CareCloud, Inc.

CareCloud offers technology solutions (a combination of software and services offering) for doctor’s offices and medical practices to drive revenue growth, workflow and operation efficiency, and transform patient experience. Its combination of software and service offerings include electronic health records, revenue cycle management, practice management, chronic care management, remote patient monitoring, business intelligence, telehealth, robotic process automation, mobile applications, workforce augmentation, and other services. Currently, ~40,000 providers leverage CareCloud solutions in 80 medical specialities.

Nasdaq: CCLD, CCLDO

IR Website: https://ir.carecloud.com/

Headquarters: Somerset, NJ

TALK TO MANAGEMENT

CareCloud Inc. is always available to talk to current and potential investors. They're happy to answer any questions you may have and tell you what makes their story unique. Please fill out this form, and we will connect you shortly.

All content on this page is accurate as of 08.22.23.

CareCloud At A Glance

CareCloud offers technology solutions for doctor’s offices and medical practices to drive revenue growth, workflow and operation efficiency, and transform patient experience. Its combination of software and service offerings include electronic health records, revenue cycle management, practice management, chronic care management, remote patient monitoring, business intelligence, telehealth, robotic process automation, mobile applications, workforce augmentation, and other services. Currently, ~40,000 providers leverage CareCloud solutions in 80 medical specialities.

Key Considerations:

Press Releases

Investor Presentation

To download the CareCloud Inc. investor presentation, please fill out the form below.

Stock Chart (Intraday)

Stock Chart (Historical)

Analyst Coverage

Firm |

Analyst |

Contact |

Rating |

|

B. Riley Financial, Inc. |

Neil Chatterji |

nchatterji@brileyfin.com |

Buy |

|

EF Hutton |

Constantine Davides, CFA |

cdavides@efhuttongroup.com |

Buy |

|

Ladenburg Thalmann & Co |

Jeffery S. Cohen |

Jcohen@ladenburg.com |

Buy |

|

Maxim Group |

Allen Klee, CFA |

rbaldry@roth.com |

Buy |

|

ROTH Capital Partners, LLC |

Richard K. Baldry, CFA |

rbaldry@roth.com |

Buy |

|

The Benchmark Company |

Bill Sutherland |

bsutherland@benchmarkcompany.com |

Buy |

CareCloud, Inc. is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding CareCloud, Inc.'s performance made by these analysts are theirs alone and do not represent opinions, forecasts or predictions of CareCloud, Inc., B2i Digital Inc. or their respective management. Both CareCloud, Inc. or B2i Digital Inc. do not by their reference above or distribution imply their endorsement of or concurrence with such information, conclusions or recommendations.

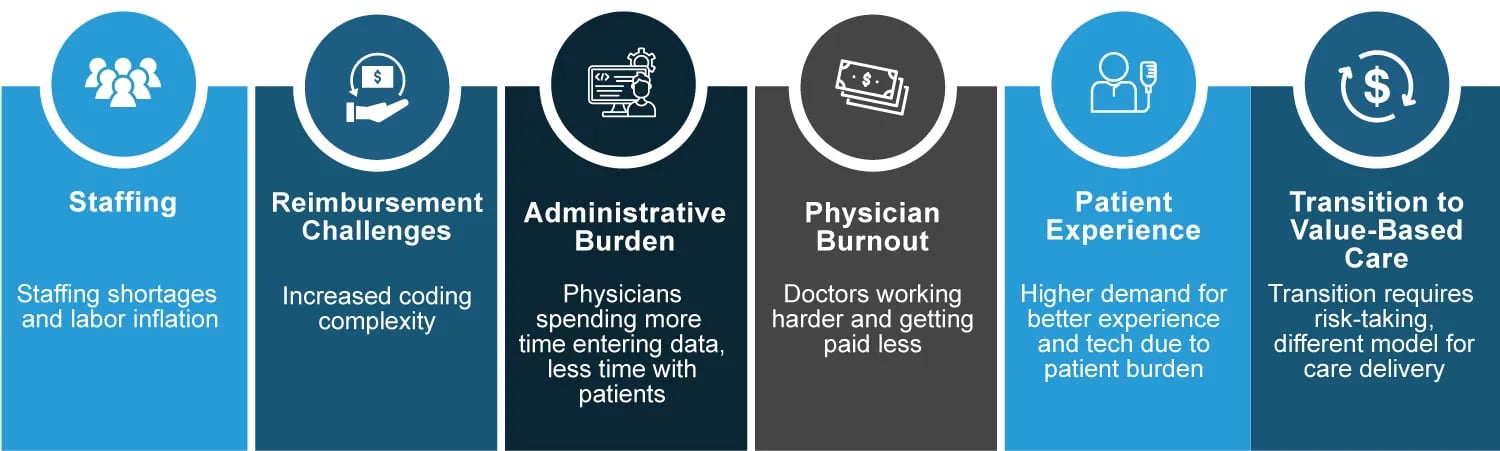

Industry Challenges

The healthcare industry has been through tremendous changes in the past decade and continues to face many challenges, including staffing shortages, reimbursement complexity, and administrative burden.

Also, there has been a gradual shift from fee-for-service payments to value-based and clinical outcomes-based care payments. This requires more risk-taking and a different model for care delivery for many providers.

There also has been a rise in patient consumerism in healthcare as patients demand an overall better experience.

Healthcare organizations are aggressively addressing these realities and are finding opportunities for growth and expansion through investing in information technology and digital assets and transforming their data strategy at an accelerated pace. CareCloud solutions facilitate the necessary transition.

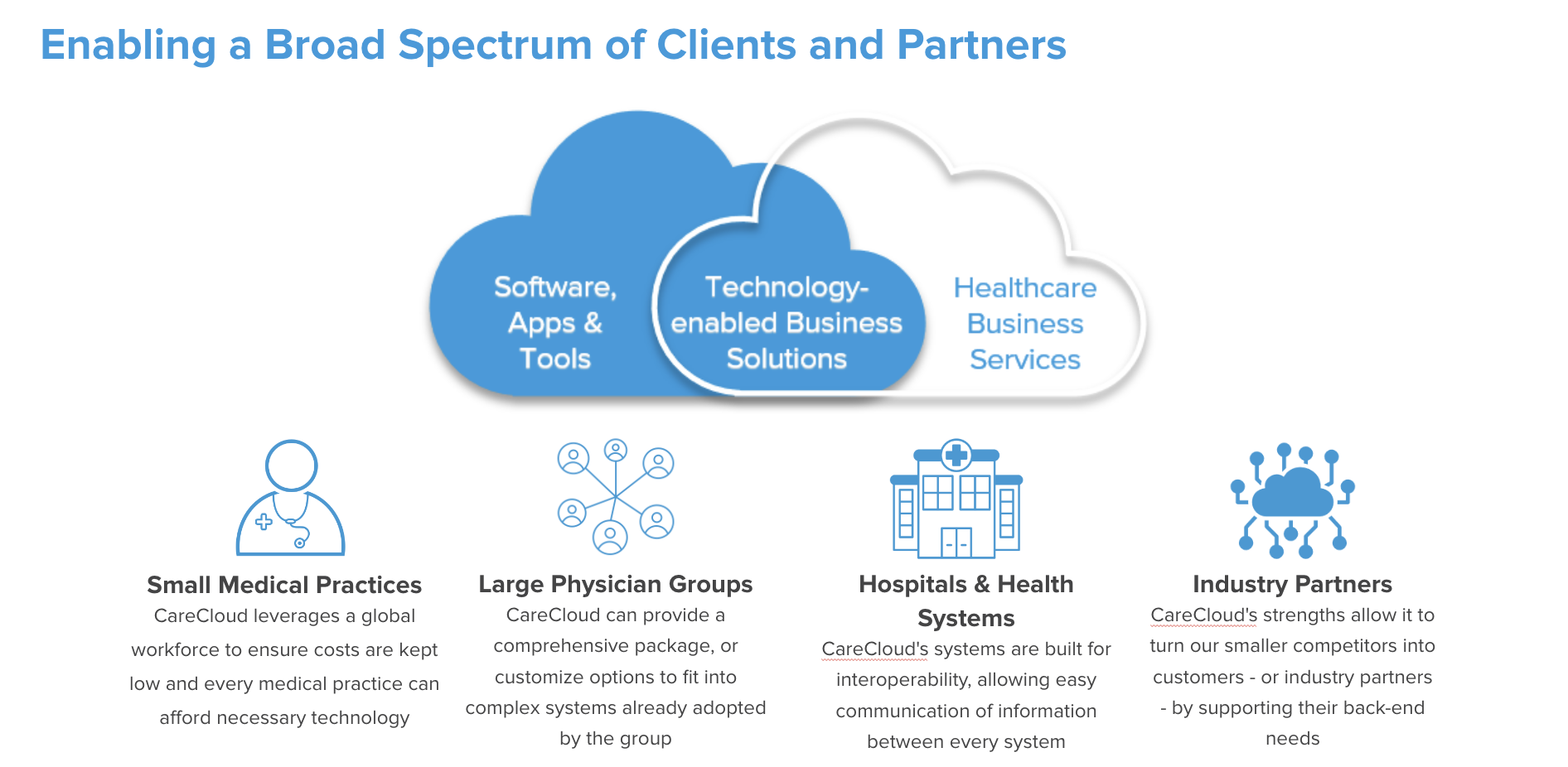

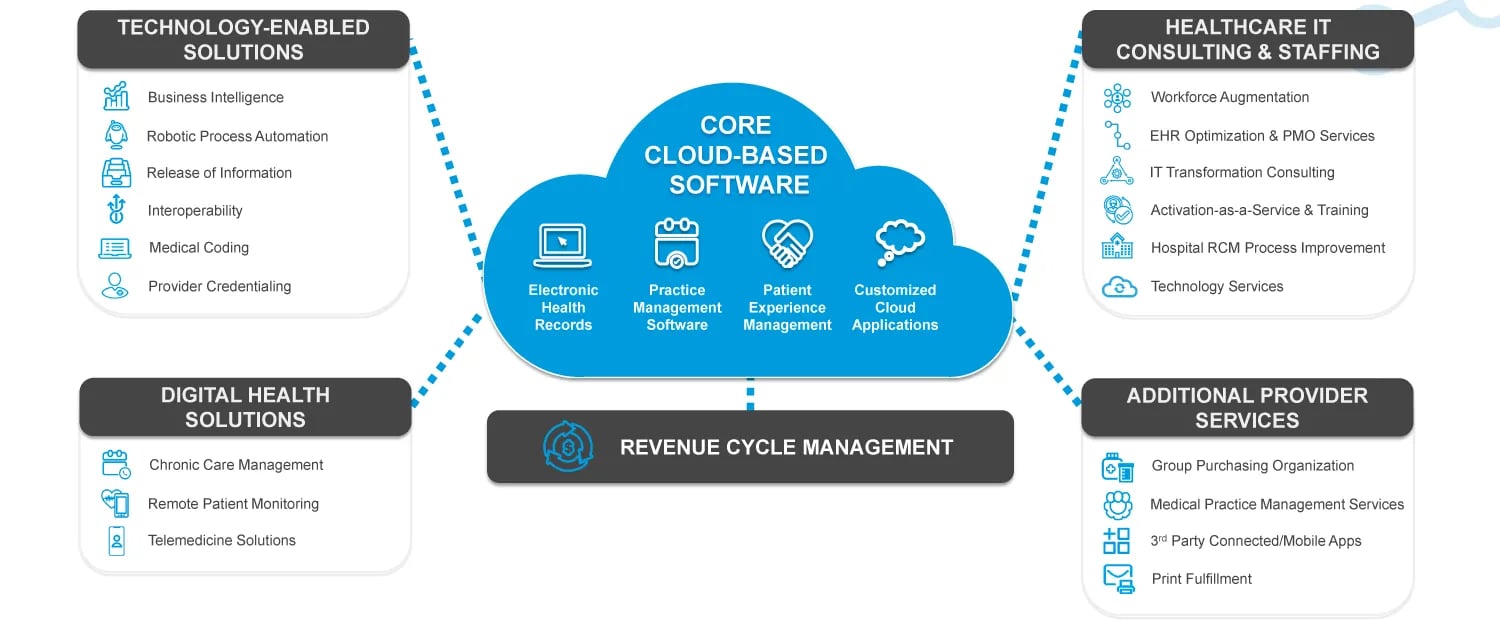

CareCloud’s End-to-End Solutions

The end-to-end solutions allow the company to be both methodical and nimble across a broad spectrum of clients and partners. CareCloud currently serves ~2,600 large & small medical practices, hospitals and health systems nationwide.

Cloud-based Software - the core systems that power medical practices across clinical, financial, and patient workflows, including practice management systems, EHR solutions and patient experience applications or customized purpose-built applications.

Technology-enabled Services - software-enabled revenue cycle management offerings, business intelligence, robotic process automation, medical coding, etc.

Digital Health Offering - chronic care management, remote patient monitoring, and telemedicine solutions

Healthcare IT Consulting & Staffing - an extensive set of services including EHR vendor-agnostic optimization and activation, project management, IT transformation consulting, process improvement, training, education, and staffing for large healthcare organizations including health systems and hospitals.

Workforce augmentation leverages the company’s unique resources, and in turn selling this capacity at scale directly to partners and clients at a reduced rate compared to other competitors in the same space. These workforce augmentation capabilities include offshore engineering capacity for development and offshore revenue cycle management operations personnel.

Additional Provider Services - medical practice management services to a select group of medical practices, a group purchasing organization with negotiated discounts with pharmaceutical manufactures containing more than 4,000 physician and mid-level provider members and other ancillary services.

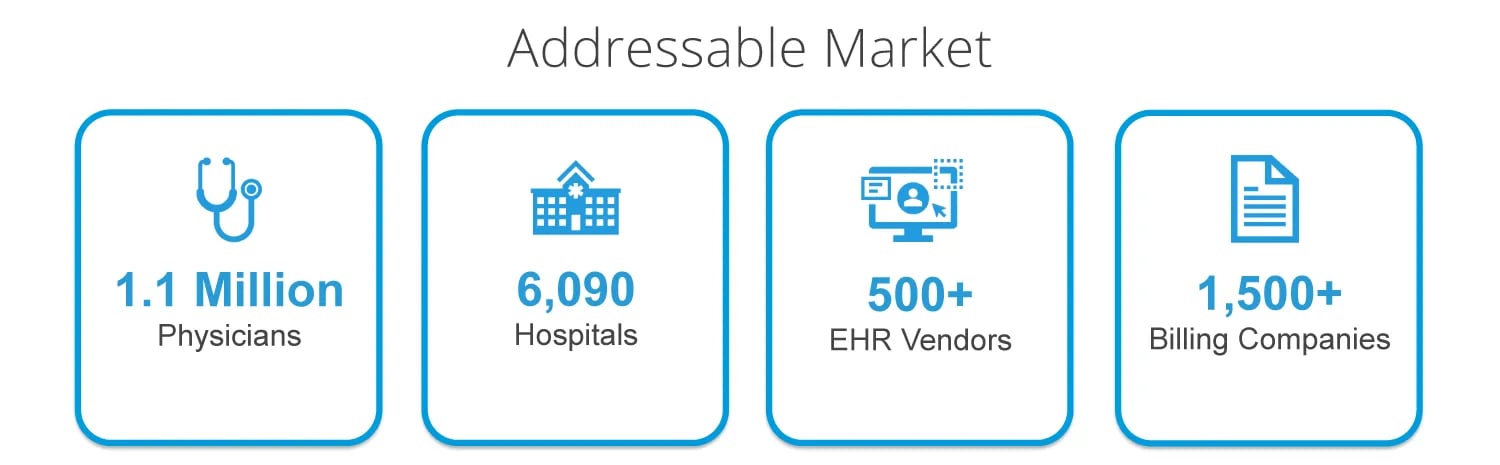

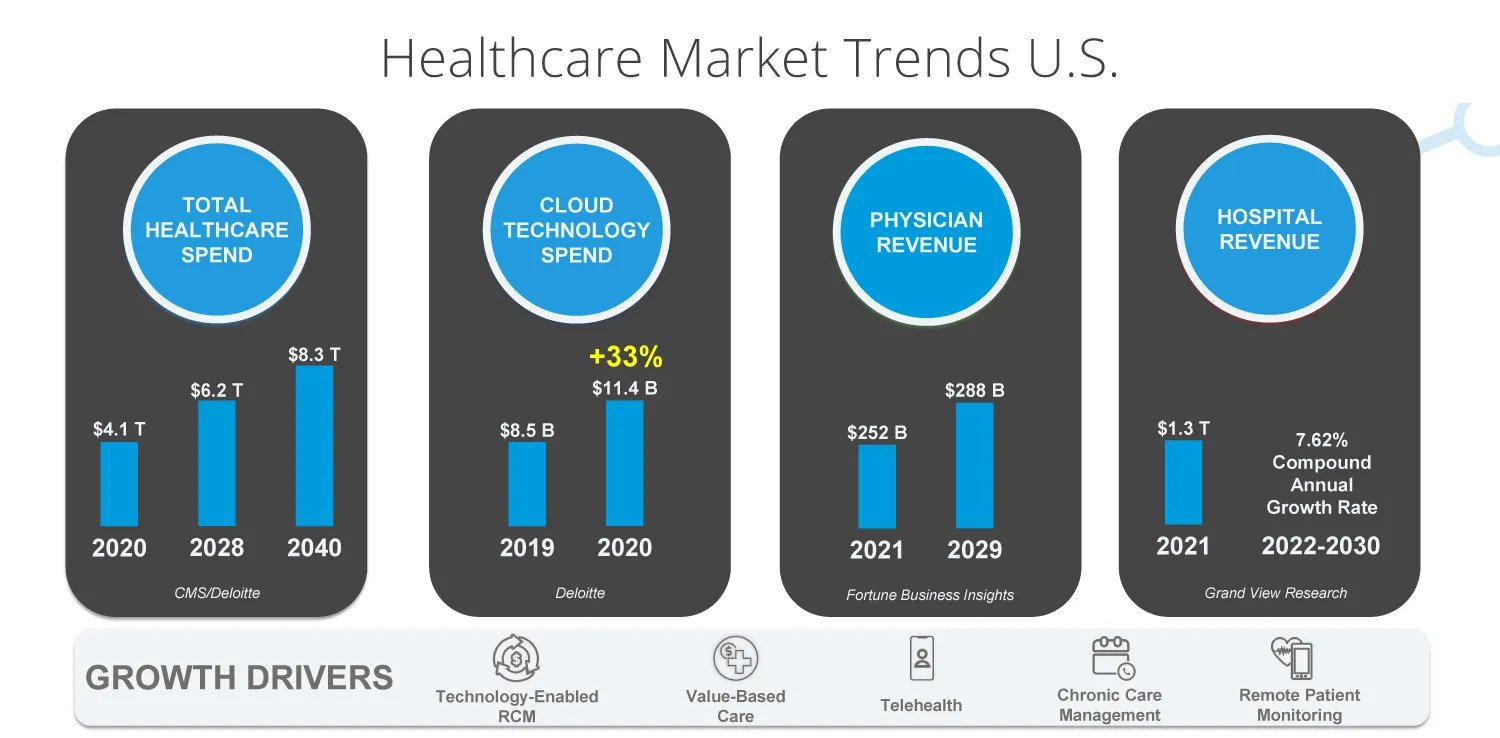

Sizable and Growing Markets

The opportunity is sizable with over 1 million physicians, 6,000 hospitals and 500 EHR vendors, and 1,500 billing companies.

According to the Centers for Medicare & Medicaid Services (CMS) and Delotte, national healthcare spending in the U.S. was $4.1 trillion in 2020, and will grow at a 5.4% compounded annual rate, reaching $6.2 trillion by 2028.

Fortune Business Insights predicts physician revenue (CareCloud’s business is largely driven by client’s volume or revenue) will expand from $252 billion in 2021 to $288 billion in 2029.

Grand View Research expects a 7.6% CAGR in hospital spending in 2022 to 2030.

Offshore Footprint as a Competitive Edge

CareCloud offshore presence (3,500+ English-speaking, college-educated employees in Pakistan and Sri Lanka and 500 dedicated technology professionals) has two key advantages:

-

Provides a competitive advantage on costs

-

CareCloud utilizes four offshore delivery centers in Pakistan and Sri Lanka

-

Most medical billing companies that CareCloud has acquired used domestic labor or subcontractors from higher cost locations to provide a substantial portion of their services. CareCloud is able to achieve significant cost reductions and high quality by shifting these labor to its own offshore employees.

-

-

Gains access to a professional workforce as talent (especially in the technology field) continues to experience global shortages.

Video: Fireside Chat with Bill Korn

M&A - Has Been A Key Driver of Growth

CareCloud was historically highly active in M&A to achieve growth. Most acquisitions are for adding customers, revenue, and occasionally extra capabilities. It has a solid track record in acquiring value creating assets and companies and integrating them to drive profitability improvements.

When integrating the businesses, the company’s playbook is to quickly reduce the cost structure of the acquirees, Integral to its success is replacing offshore subcontractors with the company’s global team and greater use of its technology. The company has completed 17 acquisitions since its IPO in 2014.

The following are the most recent acquisitions:

Acquired in June 2020; spin-off of GE Healthcare in 2013 and went private.

-

Leading healthcare technology and RCM solutions provider to large, complex, multi-specialty physician groups, prestigious healthcare systems, and national healthcare IT vendors

-

Robust robotic process automation business line

-

Proprietary, cloud-based business intelligence software

Acquired in June 2021 after having combined with two well-known healthcare system consulting brands.

-

Deep relationships in the health system / hospital space

-

Ability to drive new and large growth opportunities for CareCloud (BI, RPA, RCM, etc.)

-

Expands CareCloud footprint in enterprise and health system verticals

-

Enables broader portfolio of solutions for current CareCloud clients

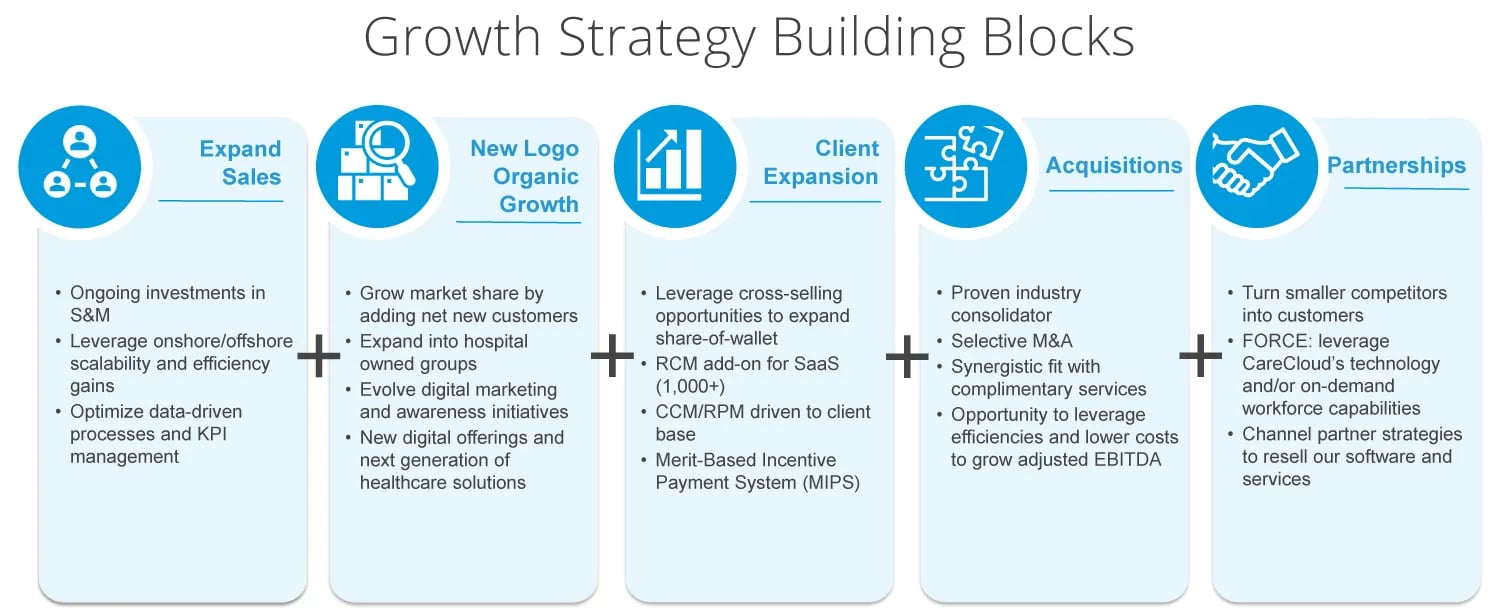

Organic Growth & Partnerships Will be Key Contributors of Future Growth

In the recent past, CareCloud started utilizing a more balanced approach in expanding the business and will be focusing on organic growth, and strategic initiatives, as well.

For partnerships, CareCloud maintains business relationships with third parties that utilize, promote, or support its sales or services within specific industries or geographic regions.

Some of these partners are customers through CareCloud Force which the company leverages its technology and/or on-demand workforce capabilities of its global team. This is particularly useful at times like post Covid-19 when hospitals and large practices need additional staff and they can’t hire as easily as due to labor shortage.

Other partners are more traditional channel partners who help promote CareCloud solutions.

The company has expanded its sales and marketing team to support future organic growth; its global sales team has grown by 11x since 2019 and measurable metrics and analysis such as quota, customer acquisition costs, close rate analysis and loss reason analysis have been established to closely track and ensure optimum performance.

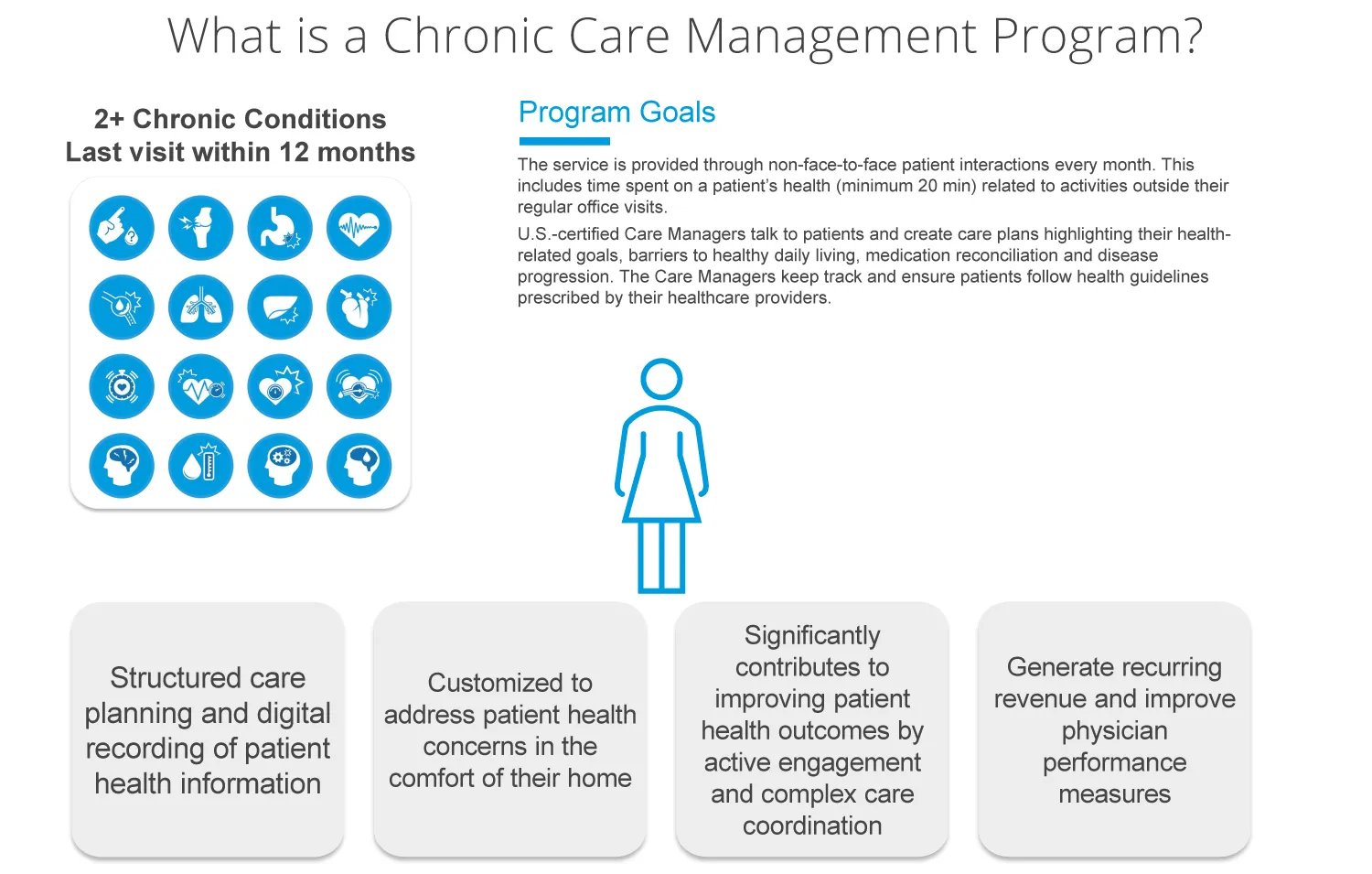

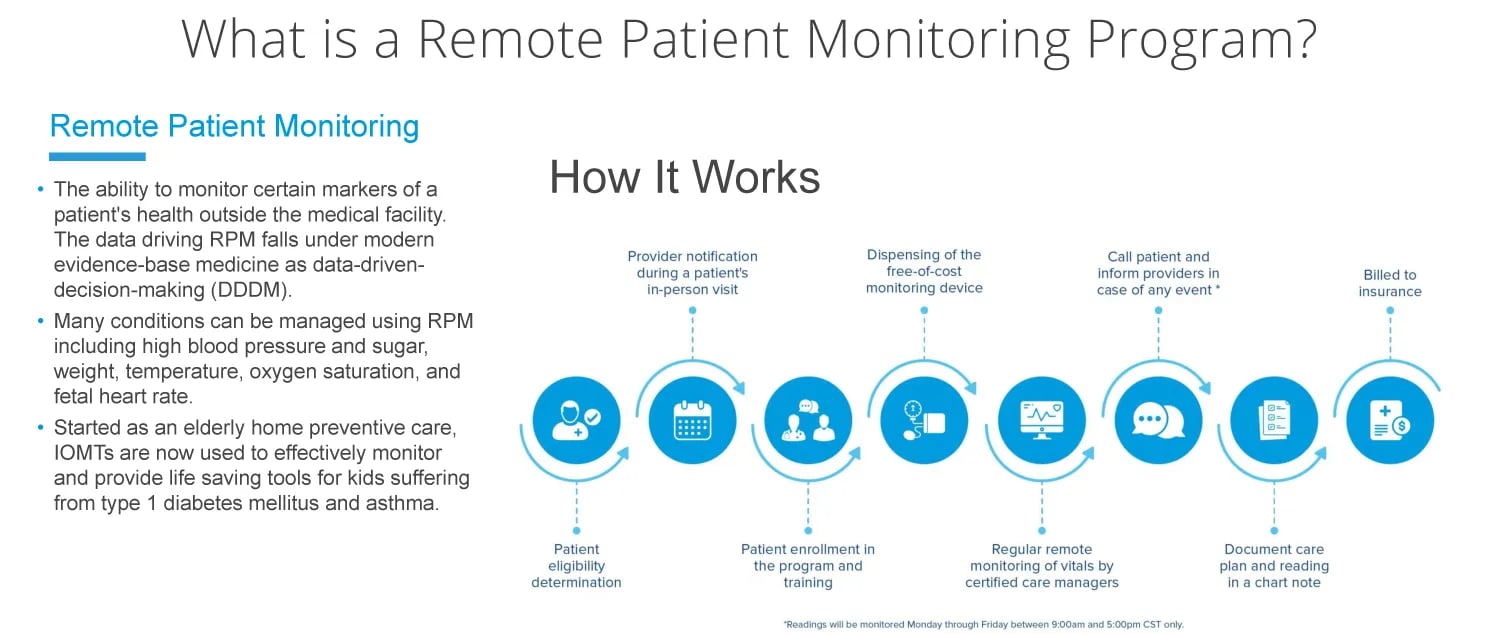

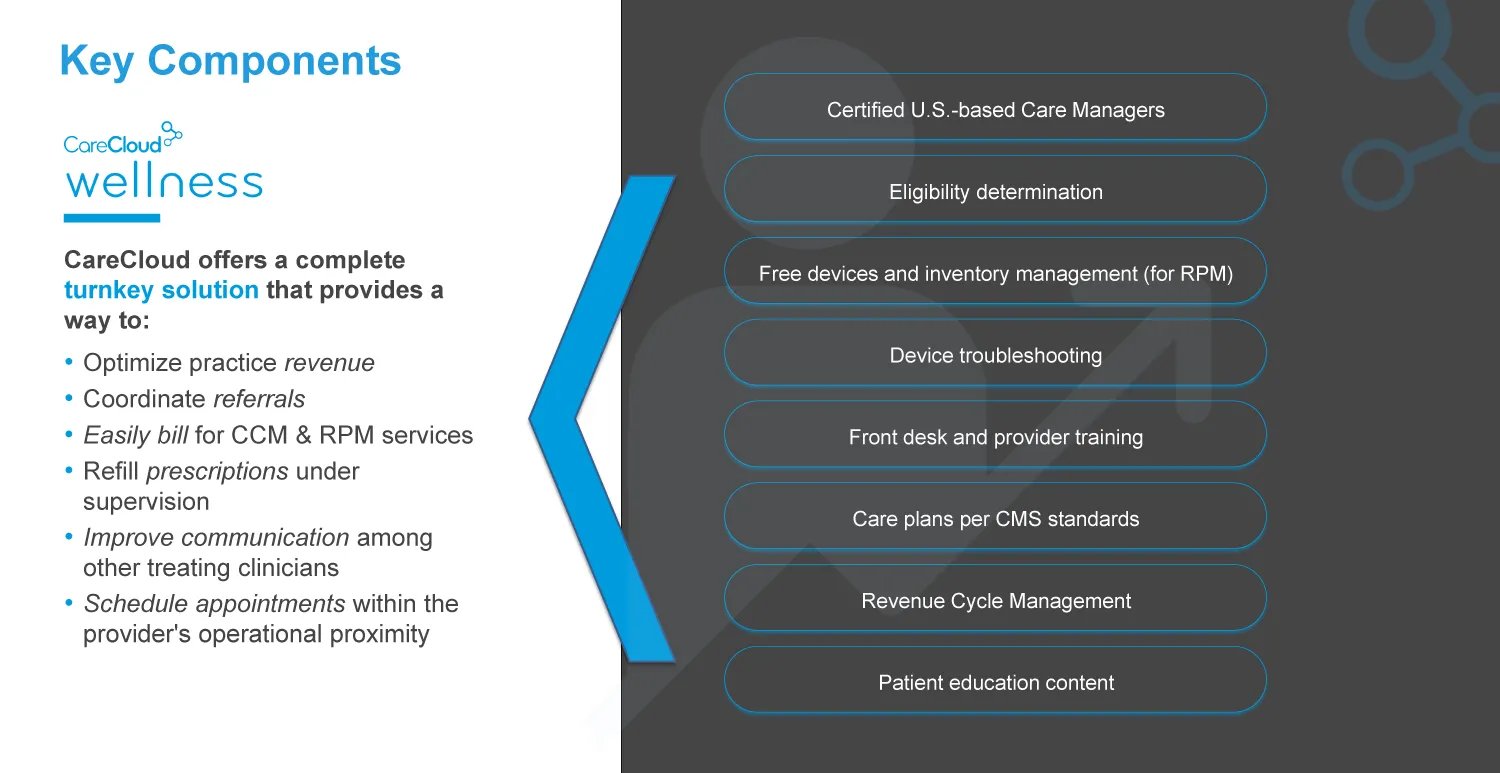

With an expanded sales force, CareCloud is well positioned to acquire new customers and expand the share of wallet of existing customers through cross-selling new solutions. In 2022, CareCloud introduced CareCloud Wellness solution suite, which consists of Chronic Care Management and Remote Patient Monitoring, which could serve as a catalyst for future organic growth. New business bookings in Q3 2022 come largely from these capability launches.

A high-single-digit long-term annual organic revenue growth rate is reasonable target

The engagement reduction of two large hospital customers who were acquired and migrated to their acquirers' systems in mid-2022 will be a headwind for 2023 performance, but a high single-digit long term annual organic revenue growth rate beyond 2023 is reasonable. It is broken down into the following components: 1) new client additions could drive 10%, assuming the same number of percent of investment in sales and marketing, and similar customer acquisition costs as in 2022, 2) cross-sells existing customers with CareCloud Wellness and other solutions could drive 4-8%, 3) the natural client churn from physicians retiring, and selling practices, etc. could be an 8% headwind.

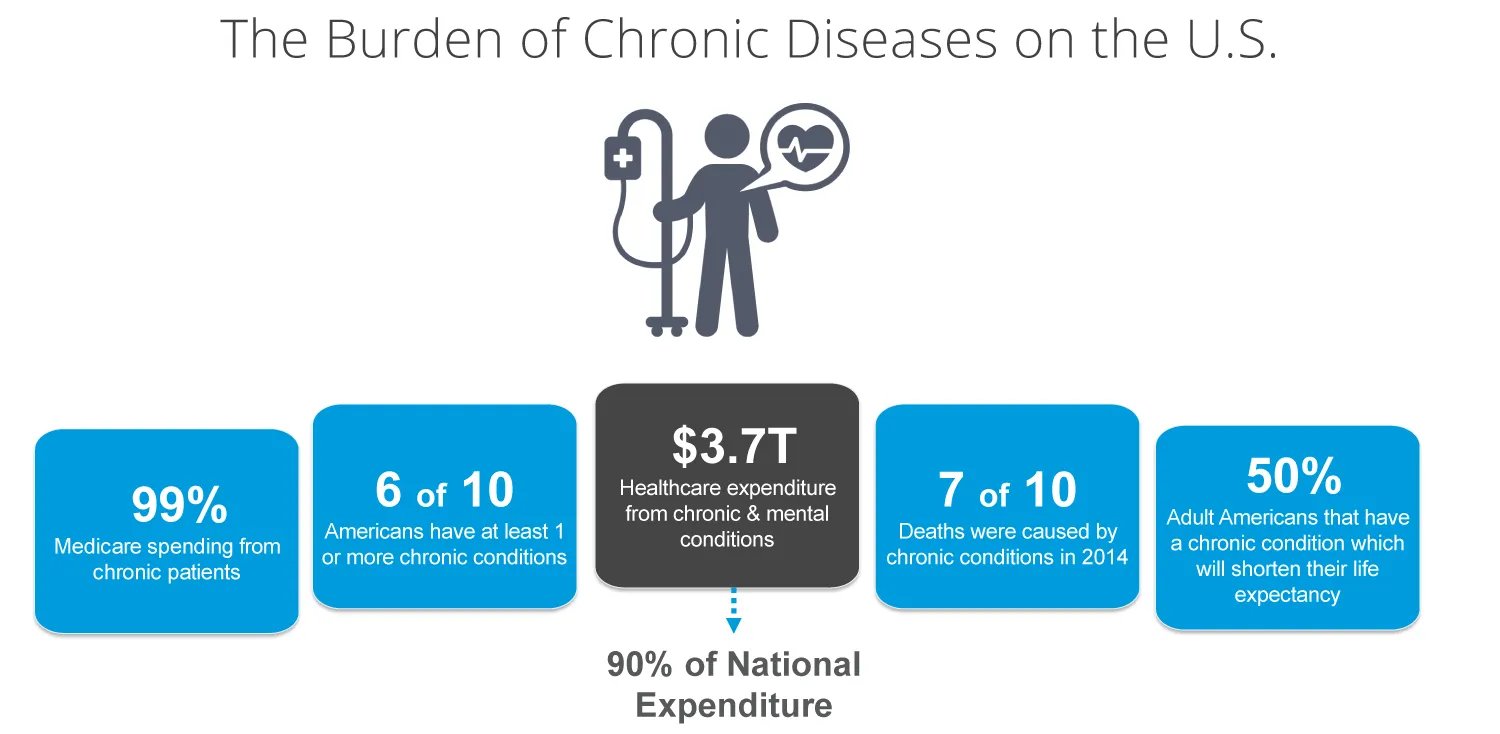

Deep Dive of Wellness & Digital Health

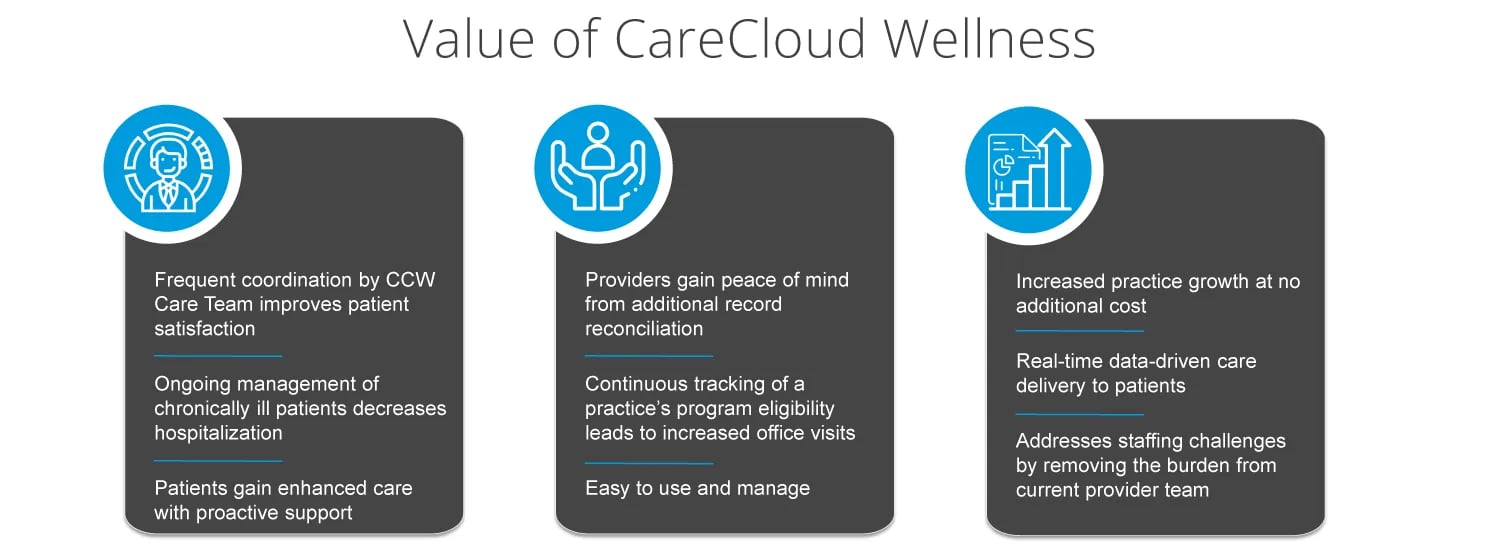

The burden of chronic diseases is sizable; healthcare expenditure from chronic and mental conditions represents 90% of total spend and stands at $3.7 trillion. CareCloud Wellness offers tremendous value for patients and healthcare providers.

Wellness services and offerings are reimbursed by Medicare and private insurance and CareCloud expects the solution to help drive meaningful revenue growth for healthcare practices. Care providers do not incur any additional costs to sign up for the solutions. CareCloud provides the software, devices that are FDA-approved and covered by Medicare, appointment setup, and remote care managers.

Proven Leadership Team

Mahmud Haq

Founder & Executive Chairman

Former CEO of Compass International Services (Nasdaq: CMPS); completed 14 acquisitions in 18 months, grew revenue to ~$180M run rate, and acquired by NCO Group. Increasing senior positions at American Express.

B.S., Aviation Management, Bridgewater State College

M.B.A., Finance, Clark University

A. Hadi Chaudhry

Chief Executive Officer and President

Joined in 2002. Previously served as Manager of IT, General Manager, Chief Information Officer, and VP of Global Operations. Extensive healthcare IT experience, including various roles in the banking and IT sector.

B.S., Mathematics & Statistics; numerous IT certifications

Bill Korn

Chief Financial Officer

Joined in 2013. Former CFO of Antenna Software (2002-2012); completed 5 acquisitions, driving 87% CAGR. Former executive at IBM (NYSE: IBM) for 10 years.

A.B., Economics, magna cum laude, Harvard College

M.B.A., Harvard Business School

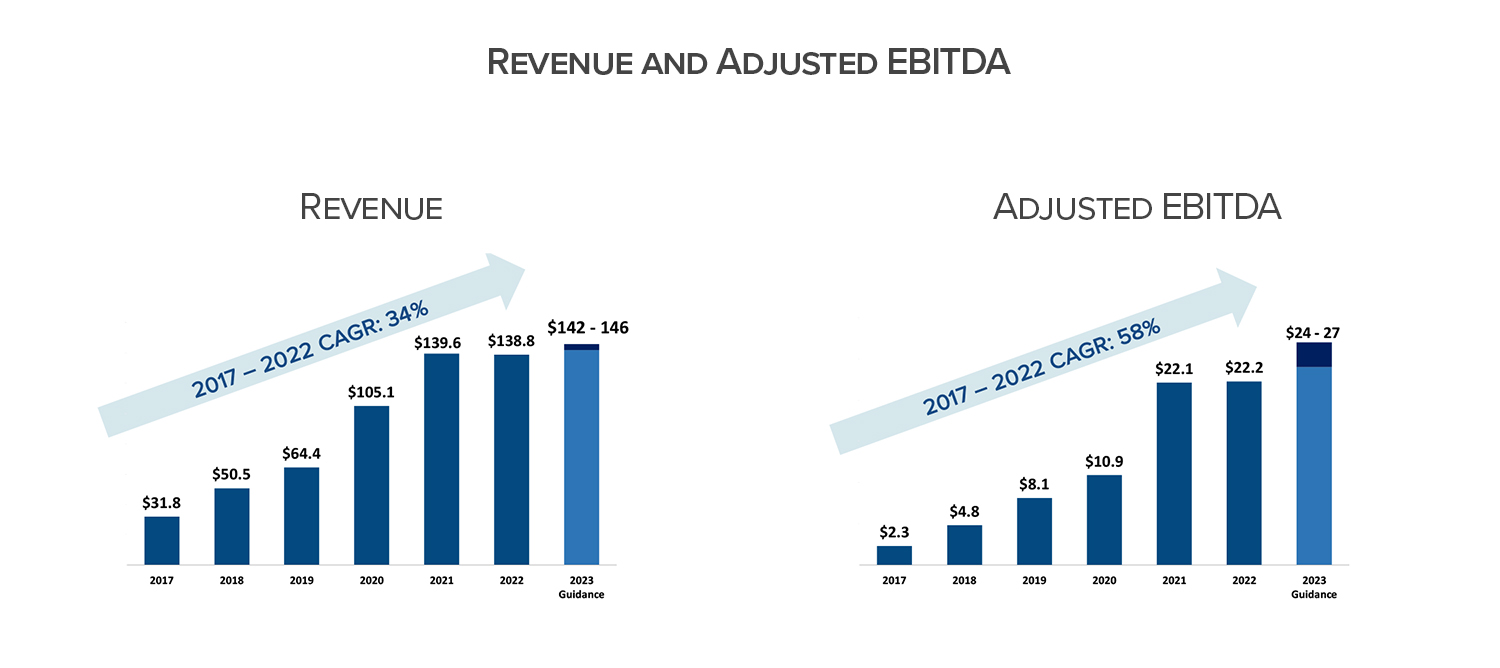

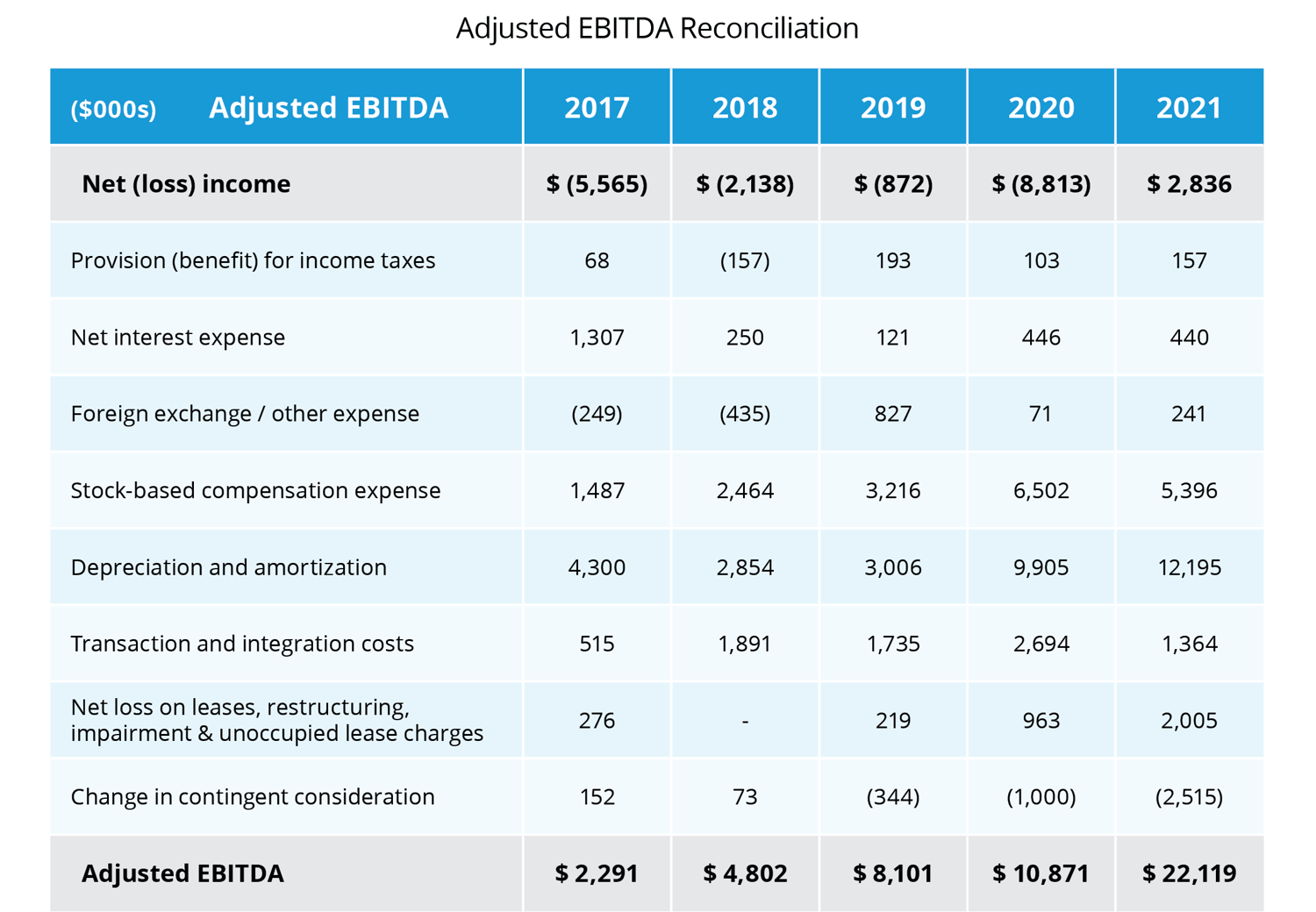

A Long History of Solid Financial Performance

Financial results were impressive with CareCloud reported 45% and 76% revenue and adjusted EBITDA CAGR respectively in 2017-2021.

See reconciliation of non-GAAP results below.

Please note that adjusted EBITDA is not audited and such information is subject to risks and uncertainties and should be reviewed

in conjunction with GAAP financial results reported in the Company’s Annual Report on Form 10-K.

Capital Structure

1. Stock prices and shares as of March 31, 2023. Debt and cash as of December 31, 2022.

The company has historically utilized its preferred stock to fund growth and M&A. On 12/9/2022, Series A perpetual preferred stock was $113 million (at $25 par value), paying an 11% dividend on par value and redeemable at $25 per share, and Series B nonconvertible preferred stock had a redemption value of $33 million, paying an 8.75% dividend on par value.

At the end of 3Q 2022, CareCloud had $4.9 million in cash, and $0.6 million in debt (paid down from $7 million in the prior quarter). The company has a strong balance sheet to support future organic growth. CareCloud also has access to a $20 million line of credit.

SEC Filings

Financials

Risks & Disclosures

This communication is neither an offer to sell nor a solicitation of an offer to buy, nor a recommendation of any securities of the company mentioned herein.

CareCloud Inc. (the “Company”) has reviewed the content of this page as well as the accompanying presentation (“Company Presentation”) displayed on this page. To the best of its knowledge, the Company does not believe this content to be misleading or inaccurate in any material respect, nor does it believe there are any material omissions with respect to such content. The Company does not believe the contents of the page or the Company Presentation to contain any non-public material information.

Information and opinions presented in the Company Presentation are provided by the Company, and makes no representation as to their accuracy or completeness. The information contained on this page is not intended to constitute any form of advice, and the information provided is not intended to provide a sufficient basis on which to make an investment decision. It is not investment research, nor does it constitute a research recommendation, as it does not constitute substantive research or analysis. This information is not to be relied upon in substitution for the exercise of independent judgment.

Information, opinions and estimates contained on this page or in the Company Presentation reflect judgments by the Company as of the original date of publication by the Company and are subject to change without notice. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied is made regarding future performance.

A complete description of the risks and uncertainties relating to the Company and its securities can be found in the company's filings with the U.S. Securities and Exchange Commission available for free at www.sec.gov.

Information on this page may relate to penny stocks, which may also be referred to as low-priced stocks. Penny stocks are low-priced shares typically issued by small companies. Penny stocks involve greater than normal risk, they may be less liquid than other stocks (i.e., more difficult to sell), and there may be less reliable information available regarding such stocks. Investors in penny stocks should be prepared for the possibility that they may lose their entire investment.

b2i digital or its related entities may own securities of the Company.

The Company is a client of b2i Digital. The Company agreed to pay b2i Digital no greater than $100,000 in cash for 12 months of digital marketing consulting and investor awareness services.

This communication includes forward-looking statements that involve risks, uncertainties and assumptions that are difficult to predict. Words and expressions reflecting optimism, satisfaction or disappointment with current prospects, as well as words such as “believes,” “hopes,” “intends,” “estimates,” “expects,” “projects,” “plans,” “anticipates” and variations thereof, or the use of future tense, identify forward-looking statements, but their absence does not mean that a statement is not forward-looking. The Company’s forward-looking statements are not guarantees of performance, and actual results could vary materially from those contained in or expressed by such statements due to risks, uncertainties and other factors. The Company urges readers to consider specifically the various risk factors identified in its most recent Form 10-K, and any risk factors or cautionary statements included in any subsequent Form 10-Q or Form 8-K, filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this communion. Except as required by law, the Company does not undertake any responsibility to update any forward-looking statements to take into account events or circumstances that occur after the date of this communication.

The CareCloud's management and investor relations team is available to talk to current and potential investors. They're happy to answer your questions and tell you what makes their story unique. Please fill out this form, and we will connect you shortly.

• Directly hear the CareCloud story

• Ask your questions

• Submit the form below and someone will get in touch with you as soon as possible

Note: Company management or its representative can only discuss and disclose information that is already available in the public domain. They will do their best to clarify such information to the extent permitted by securities law and industry regulations.

Leading cloud-based healthcare platform with new digital health offerings to address industry challenges.

CareCloud platform is uniquely and purposely designed and developed to meet the specific needs and challenges of increasing consumer experience requirements, complicated reimbursement system, and value based payments of the healthcare industry today.