Safe-T Group Ltd.

Safe-T Group Ltd. (Nasdaq, TASE: SFET) is a global provider of cyber-security and privacy solutions to consumers and enterprises. The Company operates in three distinct segments tailoring solutions according to specific needs. The segments include enterprise cyber-security solutions, enterprise privacy solutions, and consumer cyber-security and privacy solutions.

Nasdaq: SFET

TASE: SFET

IR Website: https://www.safetgroup.com/

Headquarters: Tel Aviv, Israel

Content provided by Safe-T Group on 3/11/22

TALK TO MANAGEMENT

The Safe-T Group management team is always available to talk to current and potential investors. They're happy to answer any questions you may have and tell you what makes their story unique. Please fill out this form, and we will connect you shortly.

Summary

- We are a global provider of cybersecurity and privacy solutions to the enterprises and consumers markets

- Highly scalable business model with high gross margins

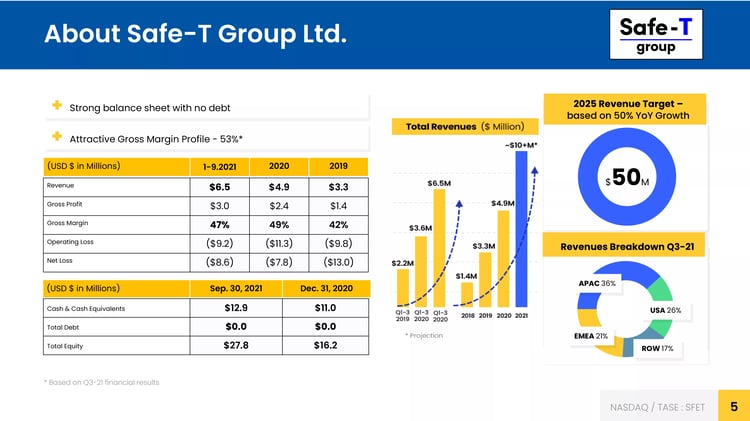

- Exponential growth-moving from annual revenue run rate of 1.6M$ in Q2-19 to ~13M$ in Q3-21

- Strong Management of entrepreneurs and ex-intelligence unit -"holding ~13% of the outstanding share capital"

- Strong balance sheet with no debt over $12 million in cash

Highlights

- Introducing new innovative products

- Expanding market potential-approaching consumers as well as organizations

- Predicted market needs-started focusing on remote access in 2019 which proven the main need for businesses during COVID-19

- New product lines with high gross margins

- Average of over 80% Growth Y/Y during the last 2 years

- Growth!Presenting record high revenues stream, quarter-over-quarter

Recent News

On March 29, following the release of Safe-T Group’s 4th quarter and fiscal 2021 earnings, Dawson James issued an updated research report reiterating its $6 price target and highlighting the Company’s guidance of 50% annual revenue and a compound annual growth rate (CAGR) and target of $50 million in revenue by 2025.

You can find the full research report here - Research Report

In the fourth quarter of 2021, Safe-T Group reported record annual revenue of $10.3 million representing over 110% growth. The Company also indicated it expects lower operational expenses commencing in the third quarter of 2022 due to its collaboration with TerraZone for its ZoneZero enterprise security solution.

Safe-T Group Reports Record Annual Revenue of $10.3 Million Representing Over 110% Growth

March 29, 2022

Safe-T Group Partners with TerraZone and DreamVPS to Launch a First-of-its-Kind “Virtual Private Workforce” Cloud Service

Mar 11, 2022

Safe-T Group Adds the Washington-Based Center for Advanced Defense Studies as First Partner to Join its Net Bridge Social Responsibility Program

Mar 3, 2022

SAFE-T GROUP TO PARTICIPATE AT THE 34th ANNUAL ROTH CONFERENCE

Mar 2, 2022

Safe-T Group Launches “Net Bridge” Social Responsibility Program Providing Free Access to its Technology for Organizations Dedicated to Making Positive Global Impact

Mar 28, 2022

Safe-T Group Launches New Malvertising Protection Product for Apple iOS Devices

Mar 16 2022

Management Overview

Shachar Daniel

Co-Founder and CEO

Shachar Daniel is the CEO at Safe-T and one of its co-founders. In his role, he is responsible for the overall vision, company strategy, day-to-day operations, and for growing Safe-T’s business and presence around the world. Shachar brings to Safe-T more than 14 years of experience in various managerial and business roles. Prior to founding Safe-T, he was program manager at Prime-sense, head of operations for project managers at Logic and project manager at Elbit Systems. He is an experienced manager with a passion and high commitment for project delivery. Shachar holds an Executive MBA from The Hebrew University, an MBA from The College of Management Academic Studies in Israel and a B.Sc. in Industrial Engineering from The Holon Institute Technology.

Risks & Disclosures

This communication is neither an offer to sell nor a solicitation of an offer to buy, nor a recommendation of any securities of the company mentioned herein.

Safe-T Group Ltd. (the “Company”) and its counsel have reviewed the content of this page as well as the accompanying presentation (“Company Presentation”) displayed on this page. To the best of its knowledge, the Company does not believe this content to be misleading or inaccurate in any material respect, nor does it believe there are any material omissions with respect to such content. The Company does not believe the contents of the page or the Company Presentation to contain any non-public material information.

Information and opinions presented in the Company Presentation are provided by the Company, and b2i digital makes no representation as to their accuracy or completeness. The information contained on this page is not intended to constitute any form of advice, and the information provided is not intended to provide a sufficient basis on which to make an investment decision. It is not investment research, nor does it constitute a research recommendation, as it does not constitute substantive research or analysis. This information is not to be relied upon in substitution for the exercise of independent judgment.

Information, opinions and estimates contained on this page or in the Company Presentation reflect judgments by the Company as of the original date of publication by the Company and are subject to change without notice. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied is made regarding future performance.

A complete description of the risks and uncertainties relating to the Company and its securities can be found in the company's filings with the U.S. Securities and Exchange Commission available for free at www.sec.gov.

Information on this page may relate to penny stocks, which may also be referred to as low-priced stocks. Penny stocks are low-priced shares typically issued by small companies. Penny stocks involve greater than normal risk, they may be less liquid than other stocks (i.e., more difficult to sell), and there may be less reliable information available regarding such stocks. Investors in penny stocks should be prepared for the possibility that they may lose their entire investment.

B2I DIGITAL, Inc. is a marketing sponsor of the Roth 34th Annual Roth Conference. B2I DIGITAL, Inc. is not an affiliate of Roth Capital Partners, LLC (“Roth”) and is not authorized to represent or act on behalf of Roth ,in any capacity. Roth has not reviewed and approved the content contained on the b2idigital.com website.