AppTech Payments Corp.

AppTech Payments Corp. is an innovative Fintech company whose mission is to deliver a better way for businesses to provide their customers with immersive commerce experiences.

Nasdaq: APCX

IR Website: https://apptechcorp.com/

Headquarters: Carlsbad, CA

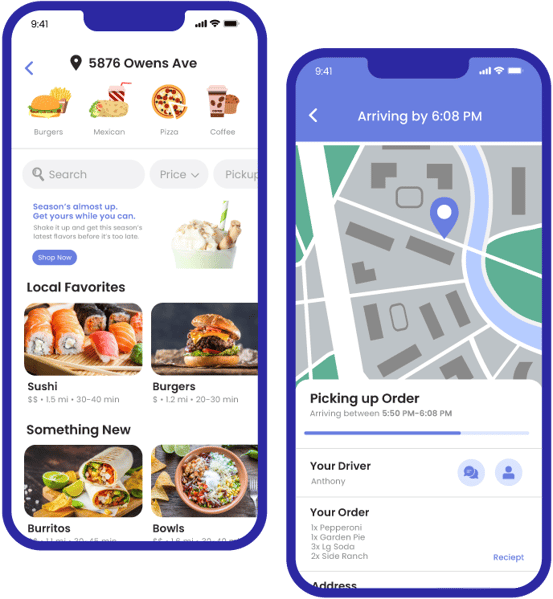

AppTech recently launched Commerse™, its patent-backed platform that powers seamless commerce experiences by combining digital banking, text-based payments, and merchant services on one unified platform. Commerse™ offers businesses integrated financial services like digital accounts, text-to-pay, payment processing, and cross-border transactions.

Combining these capabilities on a single secure platform, Commerse™ aims to increase operational efficiency and enable convenient purchasing experiences for businesses and their customers. Leveraging AppTech’s patented technology, Commerse™ transforms commerce by providing businesses with the digital banking and payment tools needed for today's markets while improving the economic convenience that customers demand.

TALK TO MANAGEMENT

The AppTech Payment Corp management team is always available to talk to current and potential investors. They're happy to answer any questions you may have and tell you what makes their story unique. Please fill out this form, and we will connect you shortly.

All content on this page is accurate as of 11.18.23.

AppTech Payment Corp. At-A-Glance

AppTech Payments Corp is an innovative fintech company developing cutting-edge digital commerce solutions for businesses and consumers. With an experienced leadership team at the helm, AppTech provides a unique value proposition for investors.

Pioneering the future of integrated financial technologies, AppTech Payments Corp aims to transform digital banking and payments. Backed by patented IP, an experienced leadership team, and specialized expertise, AppTech delivers differentiated capabilities:

Transforming Digital Commerce Through Payments and Banking Innovation

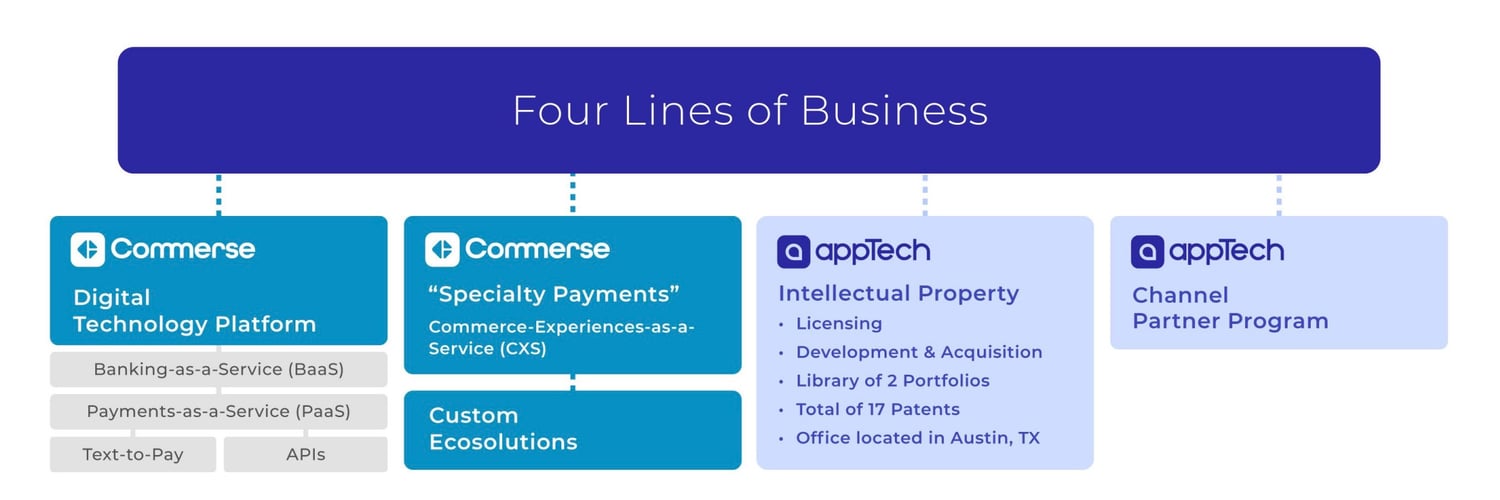

AppTech Payments Corp. aims to transform digital commerce experiences through its differentiated Fintech platform. The company operates across four complementary business lines, enabling seamless payments and banking capabilities for merchants and their customers.

AppTech’s core Commerse™ platform powers an integrated suite of digital financial services, from banking tools to payments acceptance. The company also provides flexible specialty payment solutions tailored to each merchant’s needs. Underpinning AppTech’s offerings is its robust patent portfolio covering text payments, mobile peer-to-peer transactions, two-way chat, and location-based commerce.

Additionally, AppTech leverages partnerships to drive the adoption of its platform. By combining next-gen financial technologies with incentive structures for channel partners, AppTech seeks to deliver innovation in payments, banking, and commerce experiences. Together, The Commerse platform, specialty payments, robust patent portfolio, and channel partners create a synergistic ecosystem to digitally empower businesses and consumers.

Source: Company Reports

Commerse™ Digital Technology Platform

AppTech’s Commerse™ platform delivers an innovative suite of digital banking, payments, and financial services tools that enable businesses to engage their customers better. Combining capabilities like digital accounts, payment acceptance, and text-based payments, Commerse™ provides an integrated experience on one unified cloud platform. The flexible API-based architecture allows for embedded finance and white-label offerings. With Commerse™, AppTech aims to power the future of digital commerce experiences.

Specialty Payments

In addition to the Commerse™ platform, AppTech offers specialty payment capabilities, including recurring billing, payment gateways, virtual terminals, and point-of-sale solutions tailored to specific merchant needs. Providing customized payments acceptance and payout solutions allows AppTech to differentiate from generic payment processors. The company’s focus on flexibility and integration aims to make payments seamless for merchants and their customers.

Intellectual Property

AppTech possesses a robust patent portfolio covering innovations in text payments, mobile peer-to-peer transactions, and geolocation-triggered commerce. With foundational IP in engaging consumers via text and enabling location-based mobile commerce, AppTech can provide unique platform capabilities and defend its market position. The company continues investing in IP development to support next-generation payment and banking experiences.

Channel Partner Program

AppTech leverages a revenue-sharing model to incentivize channel partners, independent software vendors, and referral partners to promote the adoption of its offerings. Partners can integrate digital banking, text payments, and embedded finance APIs into their own applications. This integration creates a force multiplier effect for AppTech’s distribution reach. The channel partner program aims to drive viral adoption of the Commerse™ platform.

A Video Overview of AppTech Payments Corp Featuring An Interview With CEO Luke D'Angelo

To learn more about AppTech Payment Corp and its patented technologies, please watch the following seven-minute video featuring CEO Luke D'Angelo.

Source: Company Reports

Bridging the Gap Between Payments, Banking, and Experiences

AppTech’s Fintech platform aims to transform disconnected systems into seamless commerce experiences. The company incentivizes partners to acquire new clients and market AppTech’s innovative payment and banking technologies.

Source: Company Reports

By integrating text payments and digital banking, AppTech delivers unified solutions that meet the needs of businesses, SMEs, and consumers. The platform bridges the gap between Fintech innovations and familiar mobile engagement, using text messaging to enable payments.

The platform combines standalone products with fully integrated solutions packaged together to power customized commerce experiences. It is all secured by a patented framework incorporating AppTech’s diverse patent portfolio.

With its platform approach, AppTech seeks to increase efficiencies and drive innovation across payments, banking, and user experiences. The company intends to simplify financial technologies to create new opportunities for client acquisition and frictionless transactions.

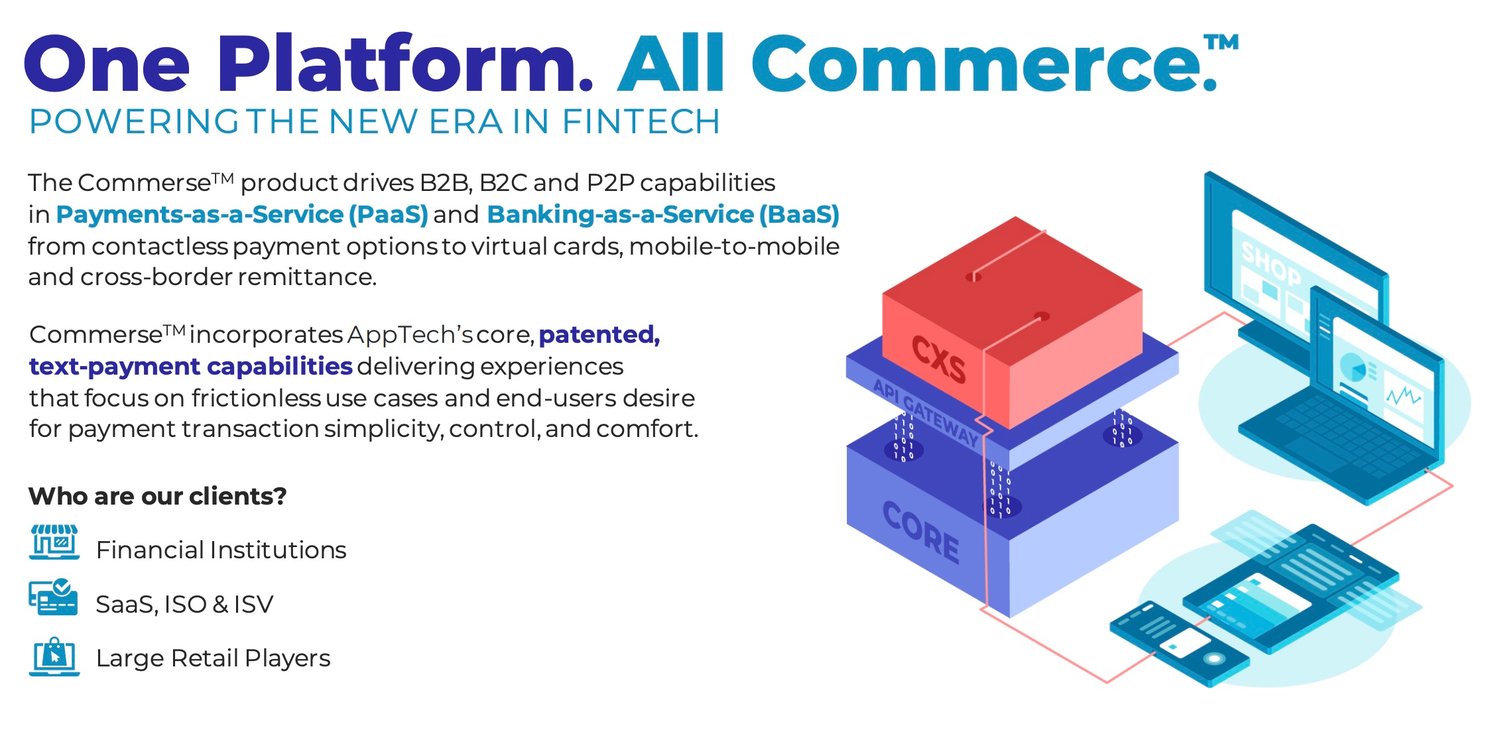

Transforming Commerce Experiences Through an Integrated Fintech Platform

By bringing together critical financial services on an integrated platform, AppTech aims to increase efficiencies, unlock new revenue streams, and deliver the seamless commerce experiences that today’s customers demand.

Source: Company Reports

-

AppTech’s Commerse™ platform powers the next generation of digital commerce by unifying key capabilities into a single, patented solution.

-

Targeting SaaS providers and enterprise retailers, Commerse™ combines Payment-as-a-Service (PaaS), Banking-as-a-Service (BaaS), and frictionless engagement tools.

-

Via embedded finance APIs and turnkey solutions, Commerse™ drives B2B, B2C, and P2P transactions from contactless payments to cross-border remittances.

-

AppTech’s patented text payment technology is central to the platform, enabling simplified, unified payment experiences across channels.

Please watch the two-minute video (below) to learn more about AppTech's Commerse™ platform:

Source: Company Reports

Powering Seamless Commerce Experiences

Commerse™ provides an integrated technology stack to create frictionless payments, banking, and commerce experiences. The platform offers modular capabilities that allow clients to tailor robust financial solutions.

Key elements of the Commerse™ product suite include:

End-to-End Digital Onboarding

Provides tools to seamlessly onboard consumers and businesses onto the Commerse™ platform through digital applications and user-friendly interfaces.

Tokenization Management

Enables secure storage of payment credentials via digital tokens instead of actual card/account details, protecting sensitive data.

APIs & Architecture

Open APIs and microservices architecture allow easy integration into third-party systems and custom development.

Updates & Release Management

Continuous delivery of new features and improvements to the platform through agile software development.

Developer Tools & Documentation

Resources to support partners and developers in building on top of the Commerse™ platform.

Channel Partner Ecosystem

Partnerships with resellers, ISVs, and referral partners to extend distribution of Commerse™-powered solutions.

Reporting & Data Analytics

Provides insights into transaction data and platform performance to optimize operations.

Digital Trust & Safety

Leverages AI and machine learning to provide security, fraud analysis, and compliance automation.

3rd Party Integrations

Pre-built connections to platforms like accounting, ERP, CRM, and communications systems.

Compliance Controls

Tools to simplify compliance with regulations like AML and PCI DSS, and to maintain high-security standards.

Together, these capabilities enable AppTech to deliver an enterprise-grade integrated payments and banking platform-as-a-service. The modular design allows flexibly combining core financial services with advanced functionality for embedded finance, analytics, and automation. AppTech aims to empower partners to build innovative commerce solutions on top of Commerse™’s secure, compliant foundation by offering robust tools and integrations.

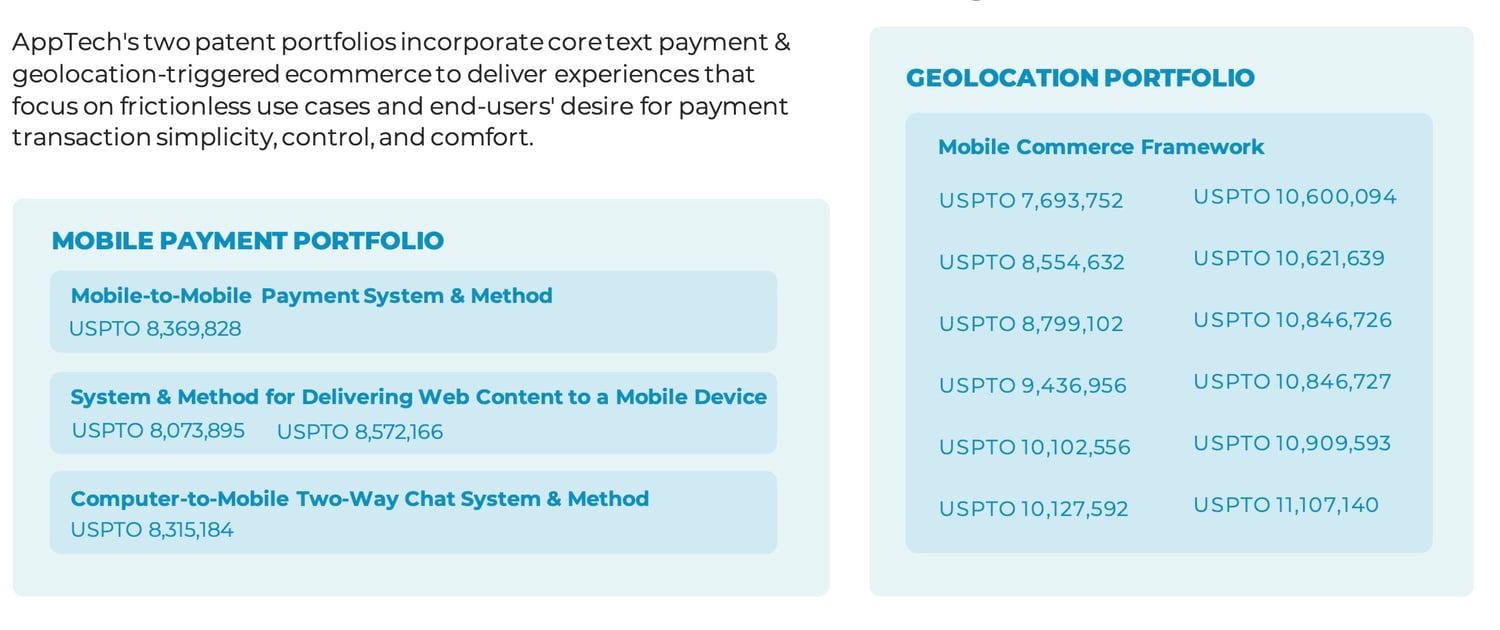

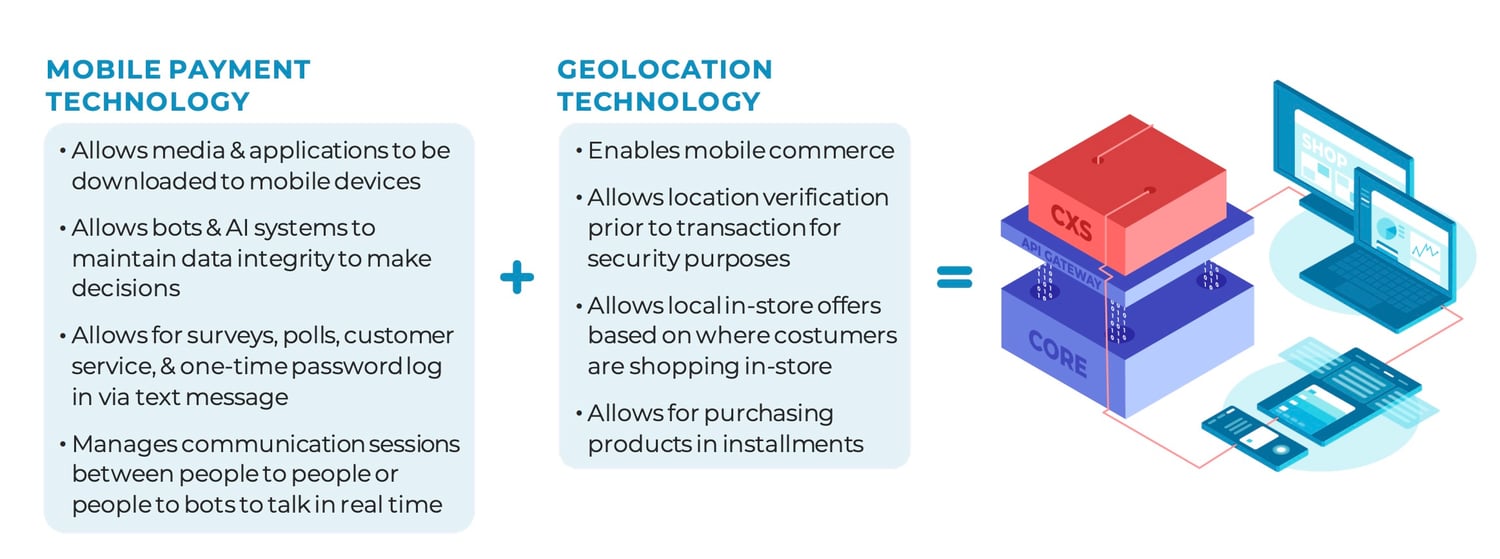

A Valuable and Powerful Patent Portfolio

AppTech has a robust patent portfolio covering foundational mobile payment and location-based commerce innovations. This intellectual property helps differentiate AppTech’s offerings and underscores the company’s technical capabilities.

Source: Company Reports

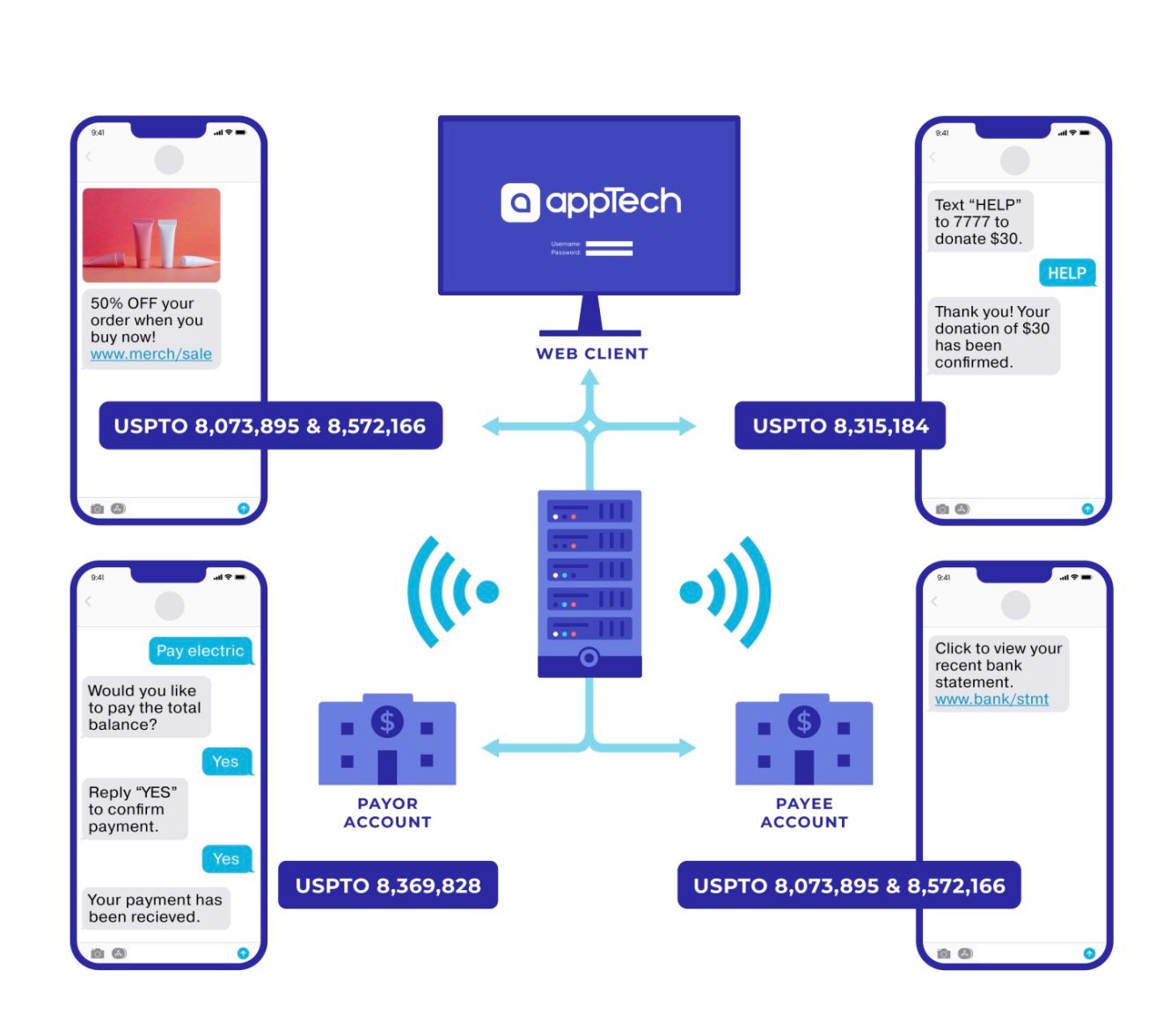

The first patent family enables key mobile functionalities like paying via text message, chatting from computer to phone, and downloading content on the go. With roots in simplifying peer-to-peer transactions and mobile messaging, these patents provided building blocks for convenient digital experiences.

The second patent group focuses on location-triggered actions for delivery, purchase, or request of any products or services from a mobile phone to a specific location. This geolocation-based patent portfolio empowers the next generation of immersive, personalized commerce.

Together, AppTech’s patents promote frictionless engagement between consumers and merchants. By protecting fundamental advances in text payments and mobile commerce, AppTech can provide unique platform capabilities while maintaining competitive barriers to entry for competitors.

Owning foundational IP demonstrates AppTech’s commitment to research and development of technology, which remains ongoing. The company continues expanding its patent library to enable innovative future payment flows and elevated banking experiences aligned with customer needs.

AppTech’s patent holdings reinforce the company’s position at the intersection of payments, experiences, and innovation. AppTech aims to license its patents and incorporate protected IP into new commercial solutions that help businesses thrive in the digital economy.

Foundational Mobile Transaction Innovations

AppTech’s mobile payments patent portfolio consists of 4 pioneering technology patents:

Source: Company Reports

-

One covers delivering web content directly to mobile devices. This patent enabled accessing links and information on the go, foreseeing today’s mobile web experience.

-

Another patent details a two-way communication system via text messaging between computers and mobile phones. This technology laid the groundwork for conversational commerce.

-

Additionally, AppTech owns IP on mobile-to-mobile money transfers. This patent presaged the rise of peer-to-peer payment apps by allowing direct smartphone transactions.

-

Finally, the portfolio includes broad IP covering mobile payments using text messages or scannable codes. This patent broadly protects mobile-based transactions.

These four patents represent fundamental building blocks for streamlining digital transactions on mobile phones. By securing patent protection early on, AppTech controls core mobile payment capabilities.

Today, AppTech aims to leverage these patents in developing next-generation payment and banking technologies optimized for mobility. The company’s legacy as an early mobile payment innovator is the foundation of its vision for commerce experiences-as-a-service.

Transforming Local Commerce Through Location Awareness

AppTech’s geolocation patent portfolio centers on delivering hyper-targeted, in-the-moment commerce experiences based on a mobile user’s location.

The thirteen patents in this family enable various location-triggered capabilities—from presenting tailored offers when entering a store to enabling on-site payments or installment plans.

Source: Company Reports

Central to the portfolio is a broad patent covering location-based advertising on mobile devices. This technology protects all location-relevant promotions within apps when users are physically present in stores.

Additional patents detail technology for transacting e-commerce or requesting services tied to specific geolocation parameters. This location-specific targeting reimagines commerce as dynamic and site-dependent.

Together, these patents provide AppTech full coverage of the emerging space of geofenced digital commerce. The portfolio represents a significant investment in R&D around location-based engagement and transactions.

AppTech intends to commercialize these patents in solutions that bridge physical and digital experiences. The company’s IP underscores its commitment to enabling personalized, immersive commerce through mobile.

Empowering Seamless Commerce Experiences

AppTech aims to transform fragmented systems into seamless experiences.

The Commerse™ platform consolidates digital banking, payments, and financial services into a unified ecosystem. This integration seeks to increase efficiency, unlock revenue, and deliver the convenient digital experiences customers want. AppTech’s history of pioneering mobile transactions and messaging guides its strategy today.

Source: Company Reports

At the core, AppTech’s patented text payment technology lets businesses accept contactless payments easily while engaging customers through a familiar mobile channel. This frictionless approach facilitates transactions, especially for the unbanked or underbanked.

Furthermore, AppTech’s location-based patents enable contextual promotions and experiences when people enter stores or venues. This technology allows for more immersive, personalized commerce moments.

AppTech strives to connect digital and physical experiences by enabling contextual engagement, easy payments, and tailored financial services. The company wants to transform commerce through technology while aligning incentives via its revenue-sharing model with partners.

By embedding payments into workflows and consolidating financial capabilities, AppTech aims to deliver the intelligent, customized experiences today’s consumers expect while providing the infrastructure to make commerce seamless.

Strategic Partnerships to Extend Reach

AppTech supplements its offerings through partnerships with leading institutions across banking, payments networks, and technology vendors.

Key partnerships include:

Channel Partners - AppTech leverages resellers, ISVs, and referral partners to promote its solutions through revenue-sharing incentives. These relationships create a viral multiplier effect.

Banking Providers - AppTech enables white-label digital banking through relationships with trusted providers.

Payments Networks - Direct integrations with major payment networks like Visa, Mastercard, and Discover allow AppTech to process transactions globally.

AppTech’s partner ecosystem provides banking licenses, global payment acceptance, robust security, and other capabilities that enhance its commerce solutions.

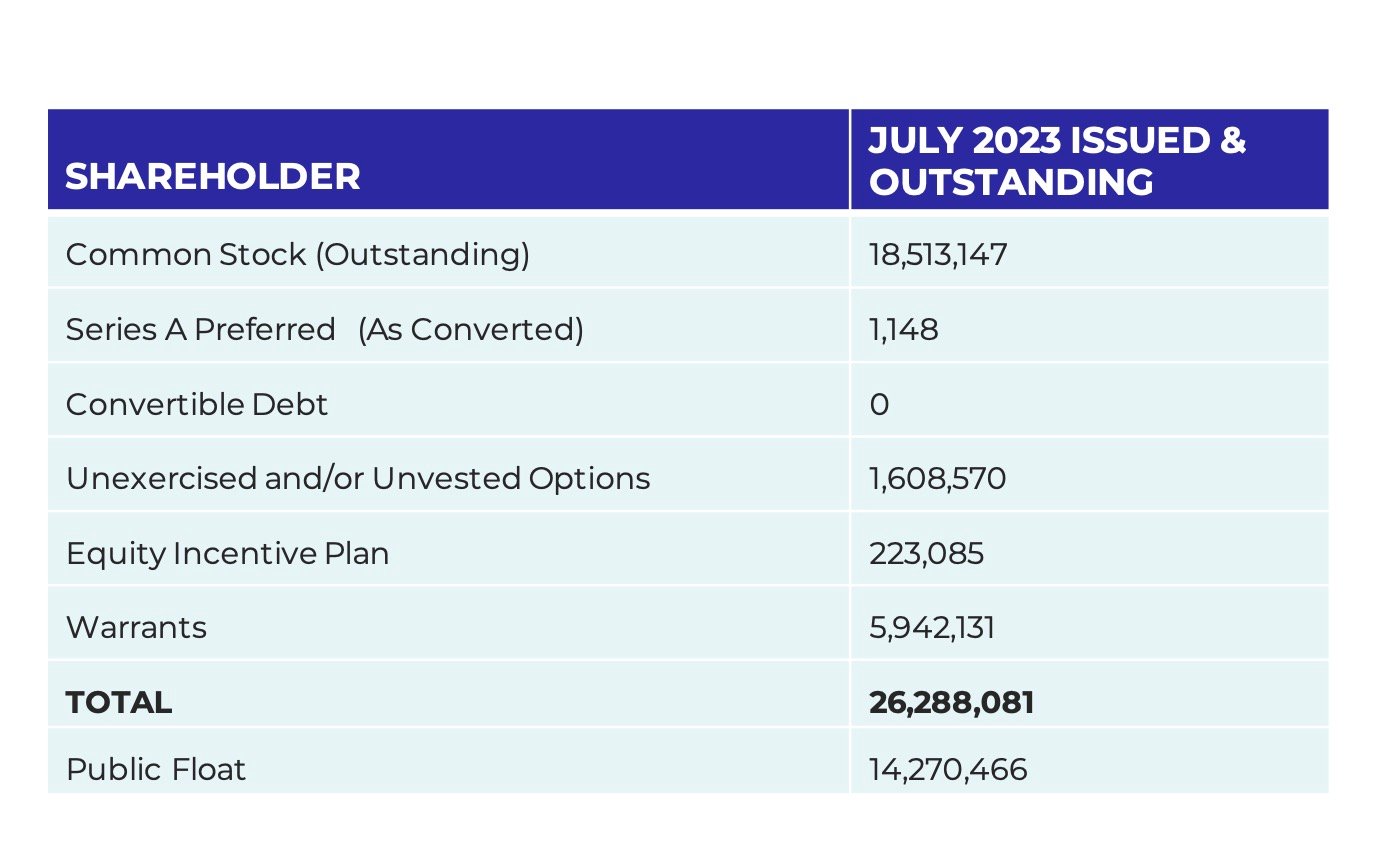

AppTech’s Capitalization as of July 2023

AppTech has a tight share structure with approximately 18.5 million shares of common stock outstanding.

Source: Company Reports

The company has 1,148 shares of Series A preferred stock, which are convertible into common shares on a one-for-one basis.

AppTech also has approximately 1.6 million unexercised and unvested options outstanding at weighted average exercise prices between $0.92 to $7.00 per share. Around 223,000 shares remain available for issuance under the company's equity incentive plan.

Additionally, AppTech has nearly 5.9 million warrants outstanding at exercise prices ranging from $4.15 to $5.19 per share. These warrants expire between 2023 and 2028, allowing time for strategic exercise as the company executes its business plan.

AppTech has a fully diluted share count of approximately 26.3 million as of July 2023. Of this amount, around 14.3 million shares represent the public float.

The company currently has no outstanding convertible debt on its balance sheet.

AppTech maintains an effective shelf registration with around $70M capacity, which provides efficient access to growth capital.

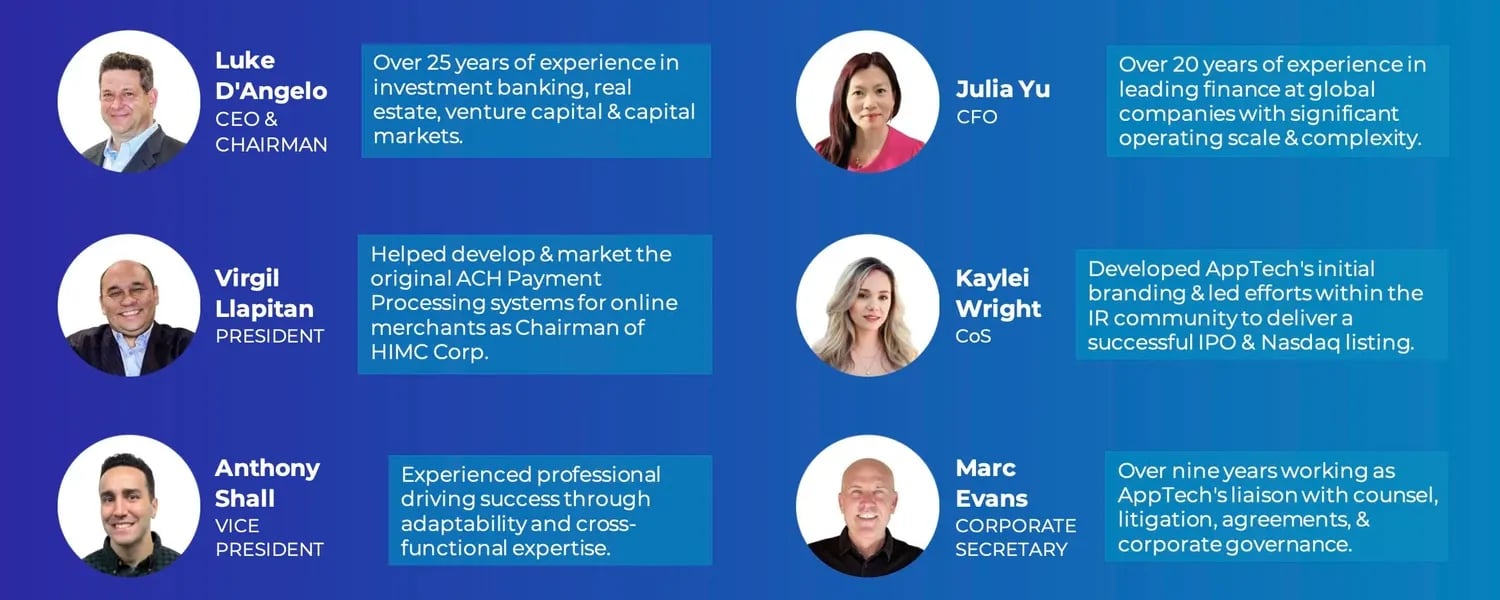

An Exceptional and Seasoned Management Team

AppTech’s leadership team shares the passion and experience needed to execute AppTech's mission of transforming commerce experiences through seamless financial technologies.

Source: Company Reports

Source: Company Reports

CEO Luke D'Angelo has over 25 years of experience in banking, capital markets, and strategic leadership roles.

President Virgil Llapitan pioneered early ACH payment processing systems, bringing deep domain knowledge in financial technologies.

CFO Julia Yu oversees financial strategy with over 20 years of experience managing finance for global companies.

The team is rounded out by the talents of Kaylei Wright, who led branding and IPO efforts; Marc Evans, who brings governance and business development expertise; and Anthony Shall, optimizing operations.

The leadership team combines significant payment processing expertise, financial acumen, legal guidance, strategic vision, and operational excellence. Their complementary skills and proven track records position AppTech to successfully develop cutting-edge digital payments and banking technologies while managing the complexity of scaling a Fintech disruptor.

Press Releases

Stock Chart (Intraday)

Stock Chart (Historical)

SEC Filings

Risks & Disclosures

This communication is neither an offer to sell nor a solicitation of an offer to buy, nor a recommendation of any securities of the company mentioned herein.

AppTech Payments Corp. (the “Company”) and its counsel have reviewed the content of this page as well as the accompanying presentation (“Company Presentation”) displayed on this page. To the best of its knowledge, the Company does not believe this content to be misleading or inaccurate in any material respect, nor does it believe there are any material omissions with respect to such content. The Company does not believe the contents of the page or the Company Presentation to contain any non-public material information.

Information and opinions presented in the Company Presentation are provided by the Company, and b2i Digital makes no representation as to their accuracy or completeness. The information contained on this page is not intended to constitute any form of advice, and the information provided is not intended to provide a sufficient basis on which to make an investment decision. It is not investment research, nor does it constitute a research recommendation, as it does not constitute substantive research or analysis. This information is not to be relied upon in substitution for the exercise of independent judgment.

Information, opinions, and estimates contained on this page or in the Company Presentation reflect judgments by the Company as of the original date of publication by the Company and are subject to change without notice. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance.

A complete description of the risks and uncertainties relating to the Company and its securities can be found in the company's filings with the U.S. Securities and Exchange Commission, available for free at www.sec.gov.

Information on this page may relate to penny stocks, which may also be referred to as low-priced stocks. Penny stocks are low-priced shares typically issued by small companies. Penny stocks involve greater than normal risk, they may be less liquid than other stocks (i.e., more difficult to sell), and there may be less reliable information available regarding such stocks. Investors in penny stocks should be prepared for the possibility that they may lose their entire investment.

b2i Digital or its related entities may own securities of the Company.

To comply with Rule 17(b) of the Securities Act of 1933, as amended, b2i Digital must provide full disclosure of all compensation received for investor awareness services provided by the Company.

The Company is a client of b2i Digital. The Company agreed to pay b2i Digital no greater than $100,000 in cash for 12 months of digital marketing consulting and investor awareness services.

The AppTech Payment Corp. management and investor relations team is available to talk to current and potential investors. They're happy to answer your questions and tell you what makes their story unique. Please fill out this form, and we will connect you shortly.

• Directly hear the AppTech Payment Corp. story

• Ask your questions

• Submit the form below, and someone will get in touch with you as soon as possible

Note: Company management or its representative can only discuss and disclose information that is already available in the public domain. They will do their best to clarify such information to the extent permitted by securities law and industry regulations.

Innovative Fintech platform

AppTech is developing Commerse™, a next-gen Fintech platform combining digital banking, payments, and financial services in one seamless offering.