Lion Group Holding Ltd. (Nasdaq: LGHL) operates an all-in-one proprietary trading platform offering a diverse range of financial services, including total return swaps, CFD trading, insurance brokerage, and futures and securities brokerage. Lion's suite of apps, compatible across iOS, Android, Windows, and macOS devices, provides retail and institutional clientele access to these services through an integrated, user-friendly interface.

With an eye toward emerging opportunities, Lion owns a professional SPAC sponsorship team to lead private companies through the public listing process while creating value.

Nasdaq: LGHL

Nasdaq Profile: https://www.nasdaq.com/

IR Website: https://ir.liongrouphl.com

Company Contact: ir@liongrouphl.com

Founded in 2015 and headquartered in Singapore, Lion’s customers are largely well-educated, affluent Chinese investors who seek sophisticated trading tools and investment vehicles based domestically and abroad.

TALK TO MANAGEMENT

Lion Group Holding Ltd. is always available to talk to current and potential investors. They're happy to answer any questions you may have and tell you what makes their story unique. Please fill out this form, and we will connect you shortly.

Lion Group Holding Ltd. At A Glance

Lion Group stands out as a dynamic and versatile financial services provider, operating a state-of-the-art all-in-one trading platform that caters to a diverse range of financial products and services, including total return swap (TRS) trading, contract-for-difference (CFD) trading, insurance brokerage, and futures and securities brokerage. What sets Lion Group apart is its robust regulatory framework, as the company navigates through the complexities of a heavily regulated industry with oversight from major regulators like the Cayman Islands Monetary Authority, Securities and Futures Commission of Hong Kong, and others. This regulatory compliance underscores Lion Group's commitment to maintaining high standards of operation and client services across jurisdictions.

Key Considerations:

Press Releases & Media Coverage

Social Media Updates

Recent LinkedIn Posts

Recent Facebook, Instagram, and X Posts

Investor Presentation

To download the Lion Group Holding Ltd. investor presentation, please fill out the form below.

Stock Chart (Intraday)

Stock Chart (Historical)

Stock Detail

Corporate History

Lion Group was incorporated in June 2015 in the British Virgin Islands. Shortly thereafter, in July 2015, the company registered with the Hong Kong Professional Insurance Brokers Association (PIBA), marking the start of its operational journey. This period was characterized by significant regulatory achievements and business developments, including obtaining licenses from the Hong Kong Securities and Futures Commission (SFC) for securities and futures brokerage (Type 1, 2, 4, and 5) in December 2016, and for asset management (Type 4 and 9) in August 2017.

The company expanded its service offerings by launching the Contract for Difference (CFD) business, developing an all-in-one trading platform, and introducing the Total Return Swap (TRS) service. These expansions were complemented by obtaining a Securities Investment Business License from the Cayman Islands Monetary Authority (CIMA) to act as a Broker Dealer and Market Maker.

The culmination of these efforts and achievements led to Lion Group's listing on the Nasdaq on June 17, 2020, under the symbol LGHL, signifying its commitment to global financial markets and regulatory standards.

Source: Company Documents

Business Licenses

Lion Group holds a comprehensive suite of business licenses, allowing it to operate across various financial sectors. It possesses licenses from the Hong Kong Securities and Futures Commission (HKSFC) for securities and futures brokerage, as well as for asset management. Additionally, it is licensed by the Cayman Islands Monetary Authority (CIMA) as a Broker Dealer and Market Maker, and by the Hong Kong Insurance Authority for insurance brokerage. Lion Group also holds a Capital Markets Services license from the Monetary Authority of Singapore, expanding its regulatory footprint into Southeast Asia, and a license from the Dubai Multi Commodities Centre for proprietary trading in cryptocommodities. These licenses enable Lion Group to offer a wide range of financial products and services, including high-leverage CFD products, under the regulatory advantages provided by CIMA.

Source: Company Documents

Lion Group Investment Opportunity

Lion Group distinguishes itself through a combination of strategic advantages in the financial sector. It commands a leading market position, specifically targeting the high-volume Asian retail and institutional markets with its Contracts for Difference (CFD) and other brokerage services.

The company's diversified product portfolio meets customer demands for trading across global financial markets, underlining its adaptability and breadth of service. Lion Group enhances the trading experience through the latest user-friendly mobile and desktop technologies, ensuring a superior user experience.

Strategic partnerships with industry leaders in TRS services and other areas contribute significantly to organic growth and brand expansion. Furthermore, Lion Group is actively pursuing new market opportunities, continues to focus on product innovation and diversified development, and deeply cultivates financial fields, including fintech Web 3.0 and carbon finance, demonstrating its commitment to innovation and long-term business growth.

The company's forward-looking approach, combined with planned expansion initiatives, positions Lion Group for favorable financial growth, showcasing its potential as a robust investment opportunity.

Source: Company Documents

Products and Services

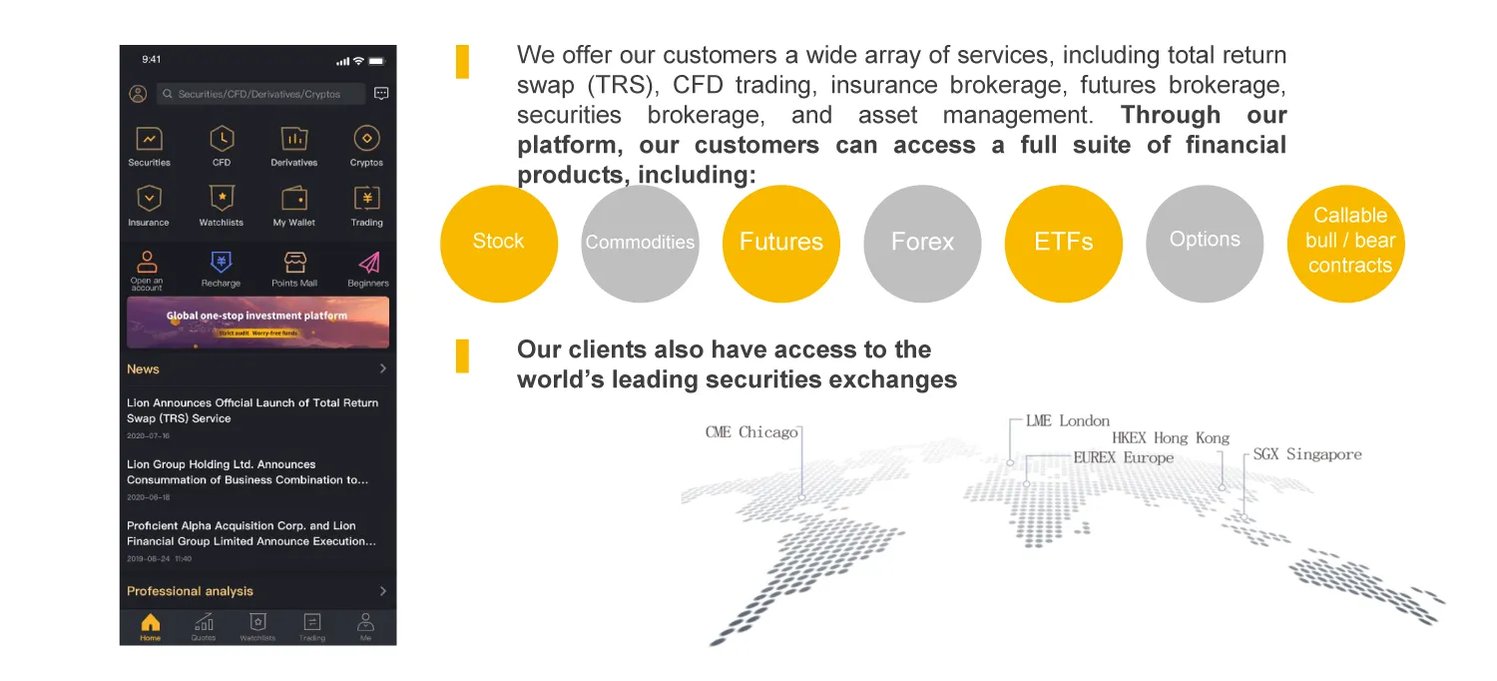

Catering to educated, affluent investors, Lion Group provides Chinese clientele access to a comprehensive suite of financial services through its proprietary trading platform. The product mix encompasses total return swap (TRS) trading, futures, securities brokerage, contracts for difference (CFD), forex, and asset management. This multifaceted array of sophisticated offerings targets the demands of its high-net-worth customers in China and abroad for diversity in markets and trading vehicles with leverage capabilities.

Source: Company Documents

Total return swap (TRS) trading enables exposure to underlying assets without owning them. TRS also allows hedging and speculation while unlocking leverage and tax efficiencies. Lion Group aims to expand TRS capabilities to drive growth.

Futures brokerage is a key offering enabling clients to buy or sell financial instruments set for future delivery. Futures can hedge against asset price movements in commodities, currencies, bonds, and equity indices. Securities brokerage services facilitate clients' trading of stocks, ETFs, and other securities on global exchanges.

CFD trading, or contracts for difference, allows clients to speculate on financial asset price movements like stocks or commodities without acquiring the assets themselves. Requiring little upfront capital, CFD trading is an efficient way to gain market exposure.

Forex trading, or foreign exchange trading, involves buying and selling currencies - the world's most liquid market. Lion Group provides gateway access to this and other global exchanges through its platform with sophisticated yet user-friendly interfaces to enhance trading experiences.

Through this diverse mix of product offerings, Lion Group positions itself as a comprehensive destination for Chinese investors to access global markets, manage risk, and execute complex trades in a user-friendly platform.

Source: Company Documents

Contract for Difference (CFD) Trading Expertise

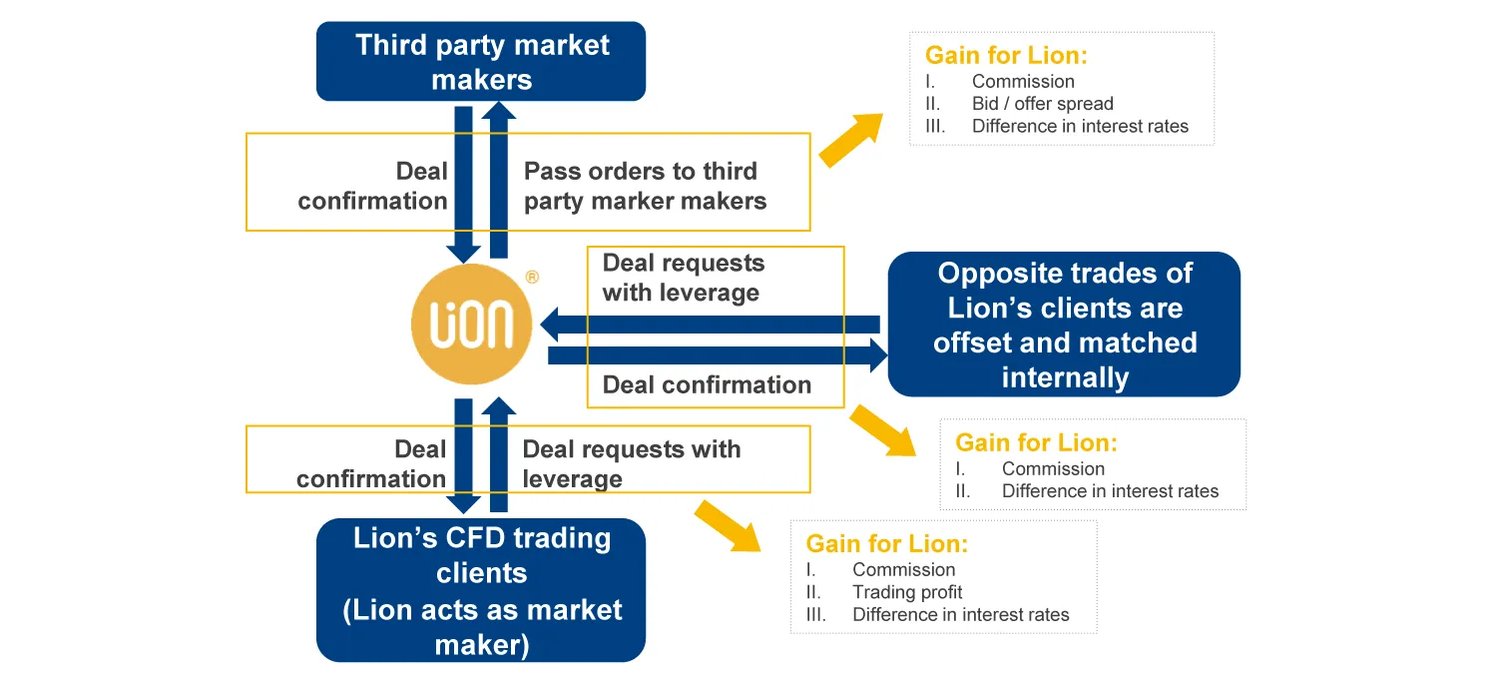

A Contract for Difference (CFD) allows clients to speculate on financial market price movements without owning the underlying asset. Here's how it works for Lion and its clients:

1. Clients' Perspective: They enter into a contract with Lion to exchange the difference in the price of an asset from when the contract is opened to when it's closed. Clients can use leverage, meaning they can control large positions with a relatively small amount of capital. This increases potential returns but also risks.

2. Lion's Role: Lion acts as a market maker, providing liquidity and prices for clients to trade CFDs. Lion can match trades internally (between its clients) or pass orders to third-party market makers.

3. Lion's Gains: From these activities, Lion earns through commissions on trades, the bid-offer spread (the difference between the selling price and the buying price), and the difference in interest rates. When trades are matched internally, Lion also benefits from trading profits arising from positions not perfectly offset.

This structure allows Lion to offer a flexible trading environment while managing its risk and generating revenue through various channels.

Source: Company Documents

Regulatory Advantage in Contract for Difference (CFD) Trading

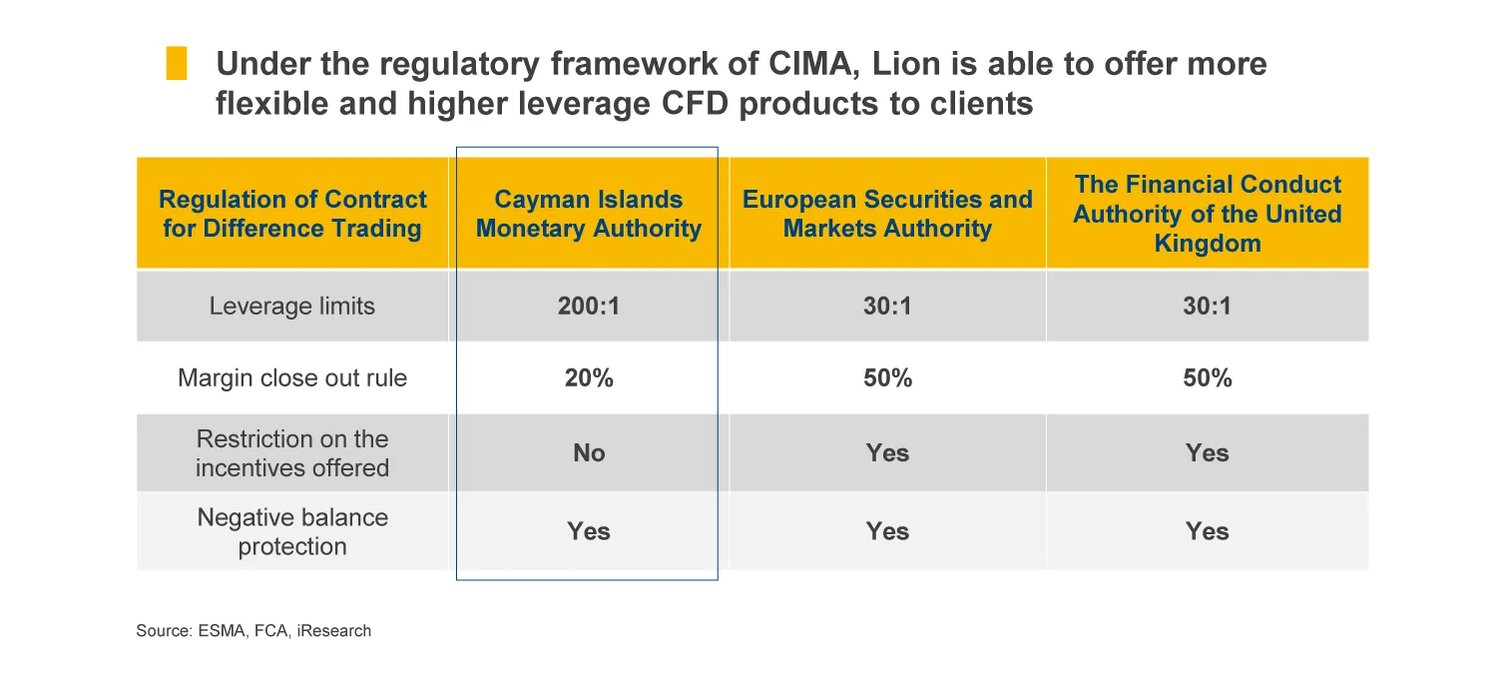

Lion Group's regulatory advantage in offering Contract for Difference (CFD) products stems from its licensure under the Cayman Islands Monetary Authority (CIMA), which permits higher leverage limits compared to regulations in the European Union and the UK, where the European Securities and Markets Authority (ESMA) and the Financial Conduct Authority (FCA) impose stricter controls.

This flexibility allows Lion to offer CFD products with up to 200:1 leverage, significantly higher than the 30:1 limit in the EU and UK. Higher leverage means clients can control larger positions with a smaller amount of capital, potentially increasing returns on investment. Additionally, CIMA's regulations do not restrict incentives offered to traders and have a more favorable margin close-out rule, enhancing Lion's ability to attract clients seeking higher leverage and more flexible trading conditions.

Source: Company Documents

Total Return Swap (TRS) Trading Proficiency

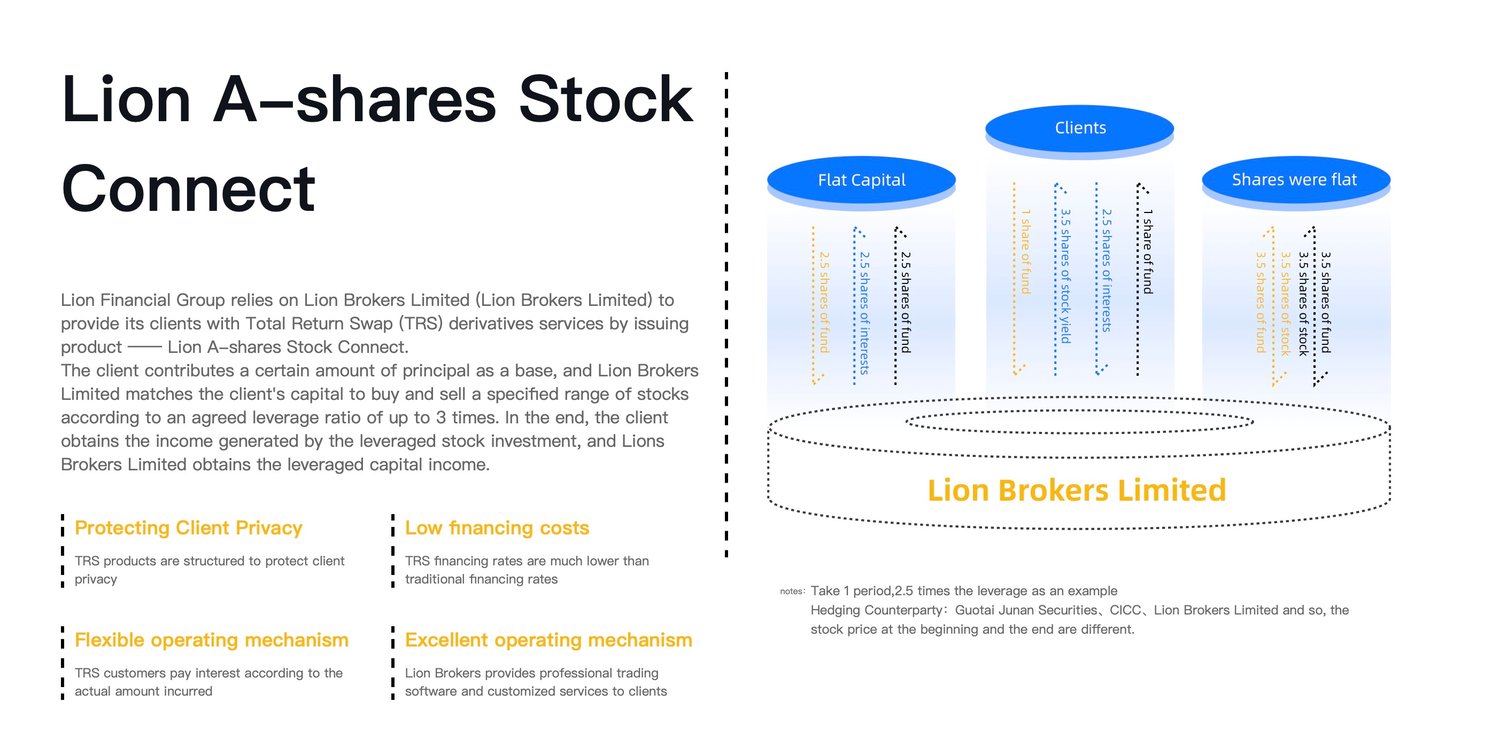

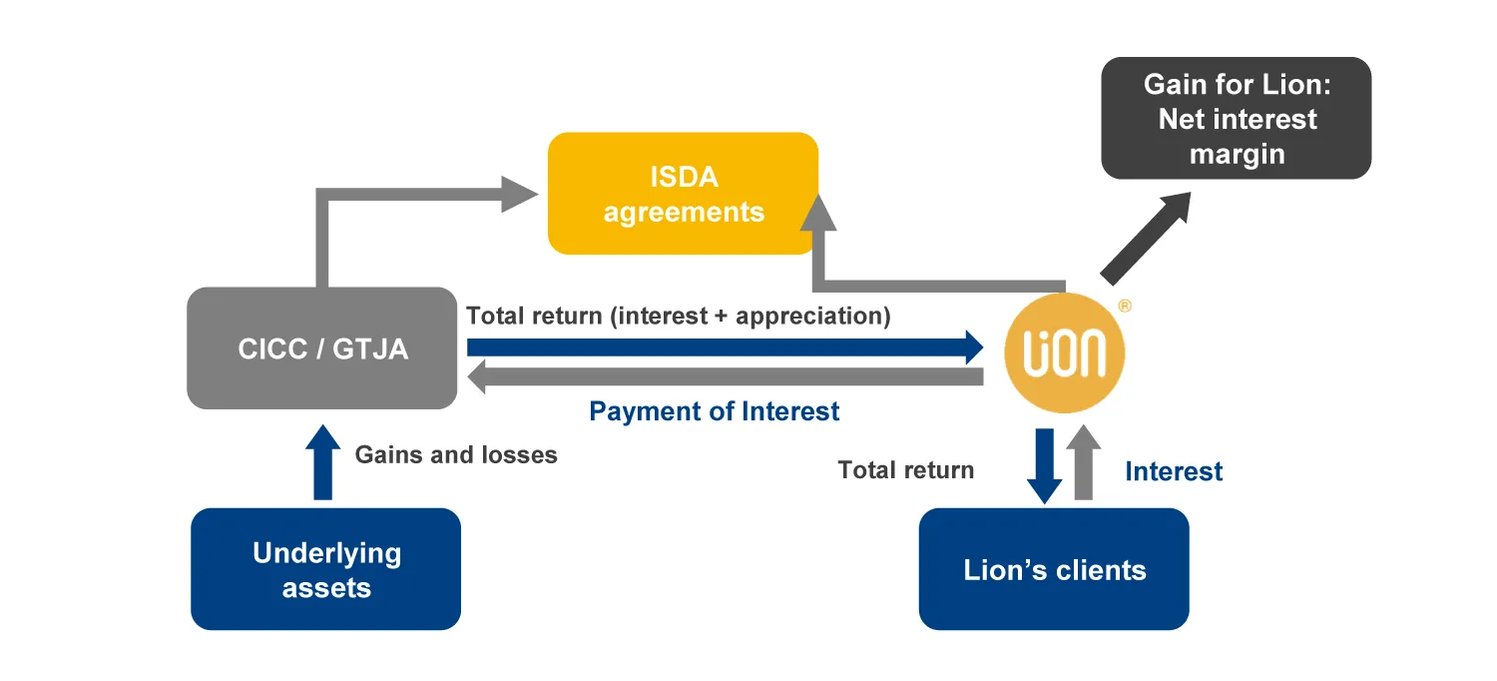

Total Return Swaps (TRS) are agreements between Lion Group and its clients to exchange the total returns of an asset for interest payments over a set period. This arrangement allows clients to gain exposure to the asset's price movements (both gains and losses) without owning it.

Clients trade via Lion's proprietary TRS Financing Trading software, which the company provides via macOS, Windows, Android, and iOS.

Source: Company Documents

Lion earns from the net interest margin, which is the difference between the interest received from clients and the interest paid to them. Essentially, clients bet on an asset's performance, and Lion profits from the financing side of these deals. Contracts like these are often governed by ISDA agreements, ensuring standardization and reducing counterparty risk.

Source: Company Documents

Strategic Partnerships

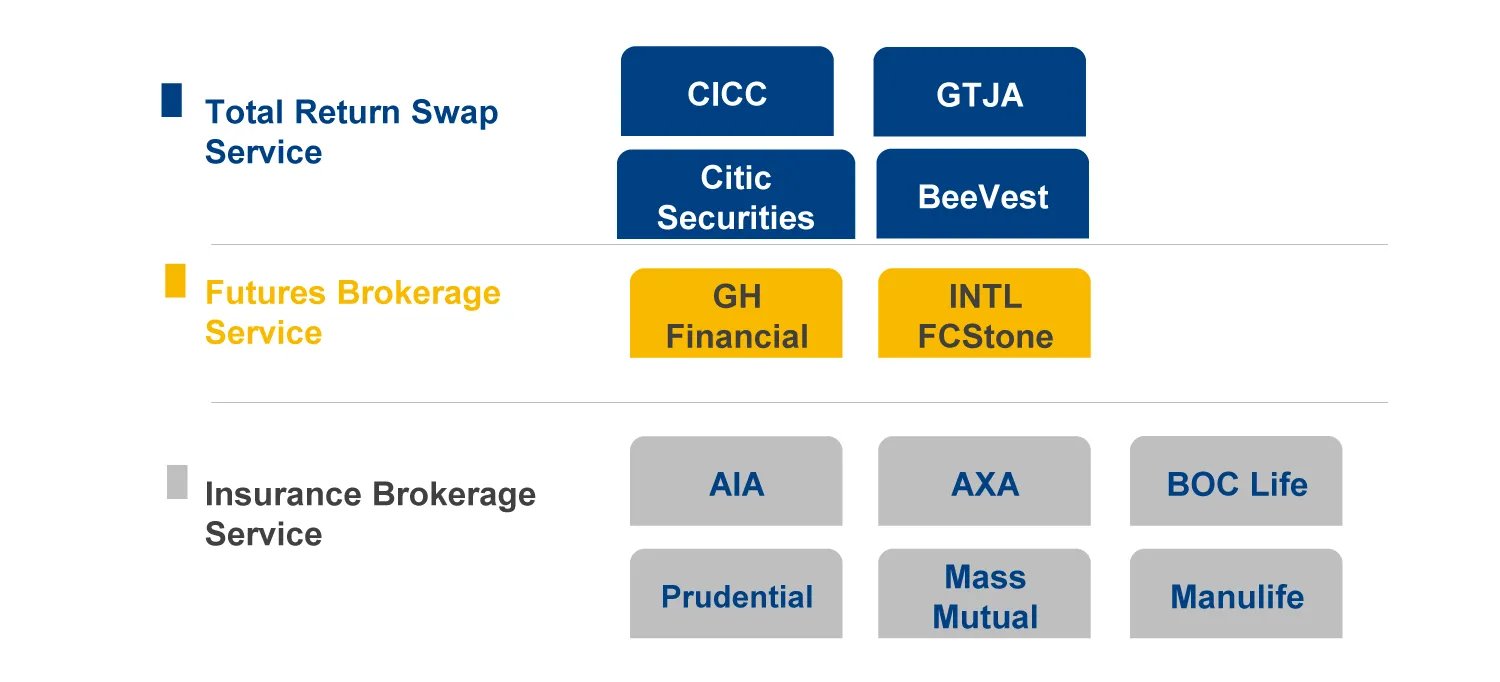

Lion Group's strategic partnerships span across Total Return Swap Service, Futures Brokerage Service, and Insurance Brokerage Service, aligning with industry giants like CICC, GTJA, Citic Securities, AIA, and AXA. These collaborations enable Lion to deliver a wide array of financial solutions, from customized OTC derivatives to comprehensive insurance coverage, leveraging the expertise and client base of its partners. By engaging with leaders in the financial and insurance sectors, Lion Group significantly enhances its service offerings, expands its market reach, and positions itself for robust growth. These partnerships are instrumental in driving Lion's strategic expansion and reinforcing its competitive edge in the global financial services industry.

The company's strategic collaborations with premier financial institutions and insurance companies underscore its multifaceted approach to growth and service diversification. Through partnerships in key sectors—Total Return Swap Service, Futures Brokerage Service, and Insurance Brokerage Service—Lion has fortified its market position. By aligning with CICC and GTJA, leaders in the Over-The-Counter (OTC) Derivatives Market, Lion taps into a high-potential growth area, offering customized financial contracts outside traditional exchanges. This strategy not only broadens Lion's client base but also enhances its financial performance, evidenced by substantial net profit increases and trading volume growth.

Moreover, Lion's engagements with Citic Securities in its Total Return Swap (TRS) trading business, and global insurers like AIA and AXA expand its capabilities in futures brokerage and insurance services. These strategic partnerships enrich Lion's product suite, allowing it to cater to a wider range of financial and risk management needs. By leveraging the expertise, reputation, and client networks of these partners, Lion Group not only deepens its service offerings but also cements its reputation as a comprehensive provider of financial services. Through its collaborations, Lion demonstrates its commitment to innovation, customer service, and sustained growth, setting a strong foundation for future expansion and solidifying its standing in the global financial marketplace.

Source: Company Documents

Growth Potential

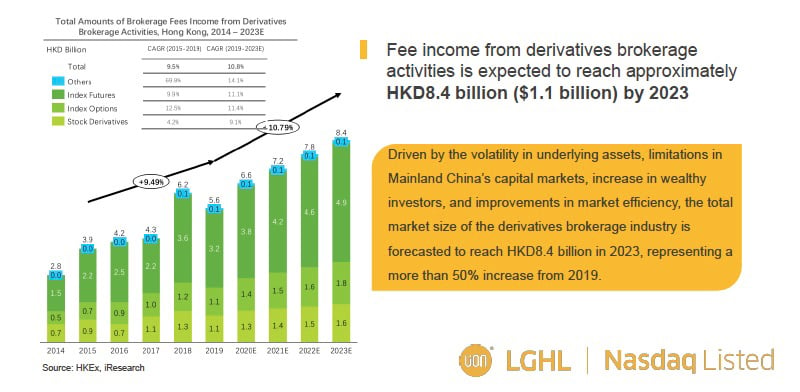

Lion Group operates in highly dynamic and growth-oriented markets. The Contract for Difference (CFD) derivatives market is expected to see significant growth, with fee income forecasted to reach approximately $1.1 billion by 2023, indicating a substantial increase due to factors like market volatility and the rise of wealthy investors.

Source: Company Documents

These markets represent key opportunities for Lion Group to leverage its expertise and innovative service offerings to capture growth and expand its global footprint.

An Exceptional and Experienced Management Team

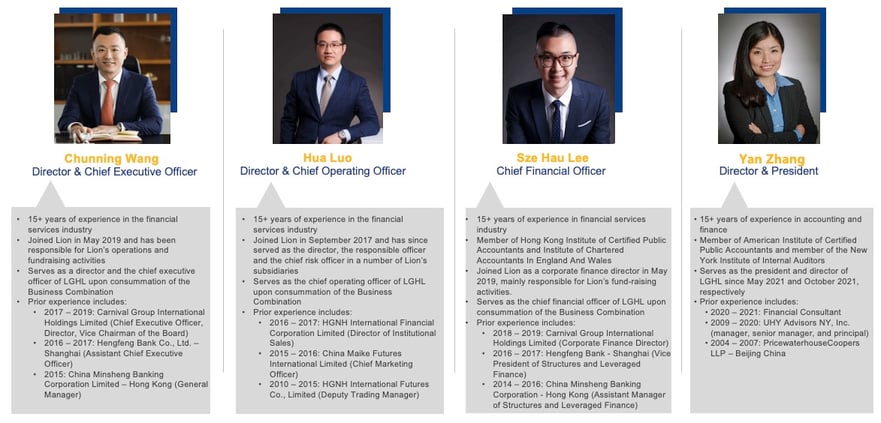

An experienced and accomplished management team leads Lion Group. Chunning (Wilson) Wang, CEO, has over 15 years of experience in the financial services industry. He joined Lion in May 2019 and has led the company's operations and fundraising activities.

Hua Luo, COO, also with over 15 years in the industry, joined in September 2017 and contributed as the director, responsible officer, and chief risk officer across Lion's subsidiaries.

Sze Hua (Alex) Lee, CFO, is a member of the Hong Kong Institute of Certified Public Accountants and the Institute of Chartered Accountants in England and Wales. He joined Lion in May 2019 and focuses on corporate finance and fundraising activities.

Yan Zhang, Director & President, is a member of the American Institute of Certified Public Accountants and the New York Institute of Internal Auditors. She brings 15+ years of accounting and finance experience to Lion and joined the company in May 2021.

Source: Company Documents

Financial Summary & Outlook

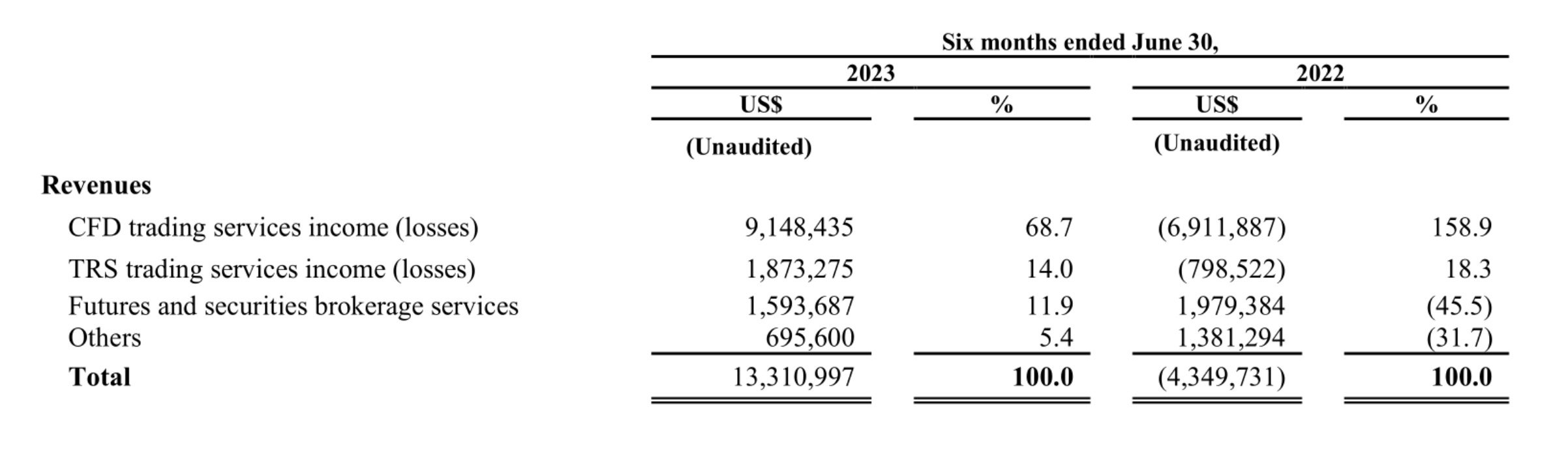

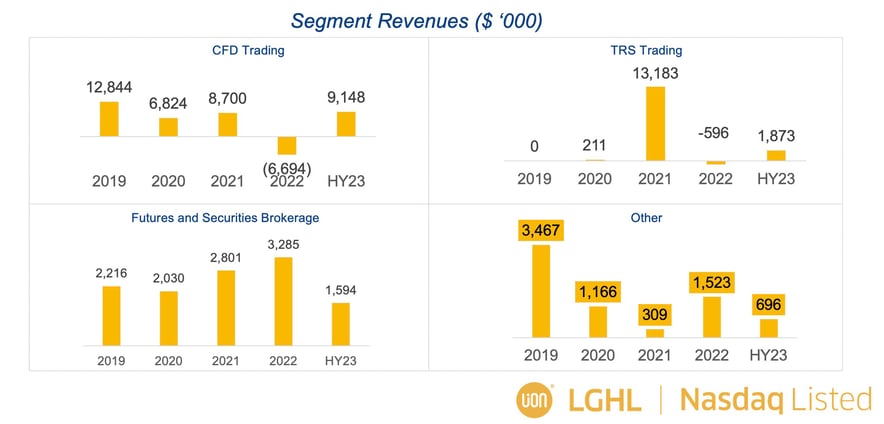

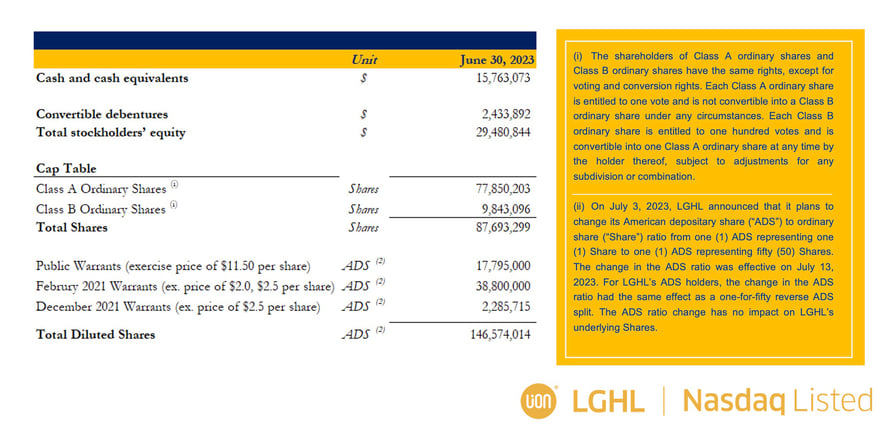

Lion Group reported a significant financial turnaround in the first half of 2023, achieving a record total revenue of $13.3 million, marking a stark improvement from the previous year's losses. This growth was primarily fueled by trading gains in CFD and TRS trading activities.

Source: Company Documents

Additionally, the company showcased resilience and adaptability in its operations, contributing to its positive performance amid economic recovery and market challenges.

Source: Company Documents

Lion Group's strategic focus on enhancing its trading platforms and risk management practices was crucial in achieving these financial results.

Source: Company Documents

The company maintains significant liquidity with a strong cash position.

FY 2024 Outlook

• Expand Hong Kong-based OTC stock options trading and set a foundation to become a leader in Hong Kong’s OTC options industry

• Maintain steady growth of TRS trading and transform into a new potential core driver

• Expand into the Southeast Asia region after obtaining the Capital Markets Services license with the Monetary Authority of Singapore in October 2021

SEC Filings

Financials

Risks & Disclosures

This communication is neither an offer to sell nor a solicitation of an offer to buy, nor a recommendation of any securities of the company mentioned herein.

Lion Grouop Holding Ltd. (the “Company”) has reviewed the content of this page as well as the accompanying presentation (“Company Presentation”) displayed on this page. To the best of its knowledge, the Company does not believe this content to be misleading or inaccurate in any material respect, nor does it believe there are any material omissions with respect to such content. The Company does not believe the contents of the page or the Company Presentation to contain any non-public material information.

Information and opinions presented in the Company Presentation are provided by the Company, and b2iDigital makes no representation as to their accuracy or completeness. The information contained on this page is not intended to constitute any form of advice, and the information provided is not intended to provide a sufficient basis on which to make an investment decision. It is not investment research, nor does it constitute a research recommendation, as it does not constitute substantive research or analysis. This information is not to be relied upon in substitution for the exercise of independent judgment.

Information, opinions and estimates contained on this page or in the Company Presentation reflect judgments by the Company as of the original date of publication by the Company and are subject to change without notice. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied is made regarding future performance.

A complete description of the risks and uncertainties relating to the Company and its securities can be found in the company's filings with the U.S. Securities and Exchange Commission available for free at www.sec.gov.

Information on this page may relate to penny stocks, which may also be referred to as low-priced stocks. Penny stocks are low-priced shares typically issued by small companies. Penny stocks involve greater than normal risk, they may be less liquid than other stocks (i.e., more difficult to sell), and there may be less reliable information available regarding such stocks. Investors in penny stocks should be prepared for the possibility that they may lose their entire investment.

b2i digital or its related entities may own securities of the Company.

The Company is a client of b2i Digital. The Company agreed to pay b2i Digital no greater than $100,000 in cash for 12 months of digital marketing consulting and investor awareness services.

This communication includes forward-looking statements that involve risks, uncertainties and assumptions that are difficult to predict. Words and expressions reflecting optimism, satisfaction or disappointment with current prospects, as well as words such as “believes,” “hopes,” “intends,” “estimates,” “expects,” “projects,” “plans,” “anticipates” and variations thereof, or the use of future tense, identify forward-looking statements, but their absence does not mean that a statement is not forward-looking. The Company’s forward-looking statements are not guarantees of performance, and actual results could vary materially from those contained in or expressed by such statements due to risks, uncertainties and other factors. The Company urges readers to consider specifically the various risk factors identified in its most recent Form 10-K, and any risk factors or cautionary statements included in any subsequent Form 10-Q or Form 8-K, filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this communion. Except as required by law, the Company does not undertake any responsibility to update any forward-looking statements to take into account events or circumstances that occur after the date of this communication.

The Lion Group Holding Ltd. management and investor relations team are available to talk to current and potential investors. They're happy to answer your questions and tell you what makes their story unique. Please fill out this form, and we will connect you shortly.

• Directly hear the Lion Group Holding Ltd. story

• Ask your questions

• Submit the form below, and someone will get in touch with you as soon as possible

Note: Company management or its representative can only discuss and disclose information that is already available in the public domain. They will do their best to clarify such information to the extent permitted by securities law and industry regulations.

Regulatory Compliance and Industry Standing

Lion Group operates under strict regulatory oversight in multiple jurisdictions, ensuring a high standard of compliance and operational integrity.