. The proprietary model uses advanced algorithms and data analytics to optimize the collateral portfolio's composition, considering factors such as risk, return potential, and overall collateral portfolio balance. This data-driven approach allows Beneficient to make informed decisions about which assets to include in its collateral portfolio and how to weight them effectively.

The company's intellectual property extends beyond the OptimumAlt model to include other proprietary systems and methodologies. These tools enable Beneficient to efficiently manage and analyze its diverse collateral portfolio, providing valuable insights that inform investment decisions and risk management strategies. By leveraging this technology, Beneficient's loan portfolio not only offers exposure to diversified alternative assets but also has the potential to generate attractive risk-adjusted returns over time.

GP Solutions Program

Beneficient's GP Solutions Program is a strategic initiative designed to address the evolving needs of General Partners (GPs) in the alternative asset market. The Program mainly focuses on fund monetizations and primary capital solutions. For fund monetizations, Beneficient offers options to GPs who are managing funds nearing the end of their lifecycle or facing other liquidity challenges. This service allows GPs to provide liquidity options to their Limited Partners (LPs) or to restructure their funds, potentially extending the life of successful investments or winding down underperforming ones.

On the primary capital front, Beneficient's GP Primary Commitment Program facilitates anchor capital commitments for GPs who are in the fundraising process. This service can be particularly valuable in a challenging fundraising environment, where securing initial commitments can be important for attracting additional investors. Beneficient helps GPs overcome potential hurdles in launching new funds or expanding existing ones by facilitating the provision of this initial capital.

A unique aspect of the GP Solutions Program is the Preferred Liquidity Provider (PLP) option. GPs participating in the Program can become Preferred Liquidity Providers at no cost to them or their LPs. This arrangement can enhance the attractiveness of a GP's funds by offering a potential liquidity solution to LPs, which may be particularly appealing in funds with long lock-up periods.

The market opportunity for GP Solutions is substantial. Beneficient estimates there are over $400 billion in general partner-managed funds with identifiable liquidity and fundraising needs based on fund life cycles. The total includes funds facing fundraising challenges, those with performance issues (either absolute or relative to peers), funds with unfavorable terms, new managers seeking to establish track records, and end-of-life funds looking to wind down operations.

Source: Company Documents

For prospective investors, the GP Solutions Program represents a significant growth avenue for Beneficient. By addressing the needs of both GPs and LPs, the company positions itself as a valuable partner in the alternative asset ecosystem. This Program has the potential to drive revenue growth and expand Beneficient's network within the industry, potentially leading to additional business opportunities and strengthening its market position.

Products and Services

Beneficient offers a comprehensive suite of products and services designed to address alternative asset holders and general partners' unique needs. Through its integrated business units, the company provides innovative liquidity solutions and custody services, underpinned by its proprietary AltAccess platform, with data analytics and brokerage services planned for future release. These offerings work in tandem to deliver value across the alternative asset lifecycle, from initial investment to eventual exit or restructuring.

-

Ben AltAccess® is the company's enterprise-wide, end-to-end online platform that empowers Beneficient's various business units and provides customer-facing applications. The platform is the primary interface for customers, offering online access to Beneficient's suite of services. AltAccess streamlines the process of applying for liquidity solutions, managing alternative assets, and accessing other Beneficient services, providing clients with a seamless and user-friendly experience.

-

Ben Custody offers full-service specialized trust administration, trustee services, reporting, and qualified custodial services. This unit currently provides services to the ExAlt Trust and customers in connection with liquidity transactions and customer custody accounts. These services are important for maintaining the integrity and security of clients' alternative assets and ensuring proper management and reporting throughout these investments' lifecycle.

-

The Ben Data unit focuses on data collection, evaluation, and analytics, currently offering its products and services to the ExAlt Trusts with plans to expand to Ben customers and others. This unit provides valuable insights into alternative assets and helps clients make informed investment decisions. Data and analytics services can include market trends, asset performance metrics, and other relevant information for alternative asset investors.

-

Ben Liquidity & Capital handles liquidity transactions, including fiduciary loans and related underwriting and risk management. The unit addresses the primary need of many alternative asset holders: access to liquidity. Through this group, Beneficient offers early exit solutions for investors looking to monetize their alternative asset holdings before the end of the typical investment cycle.

-

While not yet operational and subject to regulatory approval, Ben Insurance is planned as a unit that will offer insurance policies covering risks associated with owning, managing, and transferring alternative assets. This future offering could provide an additional layer of security and risk management for Beneficient's clients, potentially making their alternative asset investments more attractive and manageable.

-

Ben Markets provides broker-dealer services, facilitating early exit transactions and other securities sales. This unit executes the transactions that allow clients to monetize their alternative assets. Ben Markets handles the complexities of these transactions, ensuring compliance with relevant securities regulations and market standards.

Source: Company Reports

Transaction-Planned Economics

Beneficient's transaction-planned economics model is designed to align the company's interests with those of its clients while providing a structured approach to liquidity solutions for alternative asset holders. This model embeds all transaction-related fees into the determination of the Advance Rate, allowing customers to avoid out-of-pocket payment of fees.

To illustrate how this model works, let's consider a hypothetical Ben ExchangeTrust® transaction:

Hypothetical Transaction Scenario:

-

Net Asset Value (NAV) of client's alternative asset: $1,000,000

-

Unfunded commitment: $100,000

-

Consideration offered: $750,000 in Ben Common Stock

-

Advance Rate: 75% (percentage of consideration relative to NAV)

-

Assumed asset growth: 7.0% per annum

-

Time until final distribution: 5 years

-

Weighted average duration of distributions: 2.5 years

In this hypothetical scenario, Beneficient's revenue would come from both one-time and recurring sources:

One-time Revenues:

-

Platform Fee: For use of the AltAccess platform providing end-to-end delivery of Ben's products and services

-

Transfer Agent Fee: For the transfer of Alternative Assets, trust and equity record holder admin, cash transfer admin and accounting, and related services

-

Broker-Dealer Fee: For services performed in connection with the exchange of Alternative Assets and delivery of Consideration

-

Insurance Premiums: For insurance policies covering risks related to the transfer of Alternative Assets (note: Ben Insurance is not currently operational and requires regulatory approval)

Recurring Revenues:

-

Trust Administration Fee (Annual): For full-service custody and trust administration services

-

Data Subscription Fee (Annual): For Alternative Asset news, data, and related proprietary metrics (planned)

-

Insurance Premiums (Annual): For policies covering risks related to Alternative Asset ownership, credit exposure, and other risks (planned)

-

Fiduciary Loan Interest: Annual interest, accrued and capitalized as income and added to the principal balance of the Fiduciary Loan monthly

-

Charity: Distributions on all ExAlt Trust income to the Kansas Charity

Based on this hypothetical scenario, over 5 years, the total revenue generated would be $384,253:

-

Total One-time Fees: $130,350

-

Total Recurring Fees: $50,632

-

Total Interest: $203,271

This model assumes that the alternative asset would distribute an aggregate of $1,188,529 to the ExAlt Trusts over the 5 years. This cash would be used to make distributions to the Kansas charity and pay expenses to Beneficient's business units.

Important Considerations and Disclaimers:

-

This hypothetical scenario does not reflect Beneficient's current offerings or historical transactions.

-

The fee and interest percentages used in this example do not reflect those used in historical transactions. They represent potential future rates if all planned Ben businesses become operational.

-

Actual revenue can vary significantly based on the performance of the alternative asset collateral, both in terms of the amount realized and the timing of realizations.

-

The economics of historical and future transactions may differ from this hypothetical example.

-

This model assumes the planned Ben businesses have launched and are fully operational, which is not currently the case for all business units.

-

Ben Insurance is not operational and requires regulatory approval.

This transaction-planned economics model illustrates how Beneficient envisions its integrated business units working together to create a comprehensive revenue stream from each client relationship. The model aims to balance upfront fees with ongoing income to align the company's and its clients' long-term interests. However, investors should know that this is a forward-looking model and that Beneficient's current operations and offerings may differ from this hypothetical scenario.

Source: Company Documents

Current Transaction Structure

To illustrate Beneficient's current approach to liquidity solutions, let's consider a hypothetical transaction based on the company's recent practices:

Hypothetical Current Transaction:

-

Net Asset Value (NAV) of client's alternative asset: $40 million

-

Type of asset: Multi-family real estate

In this scenario, Beneficient would structure the transaction as follows:

-

Asset Acquisition: Beneficient's customized trust vehicles would acquire the alternative assets.

-

Consideration: In exchange for the alternative assets, the client would receive two types of securities: a) Convertible Preferred Stock: For example, 4,000,000 shares of Beneficient’s Series B Resettable Convertible Preferred Stock, with a stated value of $10 per share. b) Warrants: Approximately 1,000,000 warrants to purchase Beneficient securities.

-

Convertible Preferred Stock Terms:

-

Initial conversion price: Set at the five-day trailing volume weighted average price (VWAP) of Beneficient’s Class A Common Stock at the time of the first closing.

-

Subject to periodic resets: The conversion may be adjusted on the last day of each month based on the stock’s performance.

-

Floor price: Typically set at 50% of the initial conversion price or $2.00

-

Mandatory conversion: Occurs on the last day of the month in which the fifth anniversary of the closing date occurs, provided certain conditions are met, including the effectiveness of a resale registration statement or the availability of resales under Rule 144.

-

-

Warrants:

-

-

Exercise price: Set at a premium to the current market price

-

Securities received upon exercise: Typically, a combination of Class A Common Stock and another series of Preferred Stock

-

-

Fiduciary Loan: Beneficient would hold a fiduciary loan with an initial principal balance approximately equal to the net asset value (NAV) of the acquired assets.

-

Rule 144 Considerations:

-

The securities issued (both Preferred Stock and Warrants) are typically restricted securities under Rule 144.

-

Generally, Beneficient, as a reporting company, has a six-month holding period before the securities can be resold under Rule 144.

-

After the holding period, sales may be subject to volume limitations and other Rule 144 requirements.

-

The mandatory conversion feature is often tied to Rule 144 eligibility to provide a path to potential liquidity.

-

This structure provides the client with securities with potential upside tied to Beneficient's performance while allowing Beneficient to acquire the alternative assets. The client gains the ability to potentially liquidate their position over time as the preferred stock converts and warrants become exercisable, subject to market conditions and regulatory requirements.

It's important to note that this structure does not provide immediate cash liquidity but offers a path to potential liquidity through publicly traded securities. The ultimate value the client realizes depends on various factors, including Beneficient's stock performance and the timing of any sales of received securities.

Investors should be aware that each transaction may have unique features, and Beneficient may adjust its approach based on specific client needs, regulatory requirements, and market conditions.

Growth Strategy & Competition

Growth Strategy and Competition

Beneficient has developed a multifaceted growth strategy designed to capitalize on the rapidly expanding global alternative investment market. The company's focus is on serving traditionally underserved segments, particularly medium-to-high net worth (MHNW) individuals and small-to-mid-sized institutions (STMI), which collectively represent a major opportunity.

Market Opportunity:

According to Beneficient's projections, MHNW investors hold approximately $1.0 trillion in alternative assets, while STMI investors hold about $1.1 trillion. This combined $2.1 trillion market segment has been historically underserved by traditional liquidity providers. Beneficient estimates the annual demand for liquidity from these segments at $51 billion, with potential growth to $106 billion in five years.

Growth Drivers:

-

Expanding MHNW Market: The MHNW population has grown significantly, from 0.76 million to 1.8 million households between 2008 and 2021.

-

Increasing Alternative Asset Allocations: From 2013 to 2020, MHNW investors increased their allocation to alternative assets 3.2 times faster than to marketable stocks.

-

Strong Market Growth: The alternative assets market has shown robust historical growth, with a 14.5% compound annual growth rate (CAGR) from 2005 to 2021.

Source: Company Documents

Beneficient's Approach:

To address this market, Beneficient has implemented an omnichannel strategy:

-

GP Solutions: Targeting fund sponsors and general partners, recognizing the growing importance of GP-led liquidity events.

-

Preferred Liquidity Provider (PLP) Program: Addressing the lack of liquidity options in wealth management firms, with over 20 GP PLP agreements representing $1.5 billion in committed NAV.

-

Direct-to-Investor and Advisor Channels: Employing a multi-pronged approach that includes in-house distribution, national coverage models, and innovative tools like AltQuote.

Source: Company Reports

Competitive Landscape:

Beneficient positions itself as a superior alternative to traditional liquidity solutions such as auction-based platforms, secondary funds, and GP-led restructurings. The company aims to address common issues in existing solutions, including uncertain buyer interest, unknown timelines, manual processes, and complex transactions.

By leveraging its technology-enabled platform, regulatory status, and diverse product offerings, Beneficient seeks to provide a more efficient, transparent, and accessible liquidity solution for the underserved MHNW and STMI segments. The company's unique approach and focus on these high-growth segments position it to potentially capture a significant portion of this expanding market.

Source: Company Reports

Financial Highlights

Updated financial highlights for Beneficient, including its Annual Report and all public filings, can be found at shareholders.trustben.com.

Beneficient's financial results for the fourth quarter of fiscal 2024 reflect the company's ongoing efforts to expand its market presence and optimize its operations:

-

Investments at Fair Value: As of March 31, 2024, Beneficient reported investments with a fair value of $329.1 million, which serve as collateral for Ben Liquidity's net loan portfolio of $256.2 million.

-

GP Preferred Liquidity Provider Program Growth: The company expanded its GP Preferred Liquidity Provider Program to 20 funds with $1.5 billion in committed capital, up from 7 participating funds with $300 million in committed capital at December 31, 2022.

-

Cost Management: Beneficient’s operating expenses were $151.9 million in the fourth quarter of 2024, which includes a non-cash goodwill impairment of $68.1 million and a recognized loss contingency totaling $55.0 million. The result was $28.8 million in operating expenses, excluding goodwill impairment and loss contingency, compared with $30.5 million of operating expenses in the same period of 2023, representing a 6% decline.

-

New Transactions: During the fiscal year ended March 31, 2024, Beneficient closed new liquidity transactions totaling a Net Asset Value (NAV) of $50.1 million.

-

Capital Position: The company improved its financial position with a $25 million 3-year term loan.

-

GP Solutions Progress: Subsequent to the quarter end, Beneficient closed $2 million of liquidity financings, building on nearly $10 million sourced from the GP Preferred Liquidity Provider Program.

These financial highlights demonstrate Beneficient's progress in expanding its core business offerings and managing its operations efficiently. The company continues to focus on growing its loan portfolio and leveraging its platform to drive shareholder value.

These financial highlights are for informational purposes only, should not be relied upon in considering an investment in Beneficient and is qualified in its entirety by the disclosures and information reported in the 2024 Annual Report and Ben’s other public filings (for other public filings and announcements, see Ben’s News Releases here).

Leadership Team

Beneficient's success is driven by its exceptional leadership team, which brings together a diverse range of expertise in finance, technology, law, and alternative assets. This group of seasoned professionals combines decades of industry experience with innovative thinking to guide Beneficient's growth and strategic direction. Each leadership team member plays an important role in executing the company's mission to democratize the global alternative asset investment market and provide innovative liquidity solutions to traditionally underserved investors.

Brad K. Heppner - Chief Executive Officer

-

Founder and CEO of Beneficient, with over 30 years of experience in the financial services and alternative asset industries

-

Previously founded and successfully exited multiple companies, including The Crossroads Group and Capital Analytics

-

Served as Director of Investments for the $3.3 billion John D. and Catherine T. MacArthur Foundation

-

Holds three bachelor's degrees from Southern Methodist University and an MBA from Northwestern University's Kellogg School of Management

-

Currently serves on the board of the Cox School of Business at Southern Methodist University

Derek Fletcher - President & Chief Fiduciary Officer

-

Expert in fiduciary issues and estate planning, crucial in developing Beneficient's products and structure

-

Instrumental in the passage of the Technology-Enabled Financial Fiduciary Financial Institutions (TEFFI) Act in Kansas

-

Previously Managing Director at Bank of America Private Wealth Management; Board-certified in estate planning and probate law, and a certified public accountant

Jeff Welday - Global Head of Originations & Distribution

-

Nearly 30 years of experience in financial services and investment management

-

Previously held executive positions at Invesco and Morgan Stanley Investment Management

-

Holds CIMA designation and multiple FINRA licenses; Member of the Board of Directors of the non-profit Impact Africa

Greg Ezell - Chief Financial Officer

-

Broad experience in manufacturing, technology, and financial services

-

Previously CFO for Pure Gen Holdings, Inc. and VP-Corporate Controller for Homeward Residential, Inc.

-

14 years with KPMG as a senior manager for audit

Scott Wilson - Chief Underwriting Officer

-

Over 20 years of experience in investment management

-

Previously Managing Director at Highland Capital Management in Dallas

-

Served as Director on the board of several companies; MBA from The Wharton School of the University of Pennsylvania

David Rost - General Counsel

-

Specializes in capital markets, securities transactions, and mergers and acquisitions

-

Joined Ben in 2020 as Associate General Counsel, promoted to General Counsel in 2022

-

Named one of The Top 50 Attorneys of Dallas by Attorney Intel in 2022; holds multiple degrees, including a law degree from SMU's Dedman School of Law

Maria S. Rutledge - Chief Technology Officer

-

Over 23 years of IT strategy and operations experience

-

Responsible for Ben's proprietary systems, digital solutions, and customized data management/AI solutions

-

Previously held technology leadership roles at MUFG Investor Services and The Michaels Companies; holds multiple degrees, including an MBA from the Jindal School at the University of Texas

Source: Company Documents

Important Disclosures

The material on this profile site is for educational and informational purposes only.

Liquidity exit strategies offered may not include all options and may vary over time; all exit options, including historic options such as cash, may not be available or offered to prospective customers at any given time; your options may differ. Exit options are presented on a case-by-case basis in Ben’s discretion and may be offered for less than current net asset value based on a variety of factors, including asset-specific factors such as Ben’s valuation analysis. References to “liquidity” generally refers to an opportunity offered by Ben to exit an investment in an illiquid asset. Ben can discuss with prospective customers what options may be currently available, including based upon the specifics of such customer’s situation and illiquid assets.

The information in this presentation is provided for convenience only, is not investment advice and may not be relied upon in considering an investment in Beneficient, a Nevada corporation (“Ben”). Any offer or solicitation will only be made in compliance with applicable state and federal securities laws pursuant to Regulation D of the Securities Act of 1933, as amended. Any securities shall be offered only to investors that also meet the applicable requirements of a qualified institutional buyer or an institutional account in a private placement under the Securities Act of 1933, as amended, or another available exemption, and this presentation is intended solely for purposes of familiarizing such investors with the company. This presentation is not an offer to sell nor does it seek an offer to buy securities in any jurisdiction where the offer or sale is not permitted. To the extent the terms of any potential transaction are included in this presentation, those terms are included for discussion purposes only. All prospective investors should carefully review the Subscription Agreement or Binding Term Sheet, as applicable, and such other documents described therein and provided by Ben (such materials collectively, the “Offering Materials”). Offers to sell or purchase any security can only be made through definitive Offering Materials and agreements with the applicable investor. These securities have not been recommended by the Securities and Exchange Commission (the “SEC”) or any state securities commission or regulatory authority, nor has any commission or regulatory agency confirmed the accuracy of the information contained in the Offering Materials. No representation or warranty, express or implied, is made as to the accuracy or completeness of any information contained herein, and any investment decision should be based solely on the information contained in the Offering Materials and the prospective investor’s independent research. In addition, no representation or warranty, express or implied is made as to the future performance of any investment in Ben, or that investors will or are likely to achieve favorable results, will make any profit at all or will be able to avoid incurring a loss on their investment. Prospective investors are encouraged to consult with their financial, tax, accounting or other advisors to determine whether an investment in Ben is suitable for them.

Forward-looking Statements

This presentation and the Offering Materials may contain forward-looking statements and information relating to, among other things, Ben, its business plan and strategy, and its industry. Forward-looking Statements are neither historical facts nor assurances of future performance. They are based on the current beliefs of, assumptions made by, and information currently available to the company’s management regarding the future of the company’s business, future plans and strategies, anticipated events and trends, the economy and other future conditions. The words “aim,” “anticipate,” “could,” “intend,” “expect,” “project,” “plan,” “would” and similar references to future periods are intended to identify forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements reflect management’s current views with respect to future events and are subject to inherent risks, uncertainties and changes in circumstances that are difficult to predict (many of which are outside of the company’s control) and could cause Ben’s actual results to differ materially from those contained in the forward-looking statements. Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. All subsequent written and oral forward-looking statements concerning Ben, the offering or other matters, are expressly qualified in their entirety by the cautionary statements above. Ben does not undertake any obligation to revise or update these forward-looking statements to reflect events or circumstances after such date or to reflect the occurrence of unanticipated events.

This presentation may not be copied, reproduced, distributed, or disclosed without the written permission of Ben. Past performance is not indicative of future results. The information contained herein is based on Ben data available at the time of this presentation. It speaks only as of the particular date or dates included herein.

Use of Other Data

The data contained herein is derived from various internal and external sources. All of the market data in the presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Further, no representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. Ben assumes no obligation to update the information in this presentation.

Trademarks

This presentation contains trademarks, service marks, trade names and copyrights of Ben and other companies, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended in, and does not imply, a relationship with Ben or any of their respective affiliates, or an endorsement or sponsorship by or of Ben or such affiliates. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, SM, (c) or (r) symbols, but Ben will assert, to the fullest extent under applicable law, the right of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights.

Subject to qualifications. Securities of Beneficient, a Nevada corporation its affiliates and/or successors are offered through AltAccess Securities Company L.P. an affiliated entity. Only available in states where AltAccess Securities Company, L.P. is registered. Member FINRA/SIPC.

Source: Company Reports

SEC Filings

Financials

Risks & Disclosures

This communication is neither an offer to sell nor a solicitation of an offer to buy, nor a recommendation of any securities of the company mentioned herein.

Beneficient (the “Company”) has reviewed the content of this page as well as the accompanying presentation (“Company Presentation”) displayed on this page. To the best of its knowledge, the Company does not believe this content to be misleading or inaccurate in any material respect, nor does it believe there are any material omissions with respect to such content. The Company does not believe the contents of the page or the Company Presentation to contain any non-public material information.

Information and opinions presented in the Company Presentation are provided by the Company, and b2iDigital makes no representation as to their accuracy or completeness. The information contained on this page is not intended to constitute any form of advice, and the information provided is not intended to provide a sufficient basis on which to make an investment decision. It is not investment research, nor does it constitute a research recommendation, as it does not constitute substantive research or analysis. This information is not to be relied upon in substitution for the exercise of independent judgment.

Information, opinions and estimates contained on this page or in the Company Presentation reflect judgments by the Company as of the original date of publication by the Company and are subject to change without notice. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied is made regarding future performance.

A complete description of the risks and uncertainties relating to the Company and its securities can be found in the company's filings with the U.S. Securities and Exchange Commission available for free at www.sec.gov.

Information on this page may relate to penny stocks, which may also be referred to as low-priced stocks. Penny stocks are low-priced shares typically issued by small companies. Penny stocks involve greater than normal risk, they may be less liquid than other stocks (i.e., more difficult to sell), and there may be less reliable information available regarding such stocks. Investors in penny stocks should be prepared for the possibility that they may lose their entire investment.

b2i digital or its related entities may own securities of the Company.

The Company is a client of b2i Digital. The Company agreed to pay b2i Digital no greater than $100,000 in cash for 12 months of digital marketing consulting and investor awareness services.

This communication includes forward-looking statements that involve risks, uncertainties and assumptions that are difficult to predict. Words and expressions reflecting optimism, satisfaction or disappointment with current prospects, as well as words such as “believes,” “hopes,” “intends,” “estimates,” “expects,” “projects,” “plans,” “anticipates” and variations thereof, or the use of future tense, identify forward-looking statements, but their absence does not mean that a statement is not forward-looking. The Company’s forward-looking statements are not guarantees of performance, and actual results could vary materially from those contained in or expressed by such statements due to risks, uncertainties and other factors. The Company urges readers to consider specifically the various risk factors identified in its most recent Form 10-K, and any risk factors or cautionary statements included in any subsequent Form 10-Q or Form 8-K, filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this communion. Except as required by law, the Company does not undertake any responsibility to update any forward-looking statements to take into account events or circumstances that occur after the date of this communication.

The Beneficient management and investor relations team are available to talk to current and potential investors. They're happy to answer your questions and tell you what makes their story unique. Please fill out this form, and we will connect you shortly.

• Directly hear the Beneficient story

• Ask your questions

• Submit the form below, and someone will get in touch with you as soon as possible

Note: Company management or its representative can only discuss and disclose information that is already available in the public domain. They will do their best to clarify such information to the extent permitted by securities law and industry regulations.

Innovative Early Exit Solutions

Beneficient offers proprietary early exit solutions for alternative asset holders through its AltAccess® platform. These solutions are designed to provide options for mid-to-high net worth individuals and small-to-midsized institutions who may have limited access to traditional liquidity providers. (Link: Liquidity The Ben® Way)